- US economic growth sits at levels where risks to unemployment are lower, not higher

- Stronger US economic data drives rapid unwind of Fed rate cut pricing

- AUD/USD, NZD/USD direction heavily influenced by the US rates outlook

- US nonfarm payrolls, PCE inflation, spending and incomes data, ECI update key data points left this week

Overview

US economic growth sits at levels consistent with higher inflation and lower unemployment, forcing markets to pare Fed rate cut bets. Higher US interest rates are fuelling US dollar upside, forcing the likes of AUD/USD and NZD/USD lower.

US Economy Defying Doomers

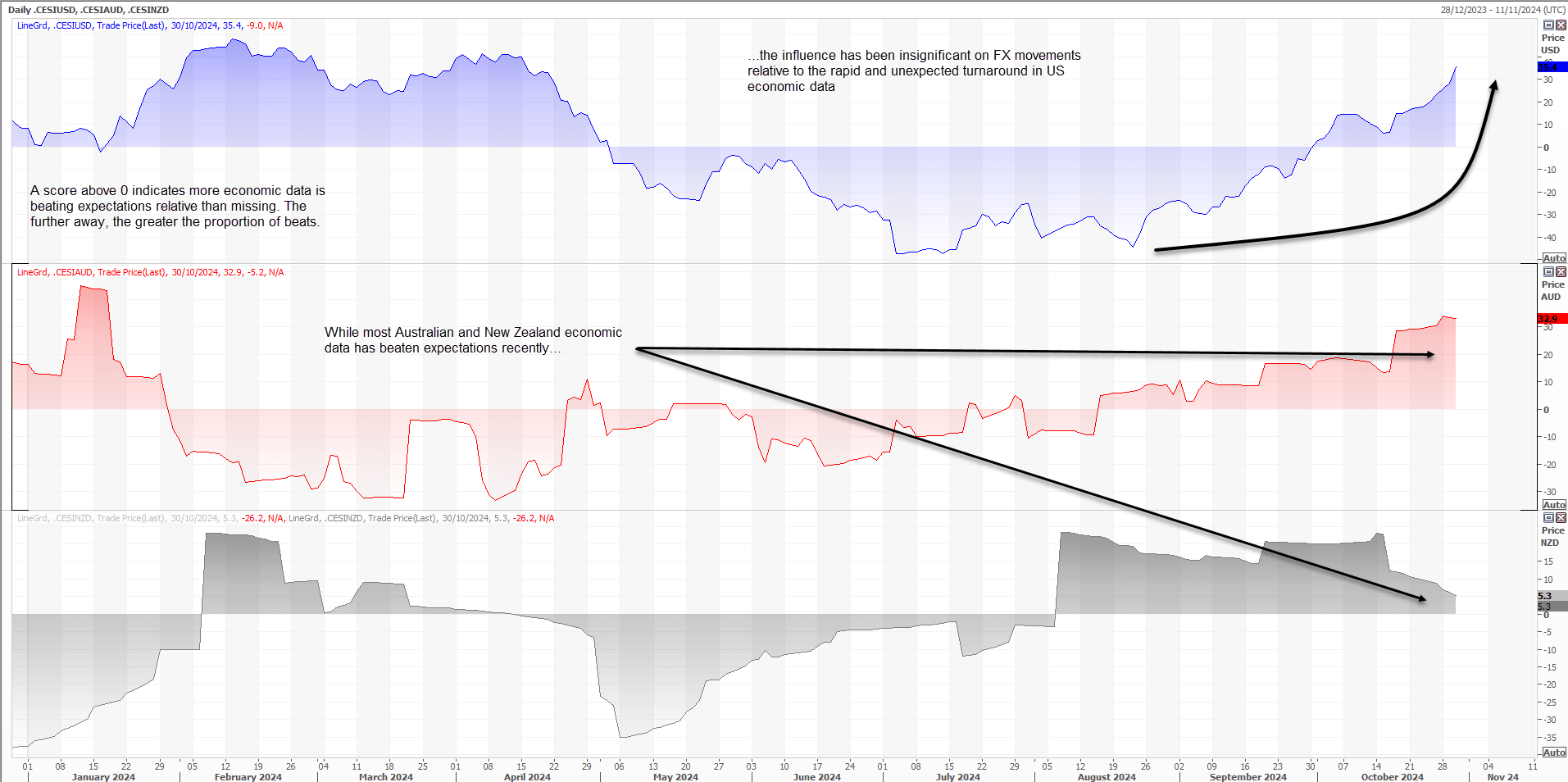

US economic exceptionalism is back. It feels like every day we see another upside surprise in US data, making a mockery of supposed concerns that monetary policy settings from the Federal Reserve are too restrictive. The US economy is growing well above levels thought to be required to keep unemployment and inflation stable, seeing Citi’s economic surprise index lift to the highest level since April. Even with the bar to impress continuing to rise, the proportion of data topping forecasts is still rising, not falling. It’s remarkable.

