Key Points:

- Aussie dollar under assault as capital swings sharply towards the USD.

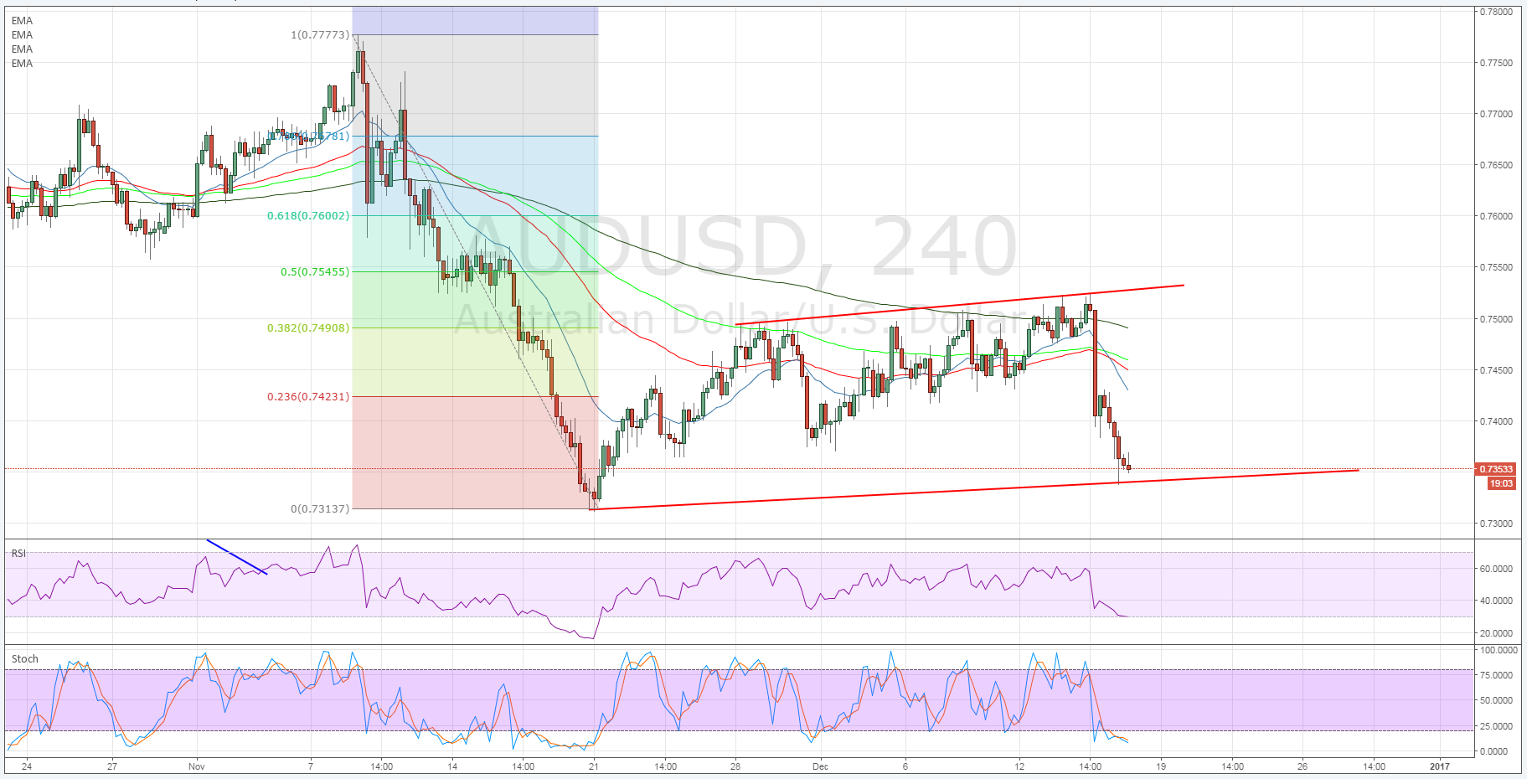

- RSI and Stochastic Oscillators enter oversold territory.

- A period of moderation or retracement likely.

The Australian dollar has seen some sharp selling pressure over the past 24 hours as global capital markets have continued to digest the FOMC’s decision. Subsequently, the Aussie dollar has been under assault as a strong sentiment swing back towards the greenback has taken it well below the 74 cent handle. However, despite the ongoing selling, the RSI and stochastic oscillators have entered oversold territory which could provide some relief in the coming session.

Price action’s collapse from 0.7508 was relatively quick and violent in the aftermath of the US rate hike. The selling pressure has largely continued unabated and we are now seeing bids around the 0.7356 mark but price action is reaching a critical juncture with the November low looming. A concerted breach of the low at 0.7314 would likely mean the loss of the 73 cent handle and sharp retreat.

However, the fact that the RSI and Stochastic Oscillators have entered oversold territory on the 4-hour timeframe should be relatively concerning for the bears amongst us. In particular, a cursory review of the historical charts shows that we are nearing a key level of support. Additionally, the Aussie dollar has been relatively responsive when the RSI Oscillator has become oversold and we would typically see either a period of moderation or a retracement. Subsequently, there are some reasons to suggest that the downside might be limited, at least in the short term.

Fundamentally, there are some sharp divergences becoming apparent between the US and Australian economies. It would appear that just when the US recovery appears to be picking up some momentum that Australia risks entering a technical recession. Although most analysts seem to suggest that the recent uptick in commodity prices will help them to avoid that moniker we are still facing a period of lacklustre growth and divergent monetary policies.

Ultimately, the markets are likely to decide the Aussie dollar’s fate over the next 24 hours but the signs are suggesting that the sharp declines might be over for at least the short term. The ideal scenario would be if the pair caught a bid and retraced back towards the 0.7450 swing point. Regardless, the pair warrants plenty of attention from both a technical and fundamental point of view given that any further declines might bring back the “Banana Republic” tag.