The Australian dollar has stabilized against the US dollar, currently trading around 0.6738. This follows a period of decline influenced by ongoing speculations regarding the US Federal Reserve's impending policy actions.

Expectations are set for the Fed to initiate rate cuts starting in September, with an additional reduction anticipated before the year's end.

Fed Chairman Jerome Powell recently reinforced these expectations by indicating that the regulator might not wait for inflation to hit the 2% target before reducing rates, responding to the current trajectory of the consumer price index.

Conversely, the Reserve Bank of Australia (RBA) is perceived to be trailing its international counterparts in easing monetary policy, which has contributed to the subdued performance of the AUD.

Later this week, Australia is slated to release its employment statistics. These figures are crucial, as they provide a tangible measure of the labor market's health and could potentially influence the RBA's policy decisions moving forward.

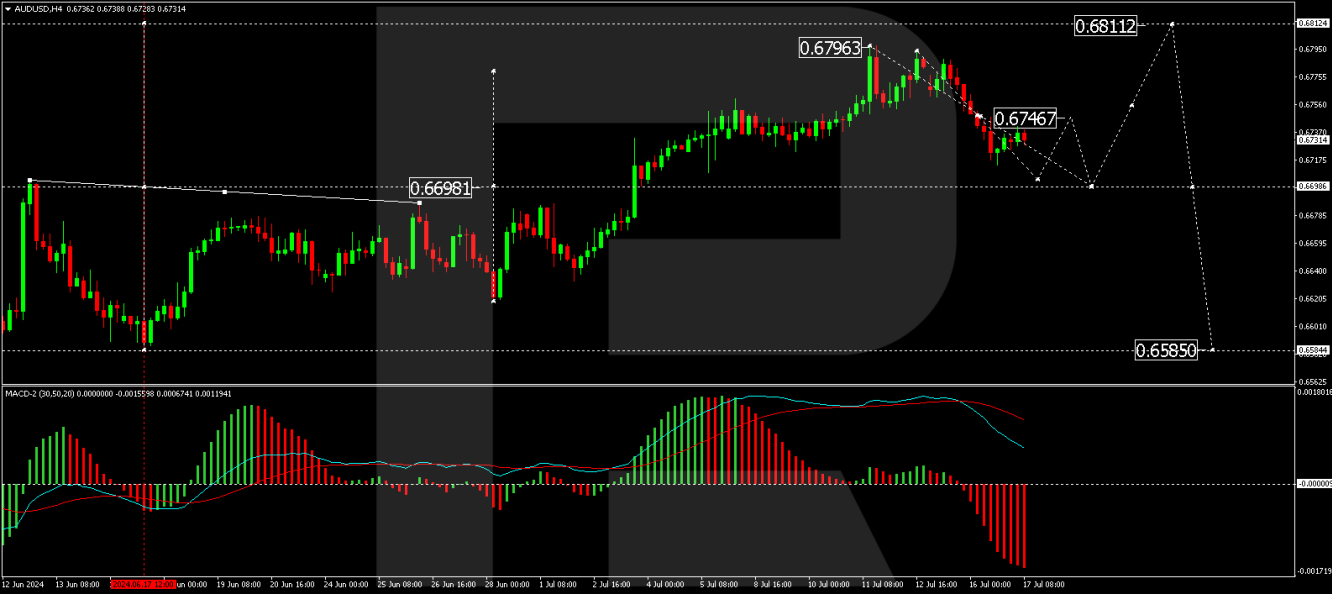

AUD/USD Technical Analysis

The AUD/USD pair is currently developing a downward movement towards the 0.6703 level, which serves as a local target. Upon reaching this level, a corrective movement upwards to 0.6747 is expected, which will test this resistance from below.

Following this correction, the market may resume its downward trend towards 0.6696, completing the current correction wave before potentially initiating a new upward trajectory towards 0.6811. The MACD indicator supports this outlook, with its signal line indicating a downward trend despite being above the zero mark.

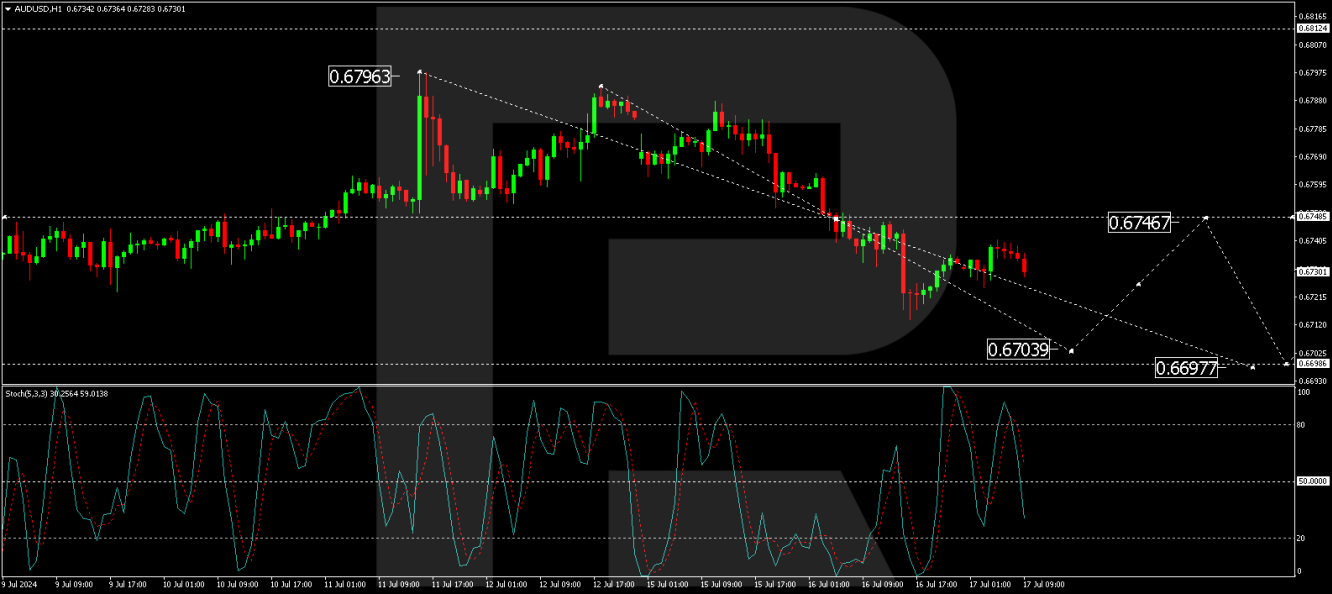

On the hourly chart, the AUD/USD has established a consolidation range around the 0.6747 level. With a downward exit, the pair continues to develop a downward structure, aiming for the 0.6704 level.

After this target is achieved, an upward correction to retest 0.6747 is anticipated. Subsequently, a new decline towards 0.6696 may occur. The Stochastic oscillator suggests that the current upward momentum is waning, with its signal line poised to drop from above 80, indicating potential for further declines.

Investors and traders should monitor these levels closely, especially in light of forthcoming economic data from Australia, which could significantly sway market sentiment and currency valuation.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.