Source: Refinitiv

Fed Rate Cut Pricing Dwindling by the Day

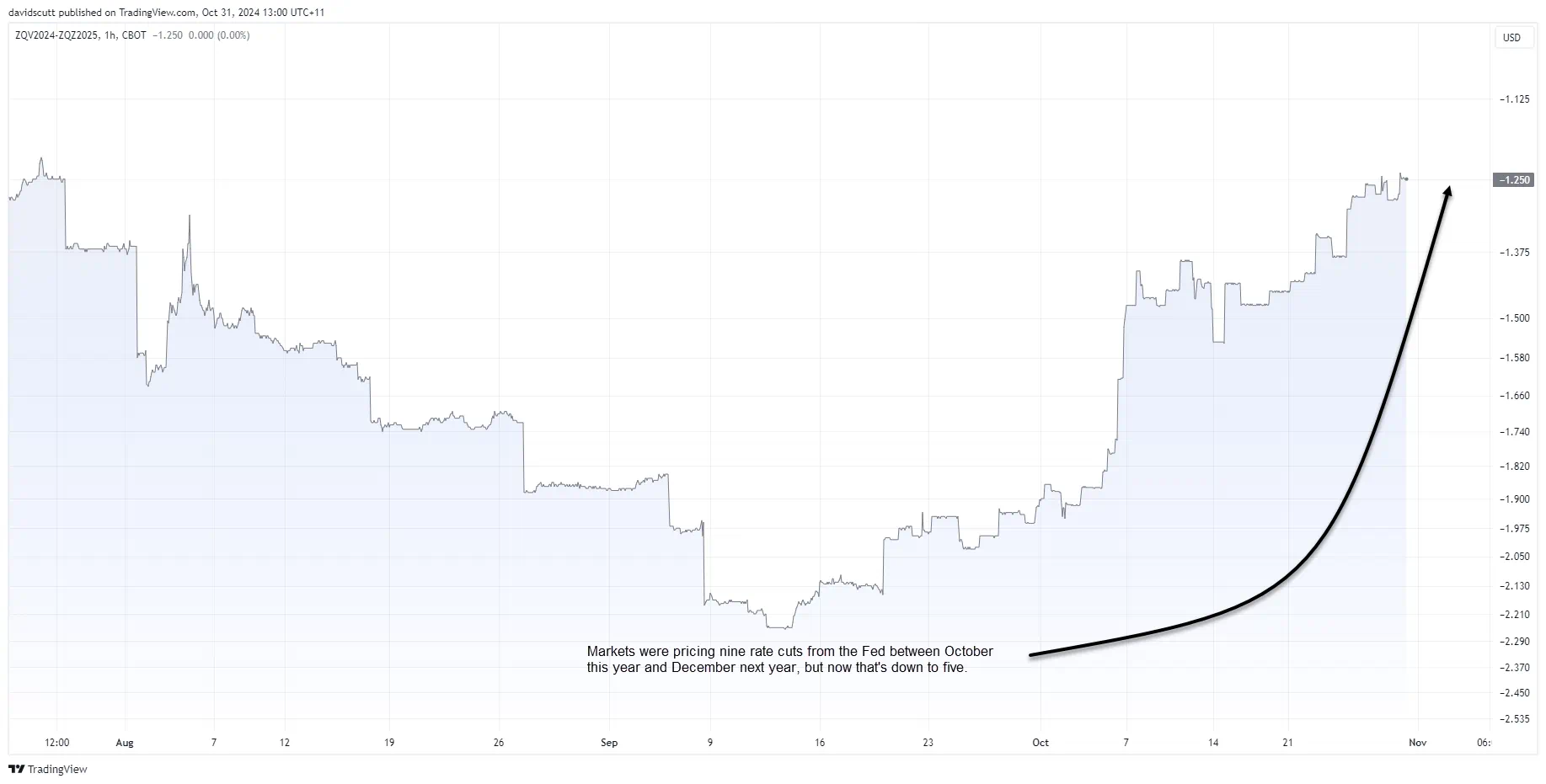

Understandably, markets are having second thoughts about the need for the Fed to deliver an aggressive rate cutting cycle. Less than two months ago nine 25-point rate cuts were expected from the Fed by the end of 2025. Now, it’s just five.

