As we already know AUD is largely dependent on China and the China A50 Indices are heavily correlated to AUD pairs, especially AUD/JPY. I have mentioned many times that China stock market was opened up for margin lending earlier this year and after the huge long bounce, commodities plummeted taking AUD pairs into spiral of doom. Also, the Governor of The People's Bank of China (PBOC) stated that stocks will be much calmer soon.

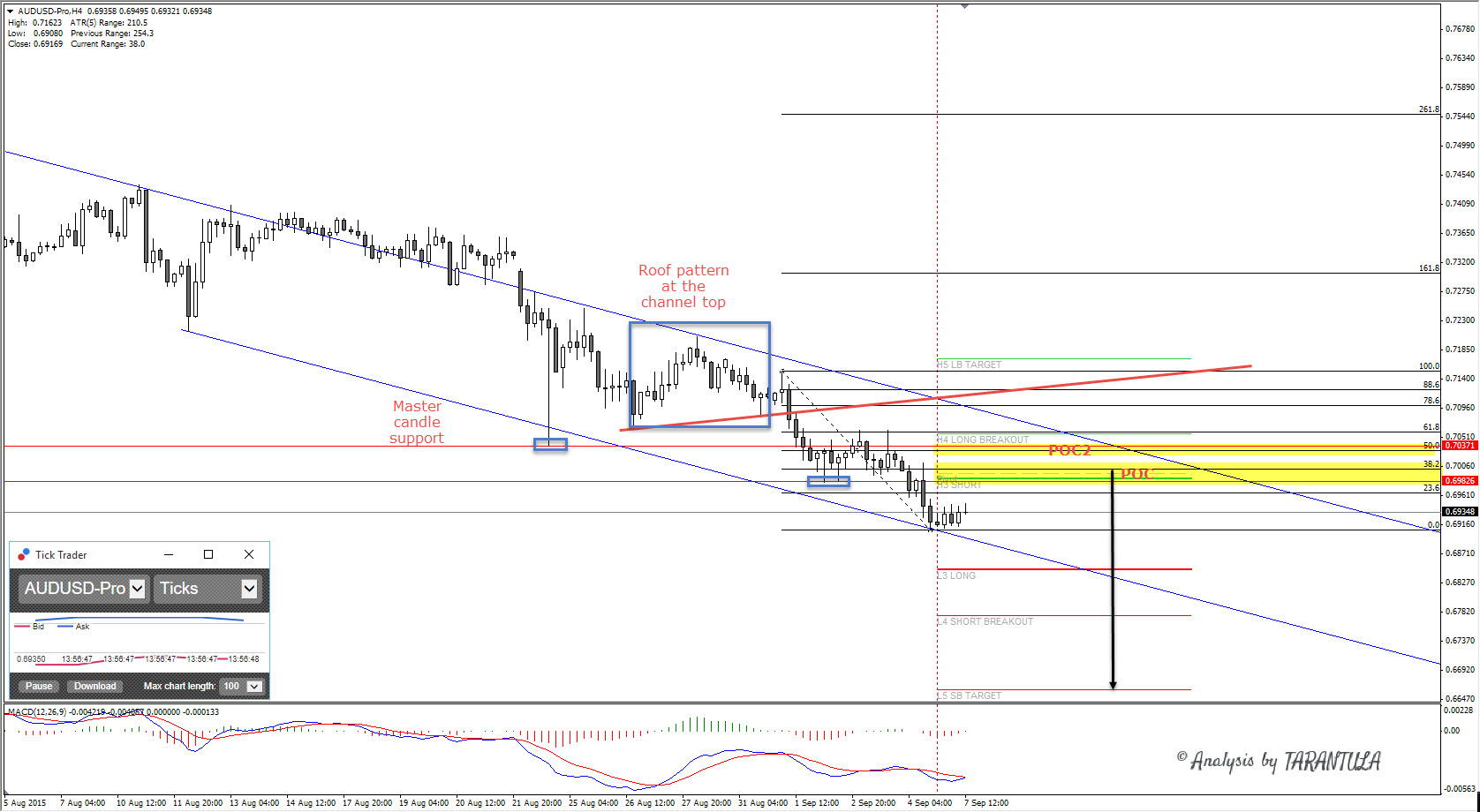

US unemployment rate fell to 5.1 percent — the record low since 2008 and that might be one stop closer to a rate hike soon. Technically AUD/USD is short into rallies. AUD weakness and USD strength are giving us a lot opportunities to short into rallies. We can see that AUD/USD is contained within the equidistant channel where a previous double bottom was broken -0.6982. H3, previous double bottom, WPP, and 38.2% is constituting POC, so any pullbacks towards 0.6985-0.7000 could be used for shorting into rallies.

Additionally master candle support which has already been broken is sitting exactly at 50.0 Fib and channel top — 7035 zone which is also constituting for a strong POC. Above we can roof pattern which marks previous top exactly at EQ channel. Roof pattern trendline is intersecting 0.7100 so that level is used for stops.

Have in mind that targets are 0.6850 and 0.6550 if 0.7100 stays unbroken.