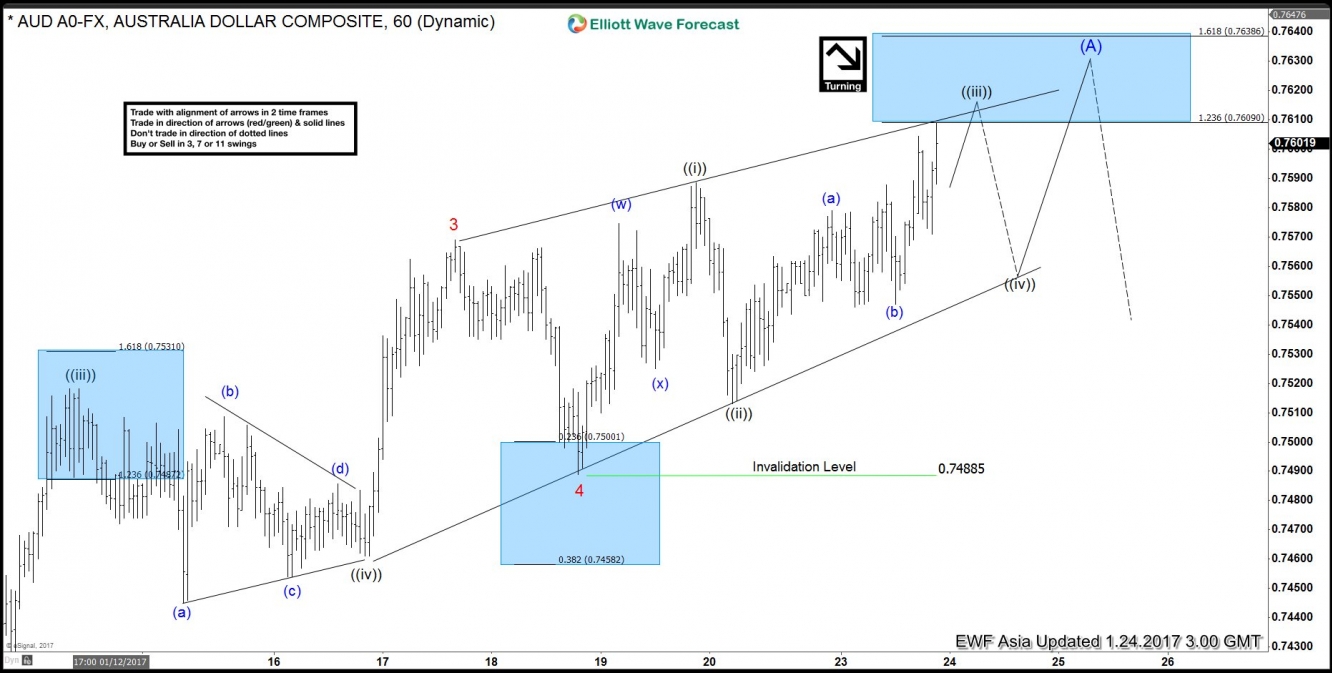

AUD/USD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected as a diagonal before pair ends the cycle from 12/23 low. Rally to 0.735 is labelled as Minor wave 1 and dip to 0.7283 is labelled as Minor wave 2. Up from there Minor wave 3 ended at 0.7568 and Minor wave 4 pullback is proposed complete at 0.7488. Pair is currently in Minor wave 5 as an ending diagonal with subdivision of 3-3-3-3-3, where Minuette wave ((iii)) is expected to end soon and a Minuette wave ((iv)) pullback should be seen in 3, 7, or 11 swing before one more push higher in Minuette wave ((v)). While pullbacks stay above 0.7488, expect AUD/USD to resume higher within Minor wave 5 towards as high as 0.762 – 0.768 area to complete 5 waves move up from 12/23 (0.7155) low. Afterwards, expect a larger degree correction in Intermediate wave (B) in 3, 7, or 11 swing to correct cycle from 12/23 low. A break below 0.7488 could be an indication that the cycle from 12/23 low has ended and pair could see larger degree correction lower.

AUD/USD 1 Hour Chart

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI