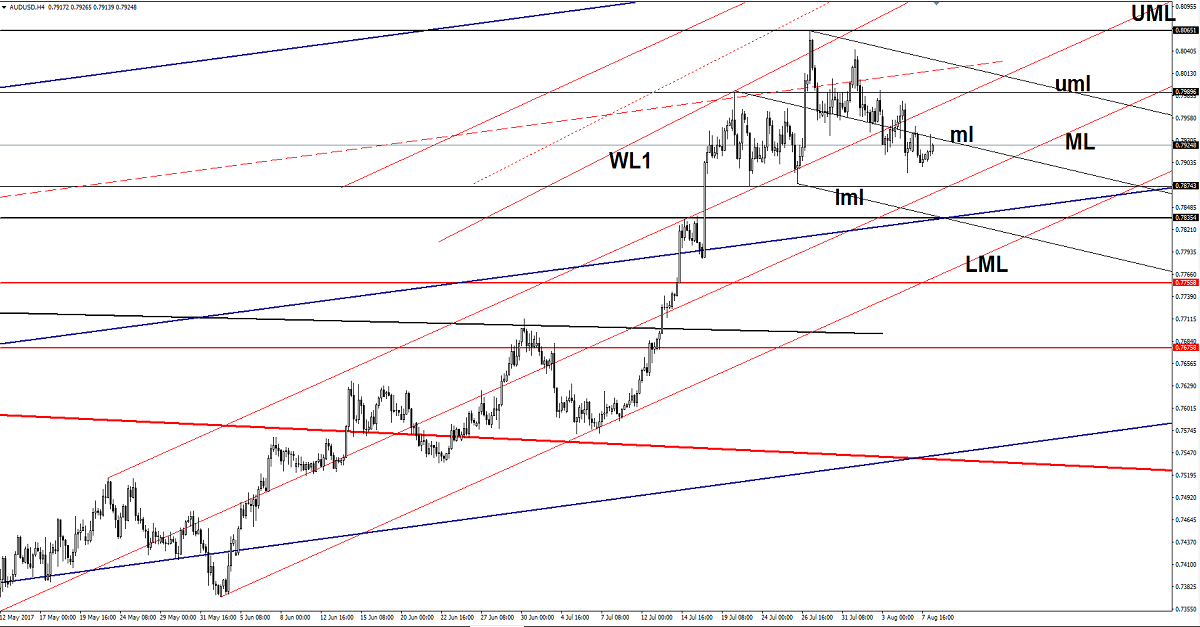

AUD/USD Accumulation Or Distribution?

Price moves sideways on the short term, is consolidating the latest gains and should climb much higher because the uptrend line remains intact. USD could slip lower again as the US Dollar Index Futures could decrease a little as well in the upcoming days.

Right now is trying to recover after the last day’s drop, the Aussie received a helping hand from the Chinese economic data, which have come in better than expected. The Trade Balance climbed from 294B to 321B in July, beating the 294B estimate, while the USD-Denominated Trade Balance increased from 42.8B to 46.7B, exceeding the 45.4B estimate. Moreover, the Australian NAB Business Confidence increased from 8 to 12 points.

The US is to release economic numbers as well today, but I don’t believe that will have any impact on the AUD/USD price action.

Price increased after the failure to reach the 0.7874 static support and now could pressure the median line (ml) of the minor descending pitchfork. A valid breakout above the median line (ml) will confirm an increase towards the upper median line (UML) of the ascending pitchfork and towards the upper median line (uml).

Continues to move between the 0.8065 and the 0.7874 levels, a breakout from this range will bring us a great trading opportunity. It could drop again, only if the US dollar index will have enough energy to climb much higher in the upcoming period.

USDX decreased a little after the Friday’s impressive rally, could move sideways till will recapture enough directional energy to really start another leg higher.