Source: TradingView

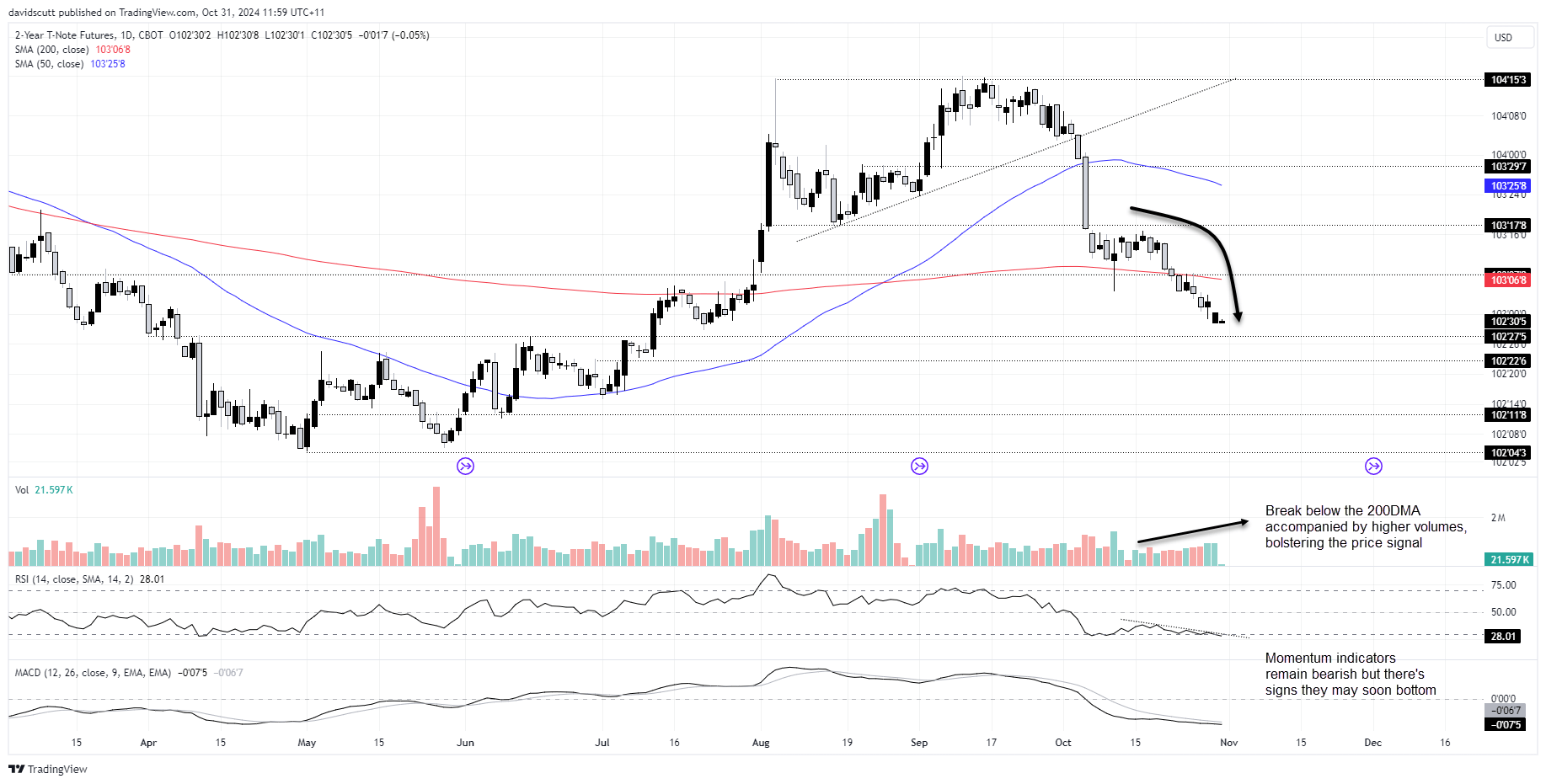

With rate cut expectations being unwound aggressively, it’s resulted in large declines in Treasury futures further out the US interest rate curve. 2-year US Treasury note futures have been sliding ever since the Fed delivered its 50-point rate cut in September, only briefly pausing to test the 200-day moving average before slicing straight through it on increasing volumes. With momentum indicators continuing to provide bearish signals, it looks far easier to sell pops than buy dips given trend. That means higher US Treasury yields.

Source: TradingView

That bodes well for further US dollar strength with higher US interest rates drawing in capital from around the developed and developing world. For AUD/USD and NZD/USD, it points to directional risks being lower.

