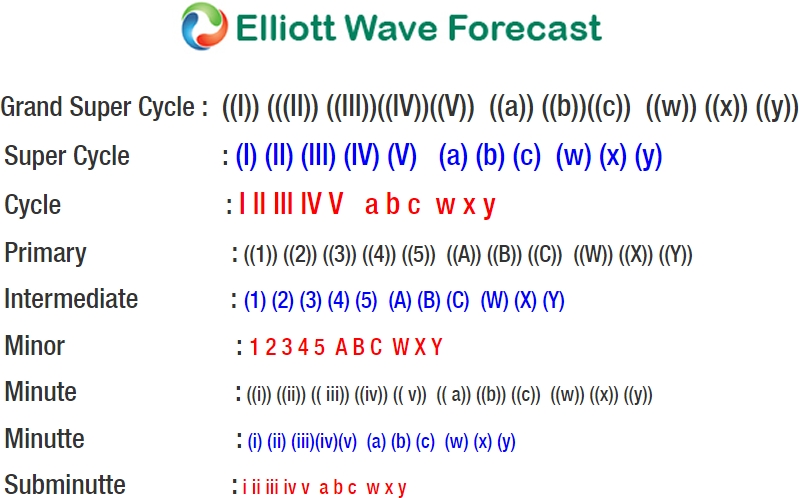

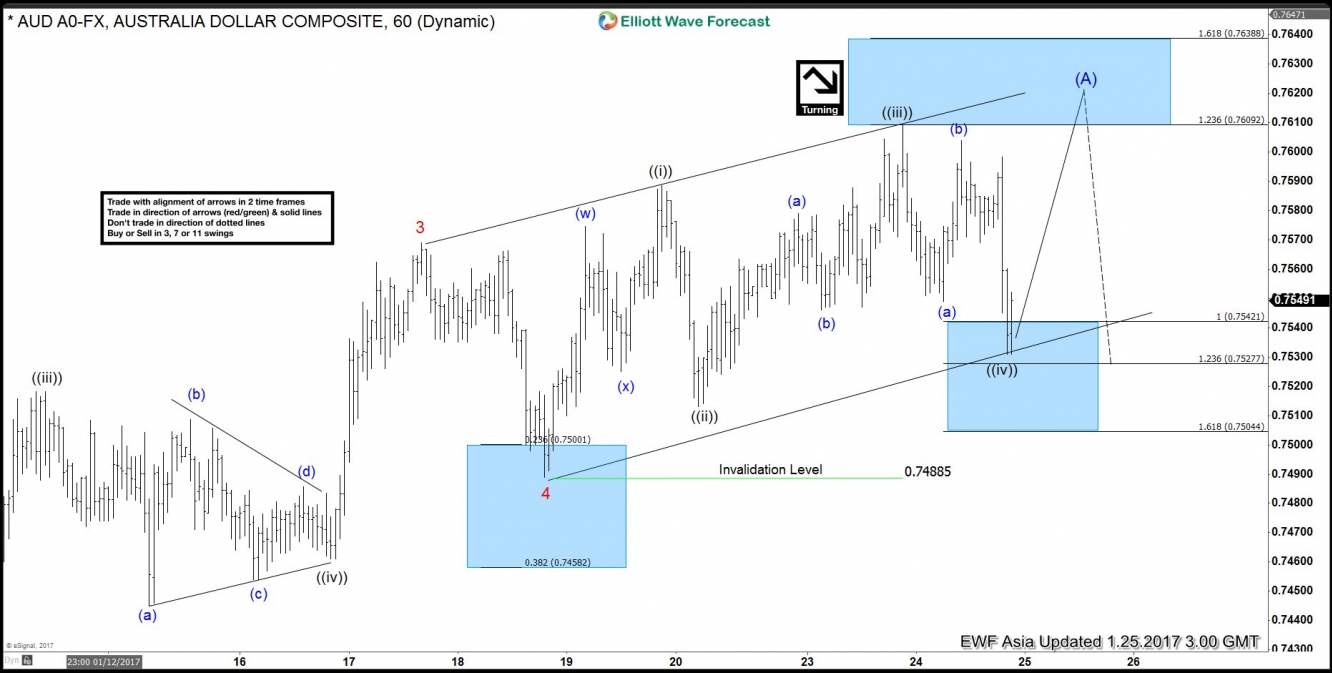

AUD/USD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected as a diagonal before pair ends the cycle from 12/23 low. Rally to 0.735 is labelled as Minor wave 1 and dip to 0.7283 is labelled as Minor wave 2. Up from there, Minor wave 3 ended at 0.7568 and Minor wave 4 pullback is proposed complete at 0.7488.

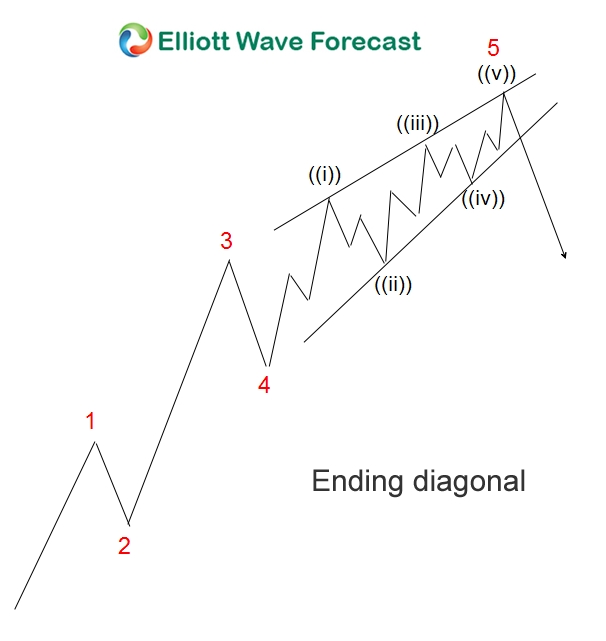

Pair is currently in Minor wave 5 as an ending diagonal with subdivision of 3-3-3-3-3, where Minuette wave ((i)) ended at 0.7588, Minuette wave ((ii)) ended at 0.7513, Minuette wave ((iii)) ended at 0.7609 and Minuette wave ((iv)) is proposed complete at 0.7531. While pullbacks stay above there, but more importantly as far as pivot at 1/19 low (0.7488) remains intact, pair has scope to do another leg higher to end Minuette wave ((v)) and also Minor wave 5 towards 0.762 – 0.768 area.

This move should also complete 5 waves move up from 12/23 (0.7155) low, then expect a larger degree correction in Intermediate wave (B) in 3, 7, or 11 swing to correct cycle from 12/23 low. A break below 0.7488 could be an indication that the cycle from 12/23 low has ended and pair could see larger degree correction lower. As cycle from 12/23 low is mature and can end any moment, it’s risky to chase the move higher at this stage.

AUD/USD 1 Hour Chart

Elliott Wave Cycle