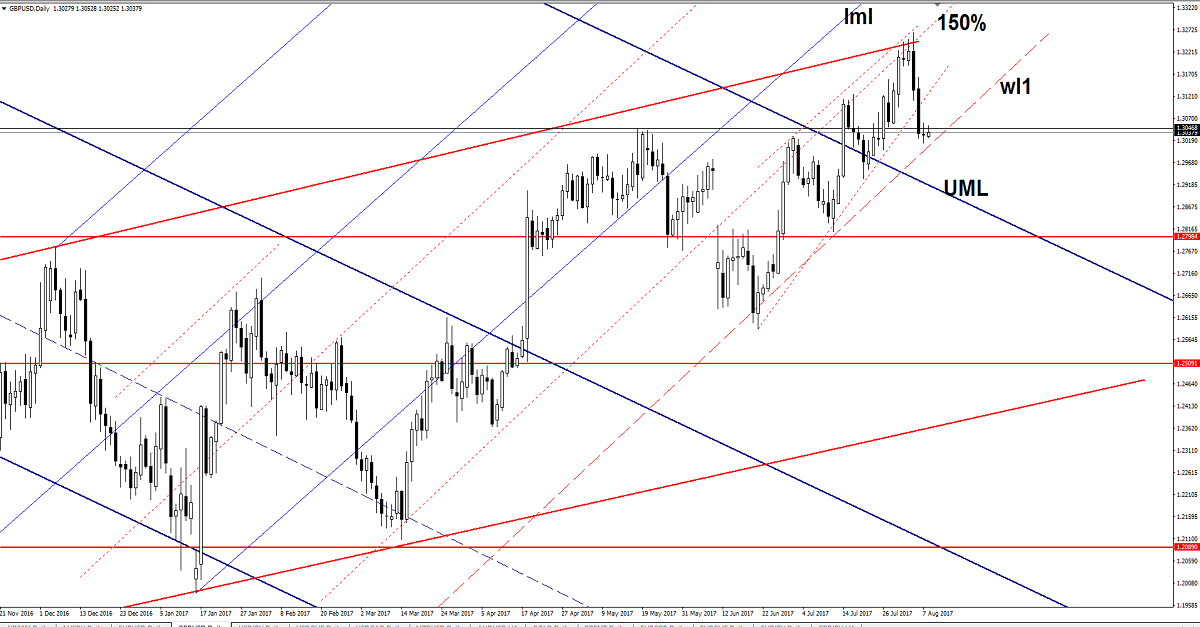

GBP/USD Downside Paused

The GBP/USD posted humble gains today, is fighting hard to stay in the green zone, but remains to see if the buyers will be strong enough to keep the price higher. Is trading within an ascending channel, between the warning line (wl1) and the 150% Fibonacci line (ascending dotted line).

Is expected to retest the warning line (wl1), we’ll see how will react because a rejection will bring us a great buying opportunity, but I want to remind that a breakdown will open the door for more declines.

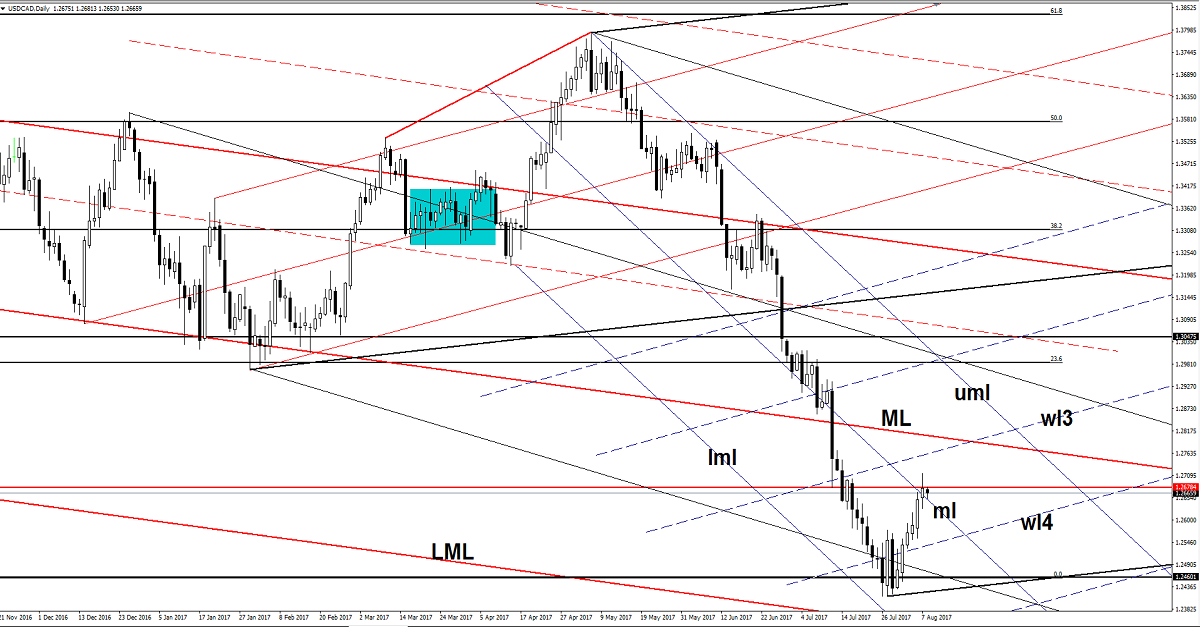

USD/CAD False Breakout?

Price failed to close above the 1.2678 static resistance and now is retesting the broken median line (ml) of the minor descending pitchfork. Will slip lower if the mentioned upside obstacle will hold, could come down to retest the fourth warning line (wl4) before will climb higher again.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.