Fed Rethink Driving AUD/USD, NZD/USD Lower

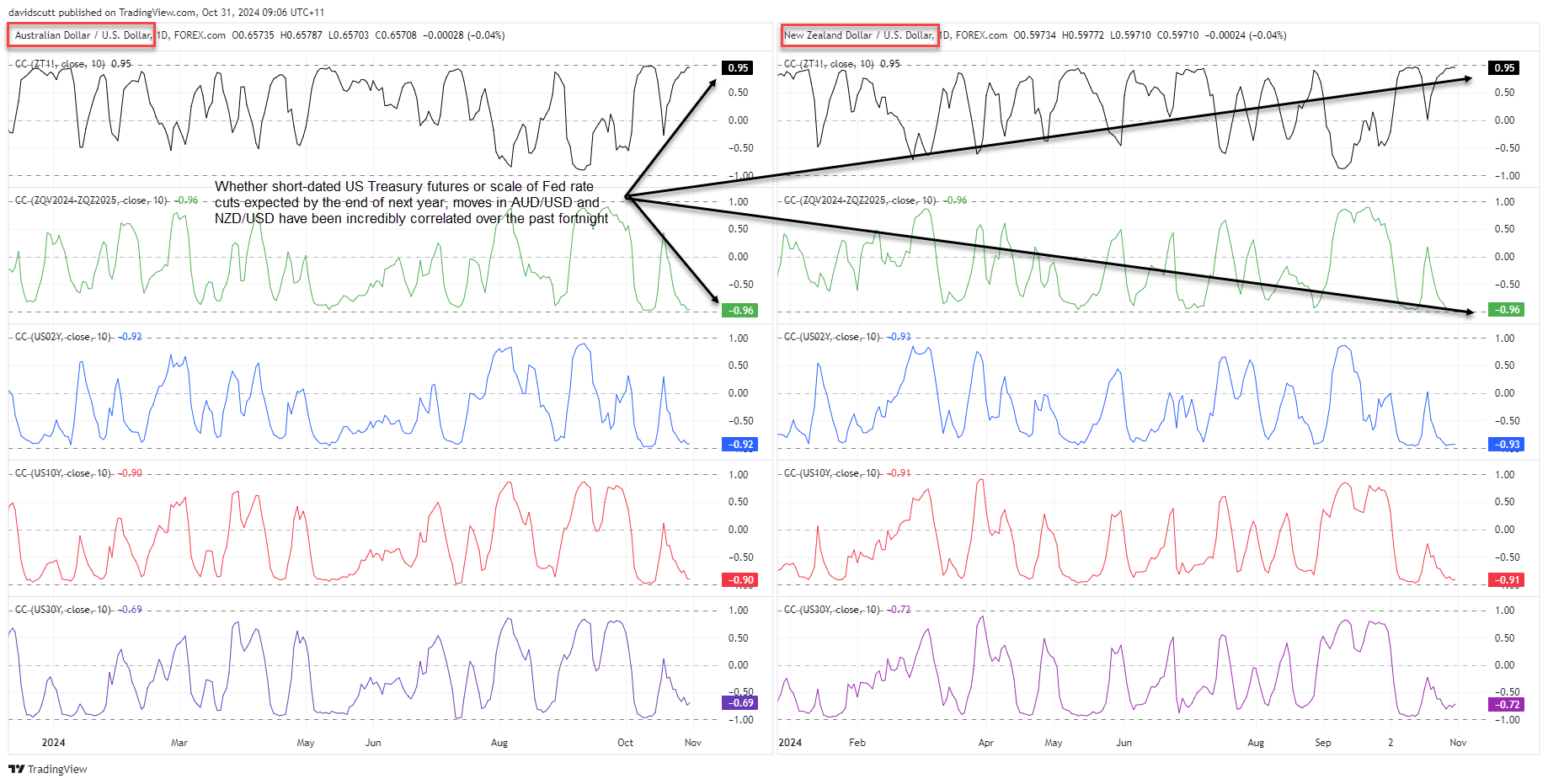

The rolling 10-day correlation between AUD/USD and NZD/USD with US two-year Treasury note futures sits at 0.95 apiece, indicating they almost always have moved in the same direction during this period. That largely reflects the continued unwind in the amount of expected rate cuts from the Fed.

Source: TradingView

The further out US interest rate curve you go, the weaker the correlation has been with AUD/USD and NZD/USD over the past fortnight. It could change, but it’s the Fed outlook that’s been heavily influencing moves in the Aussie and Kiwi recently.

That puts increased emphasis on upcoming US economic data, especially Friday’s non-farm payrolls report but also core PCE inflation, incomes and spending data on Thursday, along with the important employee cost index (ECI) which provides insights on wage pressures.

