- Australia’s inflation expectations ease

- US inflation is expected to rise to 3.3%

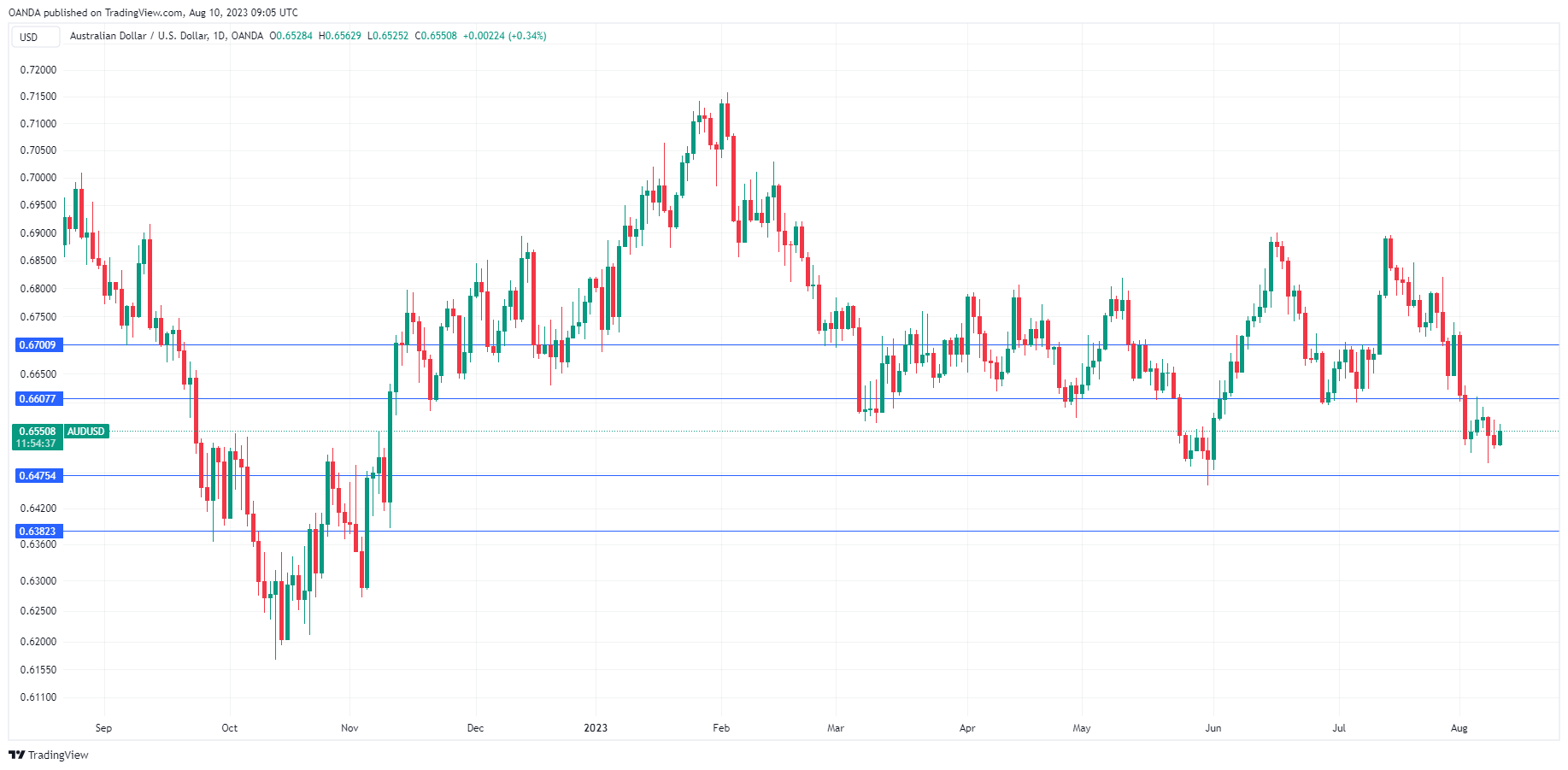

- There is resistance at 0.6607 and 0.6700

- 0.6475 and 0.6382 are providing support

The Australian dollar is in positive territory on Thursday. In the European session, AUD/USD is trading at 0.6552, up 0.37%.

Australian inflation expectations ease

Australia’s consumer inflation expectations dipped in August to 4.9%, down from 5.3% in July. The good news? This marked the lowest level since April and supports the view that inflation has peaked. The bad news? Inflation expectations remain high and are well-embedded, which means that the downturn in inflation could be slow.

The Reserve Bank of Australia has forecast that inflation will drop to 3.25% by the end of 2o24 and won’t hit the 2%-3% target until late 2025. Last week, RBA’s policy statement noted that the central bank views inflation risks as “broadly balanced”, which means that the chances that inflation overshoots or undershoots the forecast are relatively even. However, the RBA also said that “if inflation expectations were to rise, the result would be even higher interest rates [and] a more substantial slowing in the economy”. The RBA added that inflation, which has fallen to 6% is “too high”.

China and the ‘D’ word

China’s economy has fallen into deflation, as CPI declined 0.3% in July. The last time inflation declined was in February 2021. China’s economic recovery has been tepid and exports and imports fell in July. This could spell bad news for Australia, which exports gold, iron ore and petroleum gas to China. Weaker demand for Australian exports will likely weigh on the weak Australian dollar, which is down 2.4% in the month of August. A possible silver lining to Chinese deflation is that it could lower global inflation, helping central banks in the battle to bring inflation back to around 2%.

US inflation expected to accelerate

The US releases the July inflation report later today. The Fed has achieved much of its objective in wrestling inflation to lower levels. Inflation, which hit a record high of 9.1% in July 2022, is currently at 3%. The Fed wants to finish the job and bring inflation back to the 2% target, but that could prove a difficult task. Headline inflation is expected to accelerate to 3.3% in July, up from 3.0% in June. Core inflation, which the Fed pays particular attention to, is expected to remain at 4.8%. The Fed rate hike odds remain very low for September (14%) and unless there is a nasty surprise to the upside from today’s inflation data, the release should cement a pause at the September meeting.

AUD/USD Technical