- Headline and trimmed mean inflation undershoot market, RBA forecasts

- CPI rose 0.2%in Q4, with key trimmed mean slowing to 0.5%

- Government subsidies and weak housing demand drove price declines, questioning the slowdown's durability

- Markets price a 92% chance of an RBA rate cut on February 18, the first since October 2020

Summary

Headline and underlying inflation in Australia undershot market and RBA forecasts in Q4, setting the stage for a rate cut as soon as February. ASX 200 futures surged while AUD/USD slipped, though whether the latter holds its weakness is unclear given interest rate differentials haven't been a major driver in early 2025.

Q4 Inflation Report Detail

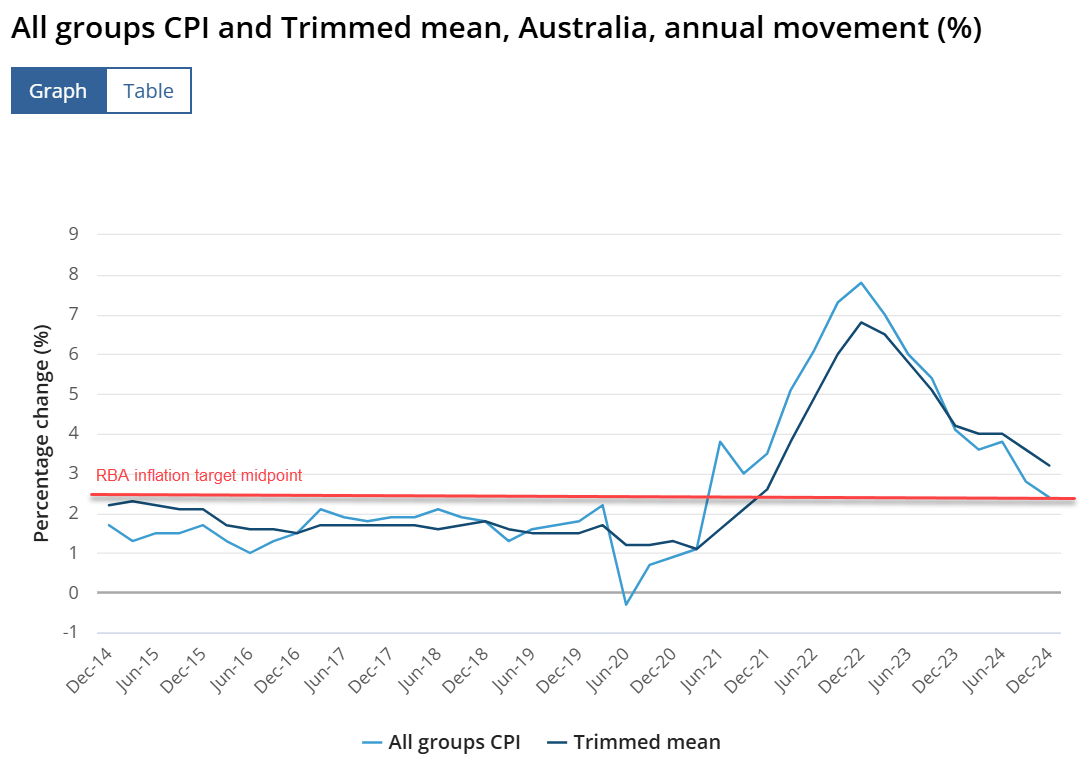

Source: ABS

Headline CPI rose 0.2% in Q4, a tenth below expectations, slowing the annual pace to 2.4%. More importantly, trimmed mean inflation—the RBA’s preferred measure—also missed to the downside, rising 0.5% for the quarter and 3.2% over the year, down from 3.6% in Q3. Markets were expecting 0.6%, with the RBA’s latest forecast at 0.7%.

Government subsidies for electricity, public transport, and rents helped push inflation lower, alongside a surprise 0.2% drop in new dwelling prices, the heaviest-weighted component in the CPI basket. The ABS noted builders were offering incentives to attract buyers amid weak demand.