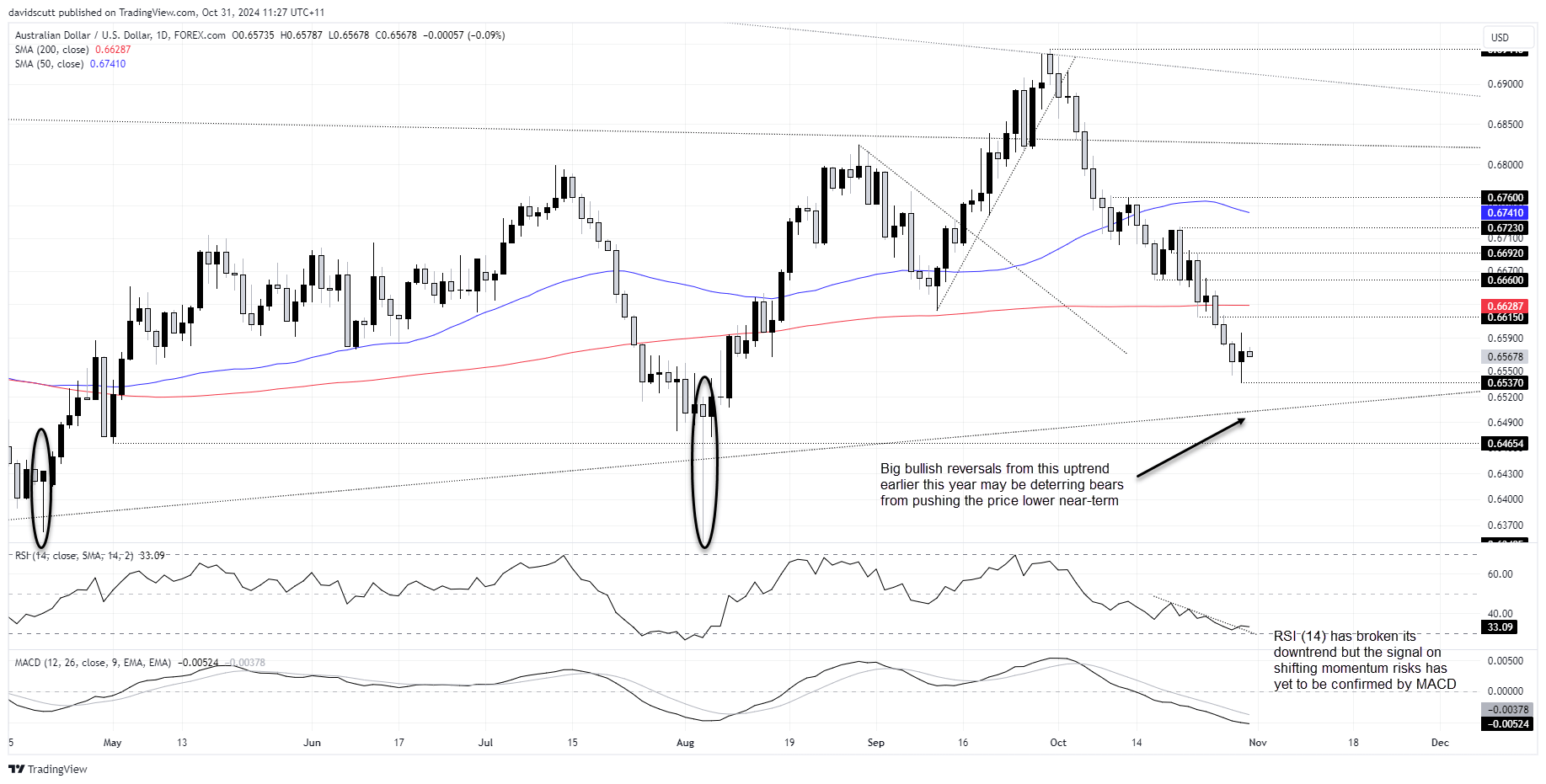

AUD/USD Trying to Put in a Near-Term Bottom?

Source: TradingView

Looking at AUD/USD on the daily, you get the sense that after the bearish unwind since late September, indecision may be starting to creep in. The long-legged doji candle on Wednesday says as much, making a distinct departure from the one-way traffic seen earlier this week.

With RSI (14) breaking its downtrend, and with the price nearing long-running uptrend support that has delivered significant bullish reversals when tested on the past two occasions, it feels like we may be trying to put in a near-term bottom. But even if we do see a bounce, unless accompanied by an obvious deterioration in the US economic data, the bias will remain to sell pops.

Near-term, resistance may be encountered around .6595, .6615, the 200-day moving average and .6660. On the downside, the price bounced from .6537 on Wednesday, making that a level of note. The long-running uptrend mentioned earlier is located just above .6500 today.

