- RBA signals growing confidence in achieving inflation target

- Traders boost odds of a 25bps rate cut in February to two-in-three chance

- AUD/USD drops sharply, testing key uptrend support below 0.6400

RBA’s Pending Pivot

The Reserve Bank of Australia (RBA) is edging closer to cutting interest rates, signalling growing confidence that inflation is sustainably moving towards its 2.5% target. The bank also dropped the phrase about not ruling anything in or out, suggesting the next rate move could still be higher, but this shift is telling.

Contrast the tone of that the RBA said last month: “This reinforces the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out. Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range.”

To what it said today: “Recent data on inflation and economic conditions are still consistent with these forecasts, and the Board is gaining some confidence that inflation is moving sustainably towards target.”

While it reiterated that underlying inflation remains "too high," there were several dovish tweaks in the December statement.

It noted wage pressures had eased “more than expected” and that some of the upside risks to inflation “appear to have eased.” It added that incomes and consumption had recovered “a little slower than forecast.”

The bank acknowledged recent data on economic activity have been mixed, “but on balance softer than expected.”

Telling.

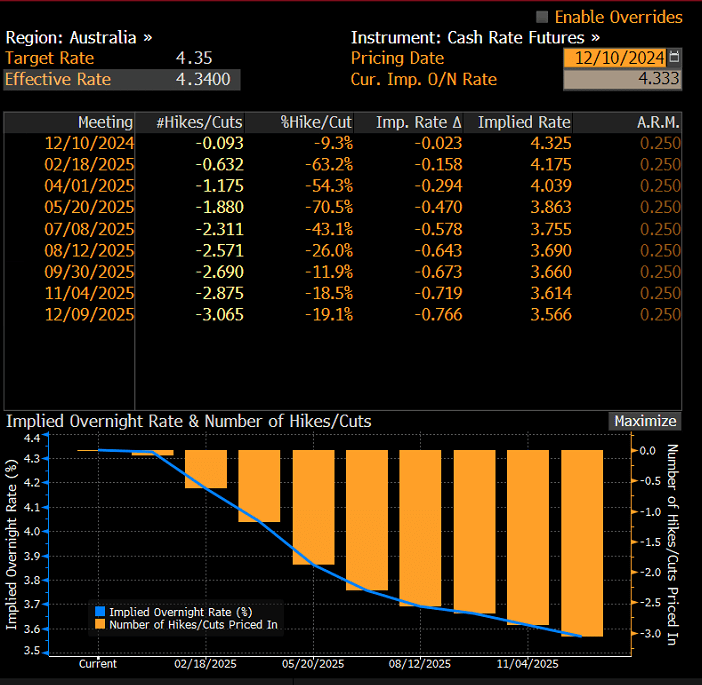

Traders Boost February Rate Cut Odds

Source: Bloomberg

There’s been a distinct market shift in response to the dovish remarks with traders boosting the probability of the RBA beginning its easing cycle when it meets in February.

Swaps markets put the probability of a 25bps cut on February 18 at 63%, up from less than 50% prior to the statement. A total of three cuts are priced by the end of 2025, an outcome that would leave the cash rate at 3.60%.

Between now and then, the key domestic release will be the December quarter inflation report in late January. To continue progress towards the RBA’s 2.5% inflation target, a 0.7% reading for the trimmed mean measure would go a long way to cementing the first cut of the cycle. Softening labour market indicators, especially unemployment, would also add to confidence that inflation will not only decline to target but stay there.

Nearer term, there will be plenty of interest in RBA governor Michele Bullock's press conference that begins at 3.30pm AEDT.