February RBA Rate Cut Likely

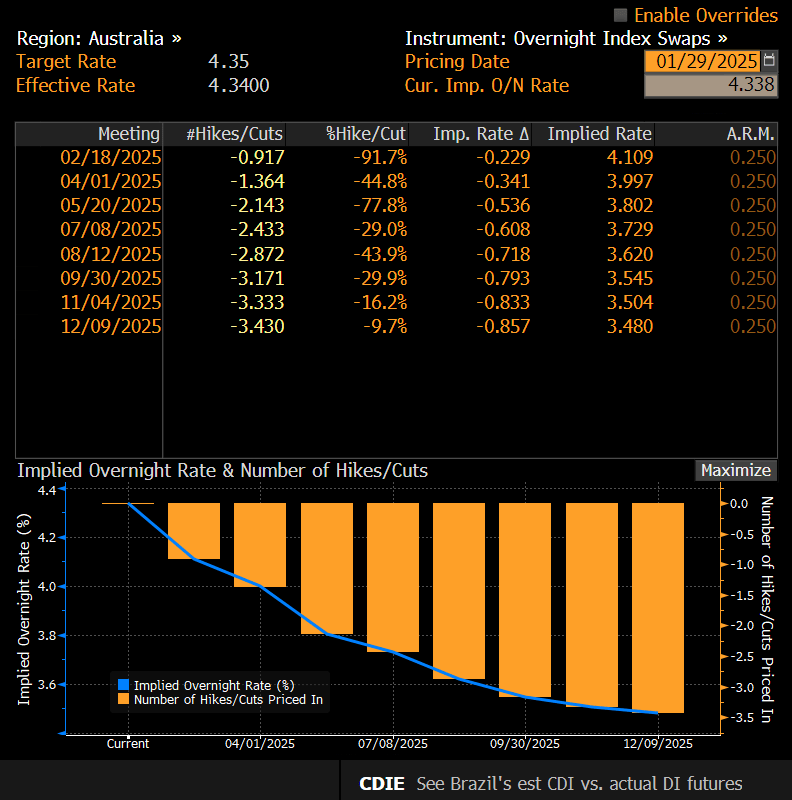

Despite questions over the sustainability of the slowdown, particularly with unemployment still below 4%, today’s inflation report has all but locked in an RBA rate cut on February 18. Swaps markets now price a 92% chance, up from 80% pre-release.