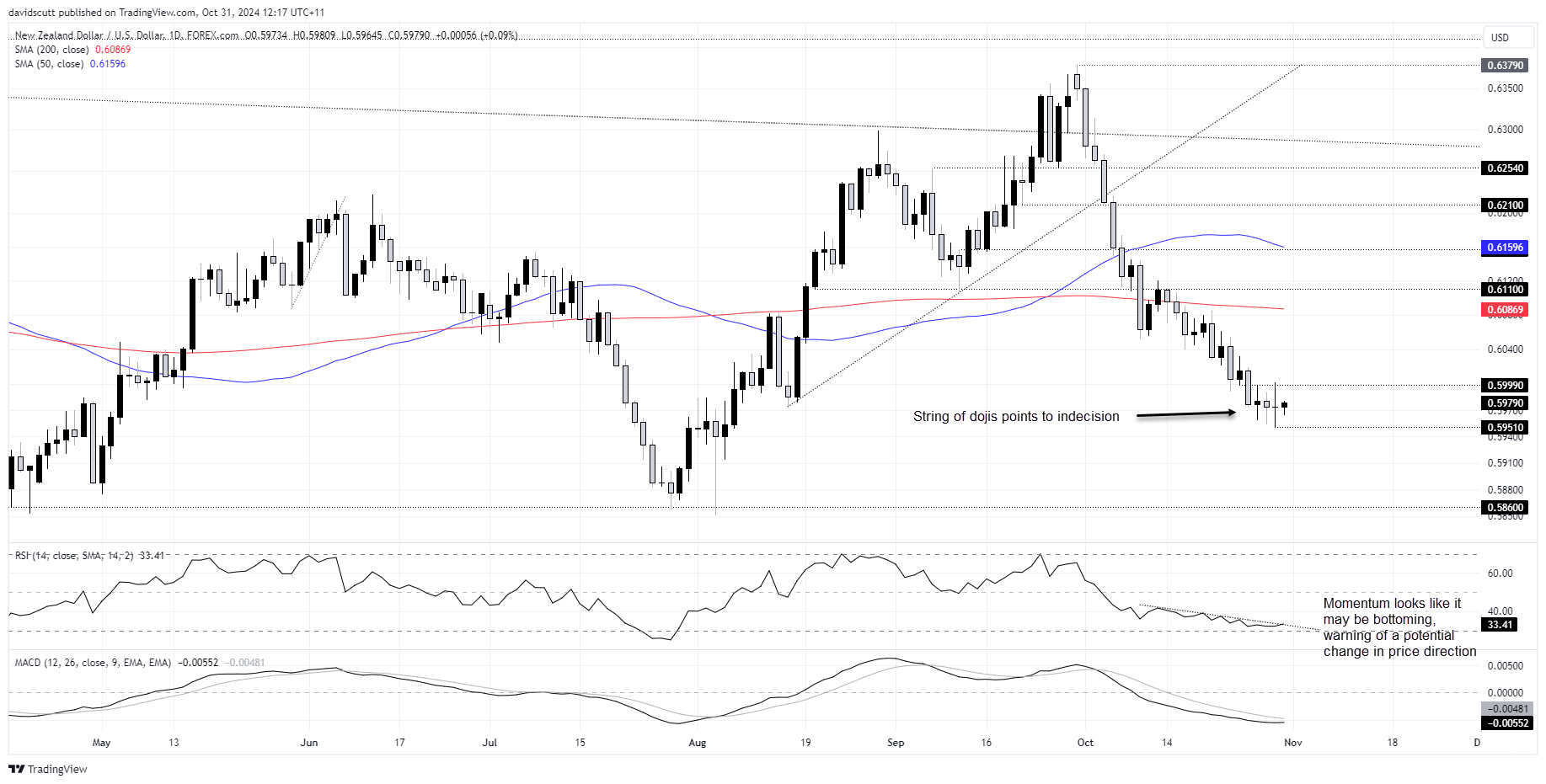

NZD/USD a Picture of Indecision

Even more so than AUD/USD. NZD/USD is a picture of indecision right now with doji candles printing every day this week. RSI (14) is threatening to break its downtrend and MACD also looks like its in the early stages of turning higher, warning bearish momentum may be stating to dissipate. But, again, the preference overall is to sell rallies given the prevailing technical and fundamental trends.

Resistance is located at .5999 and again at the 200-day moving average. Wednesday’s low of .5951 is the first downside level of note with a more pronounced support found at .5860.