- Australian consumer confidence rebounds, business confidence eases

- Fed members say higher bond yields could cool inflation

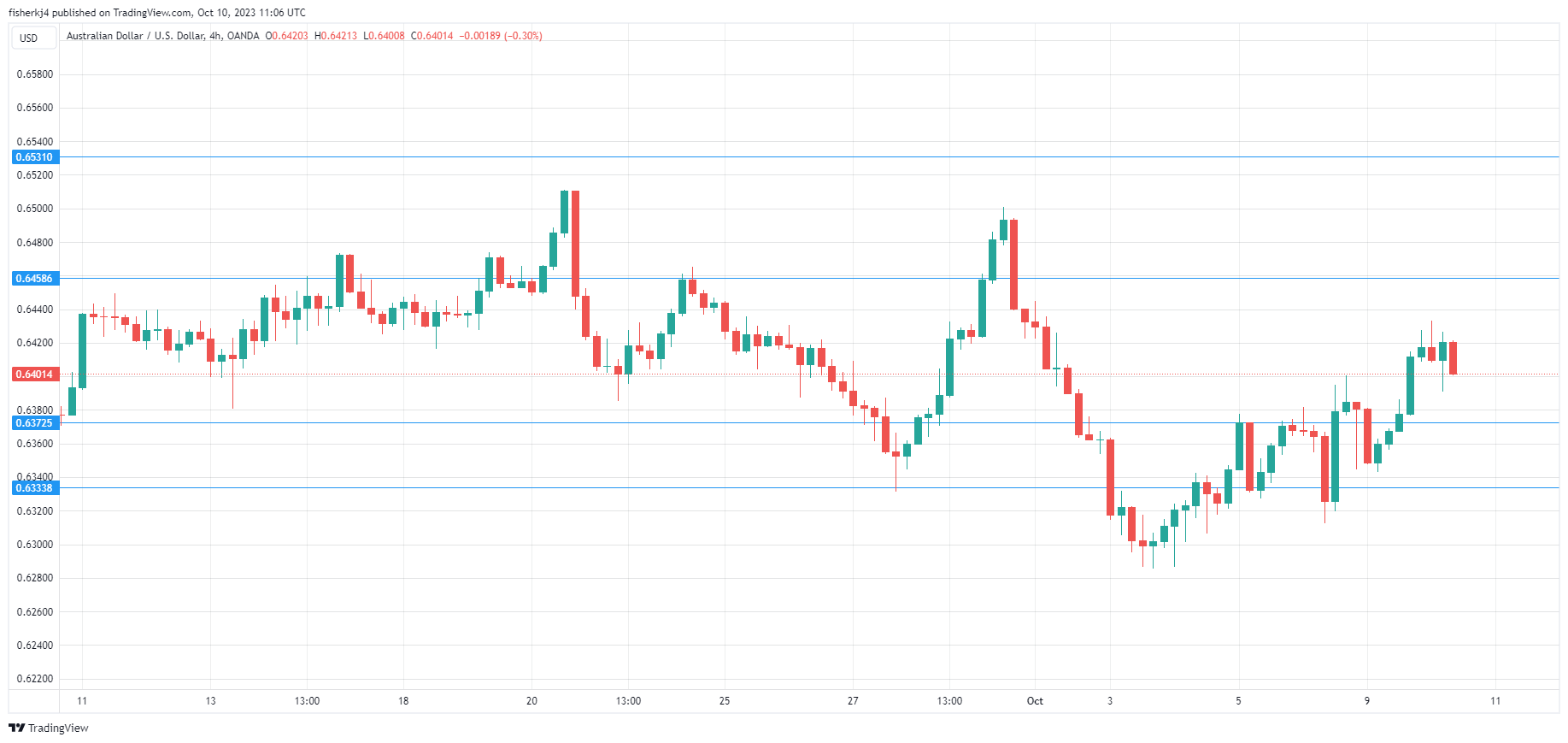

The Australian dollar is unchanged on Tuesday, trading at 0.6412.

Australian Consumer Confidence Rebounds, Business Confidence Ticks Lower

Australia’s Westpac consumer confidence index rebounded in October with a 2.9% gain to 82, up from 79.7 in September. This was the highest level in six months, but consumer confidence remains deep in pessimistic territory, below the neutral 100 level. The survey found that consumers remain concerned about high inflation and the possibility of higher interest rates. The latter is somewhat surprising, as the Reserve Bank of Australia has held rates for four straight months, but nevertheless, consumers are wary about further rate hikes.

The Westpac survey found that family finances remain under pressure, which dovetails with the Reserve Bank of Australia’s finance stability report, which found a large number of households are experiencing stress over their mortgage payments.

Australia’s NAB Business Confidence came in at 1 in September, unchanged after the August reading was revised from 2 to 1. Business conditions eased in August to 11, down from 14, with the employment sub-index component declining.

The RBA has paused four straight times and the futures markets have priced in another pause at the November 7th meeting at 95%. At the meeting earlier this month, RBA Governor Bullock said that additional rate hikes were a possibility, but the markets are viewing this as lip service in order not to lose credibility in the event that the central bank unexpectedly raises rates.

Fed Eyeing Higher Bond Yields

With no major US releases until Wednesday, the focus has been on Fedspeak, with a host of Fed members making public statements early in the week. On Monday, Fed members Jefferson and Logan said the spike in long-term bond rates could mean less of a need for the Fed to raise rates. The reason is that borrowing had become more expensive and inflation could ease without the Fed needing to raise rates.

US 10-year yield rates rose as high as 4.8% last week, a 16-year high, compared to 4.0% in July. Higher yields on Treasuries have led to an increase in other borrowing costs, including mortgages and consumer loans. This could put the Fed’s hopes for a soft landing in jeopardy and are providing support for the Fed to hold rates until next year. The odds of a rate hike before the end of 2023 have fallen to 27%, compared to 39% just one week ago, according to the CME FedWatch Tool.

AUD/USD Technical

- 0.6372 is a weak support line. Below, there is support at 0.6338

- There is resistance at 0.6458 and 0.6531