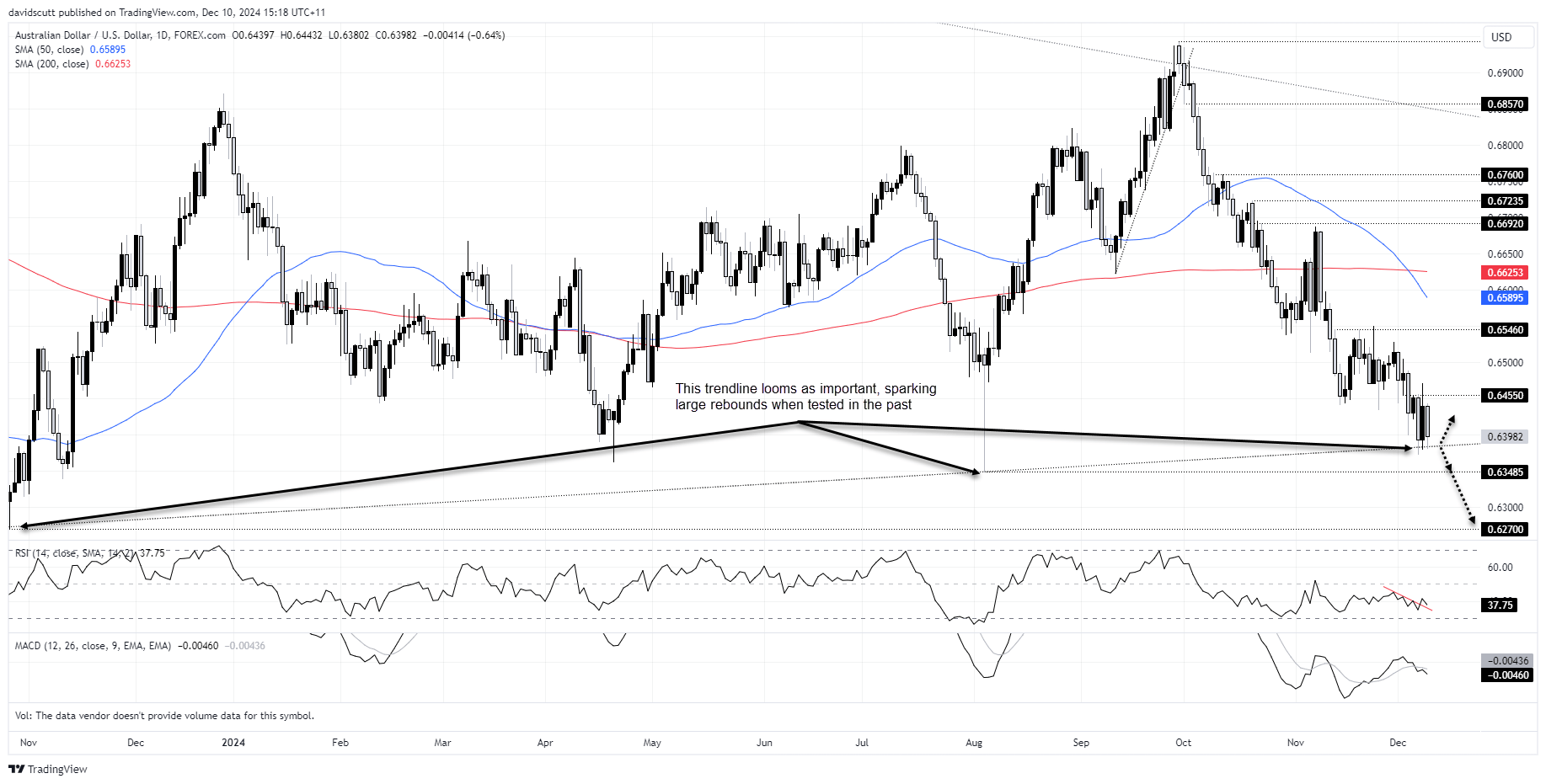

AUD/USD Teeters on Key Support

Source: TradingView

Already under pressure heading into the RBA thanks to a muted market response to China’s latest stimulus measures, AUD/USD tumbled upon the release of the policy statement, seeing it retest key uptrend support just below .6400.

As things stand, the failure and steep reversal from above .6455 hints that downside may prove easier than upside near-term, if uptrend support gives way. A break of that level could spark a run down to .6385 – the nadir of the Japanese market meltdown in August – with the November 2023 low of .6270 the next level after that.

Momentum signals are providing mixed signals near-term, placing increased emphasis on price signals for directional clues.