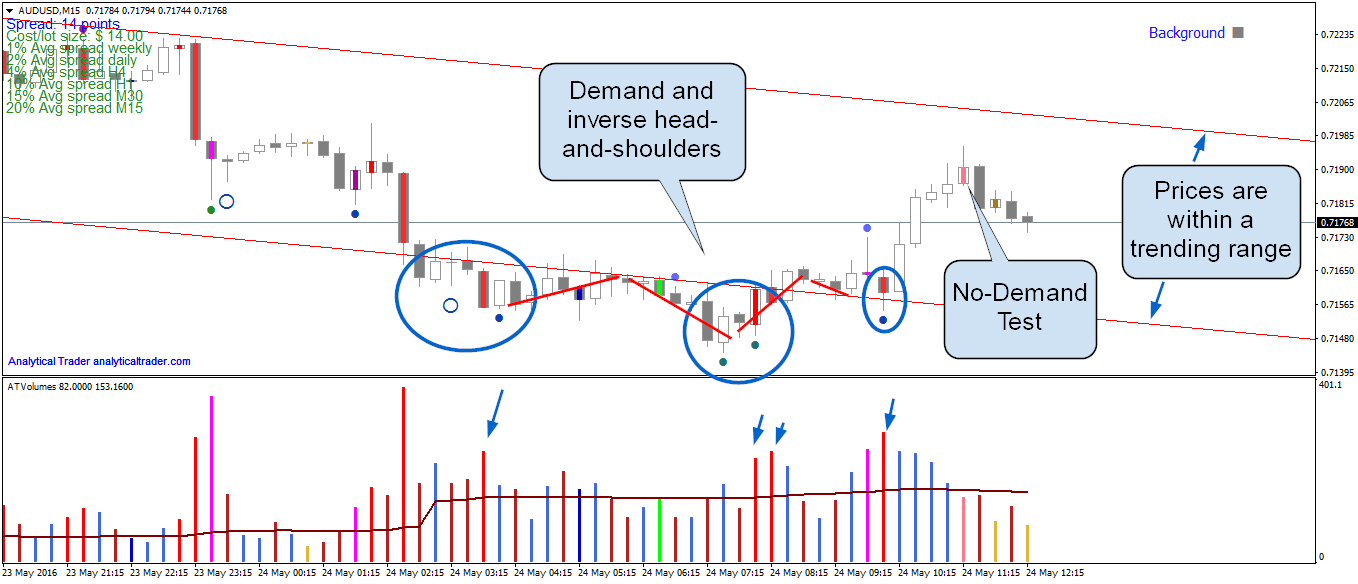

AUD/USD on the 15 minutes timeframe, is showing significant buying at nearby prices, with an inverse head-and-shoulders price pattern. This price pattern is characterized by 3 bottoms, and unlike many other unreliable price patterns, this one has actually a sound logic behind it: the first bottom is met with buying, and so the down move is halted. On the 2nd bottom, the lowest of the three, the market is shaken-out by being taken to new low ground, setting off stop-losses and triggering shorts on break-out traders. The market then reverses on professional buying using the ‘discounted’ prices, and then it still goes down one more time for some more buying, or just for supply testing. Though, using the prices alone isn’t enough, the volumes give useful information which should also be incorporated. In this case, VSA showed demand on the 3 bottoms, until the very last bar where the pattern’s high was broken.

On the last high, AUD/USD showed a no-demand test (testing higher prices for demand orders), which was met by a sudden down move, confirming the lack of demand. For an up move to continue, I expect prices to come closer to the lower part of the trending channel first.