- Crude oil and AUD struggle on vague Chinese stimulus measures

- Reports suggest Israel may not attack Iranian oil assets, sending crude sharply lower

Overview

Already on the backfoot thanks to a lack of detail from China’s stimulus update over the weekend, the crude oil price and AUD/USD were hit with even greater headwinds late in the North American session on reports Israel is unlikely to attack Iranian energy assets in retaliation for a missile strike earlier this month.

Citing two officials familiar with negotiations, the Washington Post reported that Israeli Prime Minister Benjamin Netanyahu told US officials that Israel is prepared to strike Iranian military targets, rather than its energy or nuclear facilities.

Crude Crushed as Geopolitical Risk Premium Unwinds

With a geopolitical risk premium built into the price, the headlines generated an immediate and large reaction in crude oil markets, seeing front-month Brent and WTI contracts tumble around 5%.

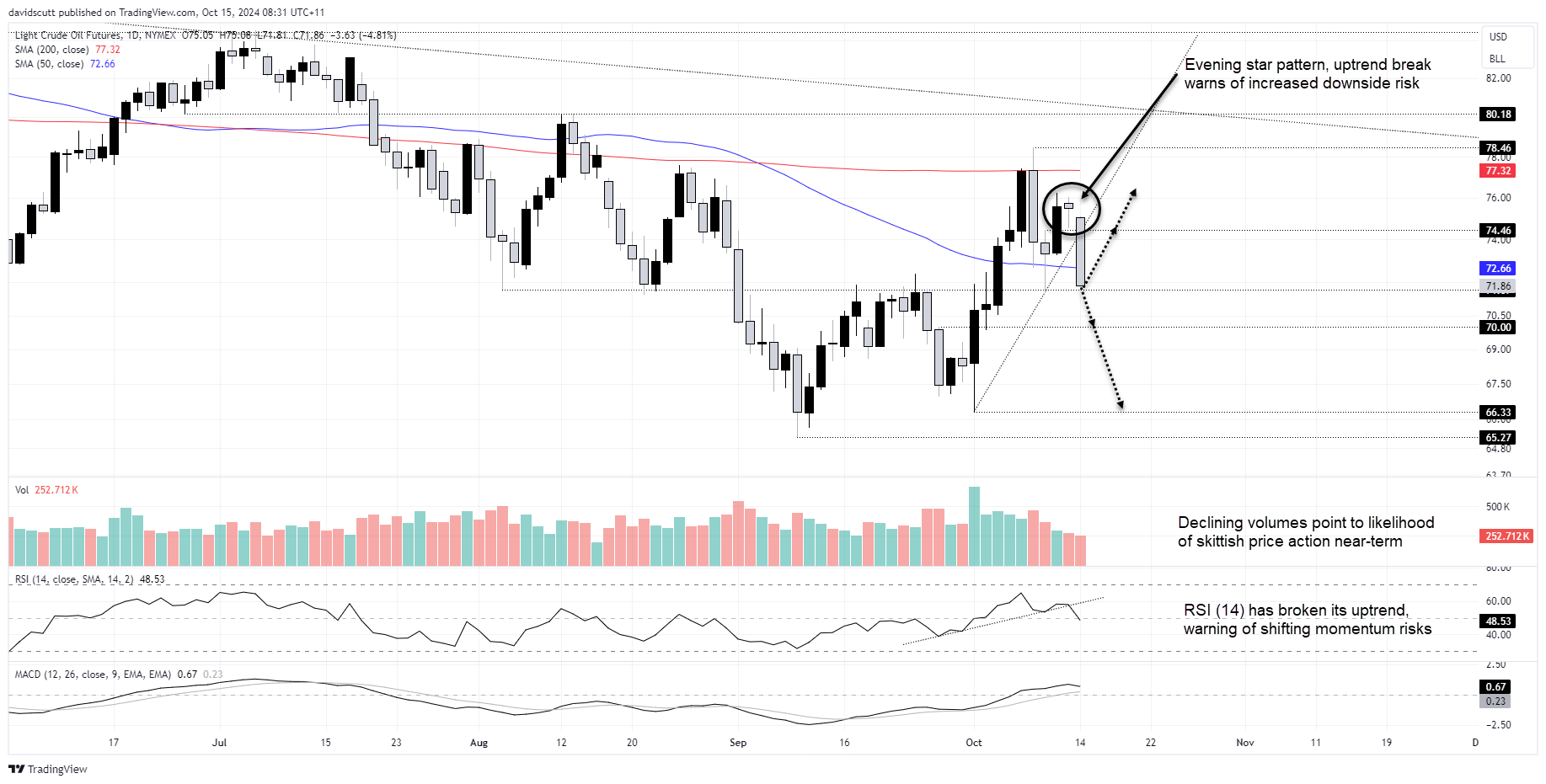

Looking at WTI on the daily chart, you can see the large bearish candle generated by the report, seeing the price slice through the uptrend dating back to the lows stuck on October 1.

The price is now approaching $71.07, a level which has acted as both support and resistance over recent months. Given its proximity, it provides a decent level to build setups around depending on how the price interacts with the level.