Source: Bloomberg

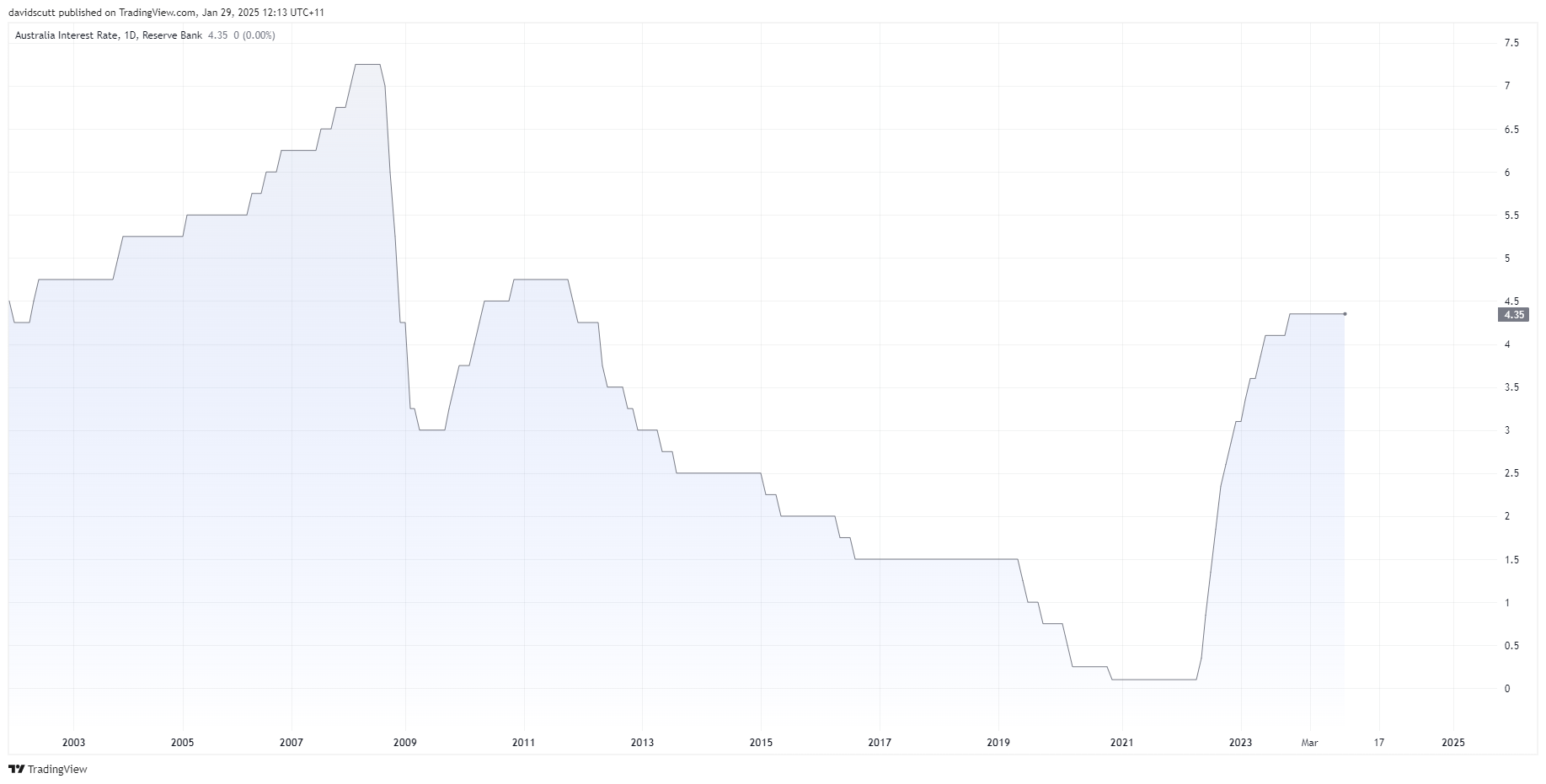

Without a strong pushback from the RBA—either officially or via media channels—it would mark the first rate cut since October 2020. Markets are also starting to price an additional 25bp cut in 2025, bringing the total expected easing to 100bp from current levels.

Source: TradingView

AUD/USD Slides Towards Key Level

AUD/USD sliced through .6247 on the data, approaching a key uptrend that has acted as support and resistance multiple times over the past year. This level may dictate the medium-term trajectory, especially as rate differentials have had little sway on the Aussie or Kiwi in early 2025.

Source: TradingView

If the price fails to break sustainably beneath the uptrend, longs could be established above with a stop below for protection. Beyond .6247, resistance may be encountered at the 50-day moving average and .6337.

Alternatively, if the price were to break and hold below .6247, short trades could be entered with a stop above for protection. .6170 and January 13 swing low of .6130 are two potential targets.

ASX 200 SPI Futures Eyeing Record Highs

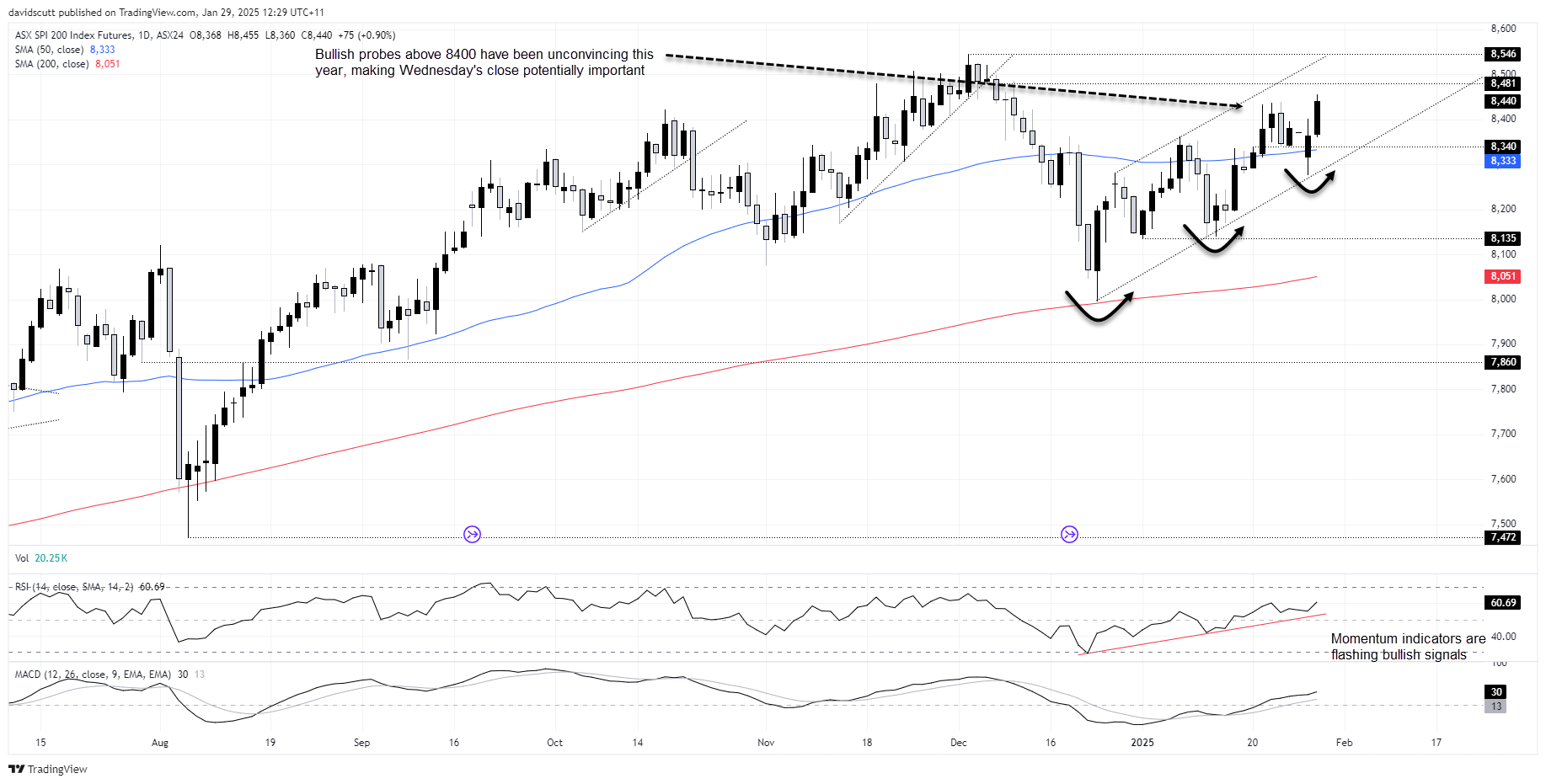

ASX 200 SPI futures hit fresh 2025 highs following the report, breaking through 8400—a level that has been tough to crack in recent months.

Source: TradingView

A close above 8440 would increase the probability of a run toward the record high of 8546 set in late December, avoiding yet another failed breakout. MACD and RSI (14) are flashing bullish signals, favouring dip-buying over selling into strength. Minor resistance sits at 8481, while recent buyers have stepped in around 8340. A break below the 50-day moving average and uptrend from the December swing lows would shift the bias bearish.