RSI (14) has broken the uptrend it was sitting in from late October, generating a bearish signal on momentum which is yet to be confirmed by MACD. While recent headlines are undoubtedly bearish for crude, I’ve been around long enough to know that bearish or bullish fundamentals does not always equate to bearish or bullish price action.

If the price were to break $71.07 and hold there, one option would be to sell with a tight stop above the level for protection. Possible targets include $70 and $66.33. The three-candle evening star pattern completed with the latest leg lower warns of increased downside risks.

Alternatively, if we saw a test and bounce from $71.07, you could flip the trade around, initiating longs with a tight stop below for protection. Potential targets include $74.46 or $76 where the price struggled to break above late last week.

AUD/USD Weakness Reflects China Disappointment

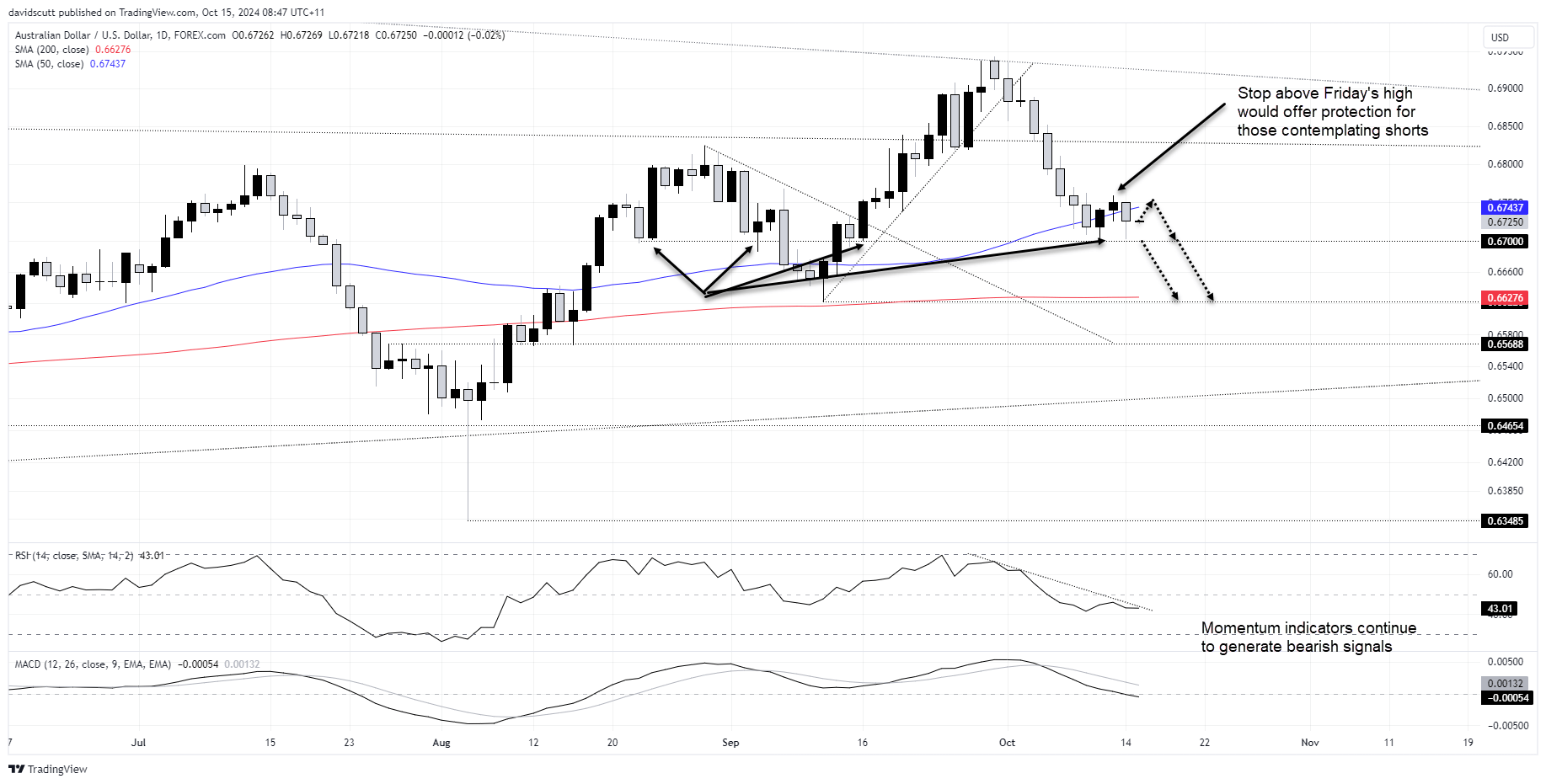

While not impacted to the same degree as crude markets, the commodity-linked AUD/USD eased lower on the headlines, reversing much of the modest gains achieved in the previous two sessions.

With RSI (14) and MACD continuing to provide bearish signals on price momentum, and three-candle evening star pattern warning of increased downside risks, selling rallies is preferred to buying dips in the near-term.

If the price were to push back towards the 50-day moving average, one option would be to short looking for a move back towards support at .7000. A stop above .6760 would provide protection against a larger upside thrust.

Alternatively, if the price were to decline to .6700, see how it interacts with the level for clues on how to proceed.

If the level were to be broken easily, you could sell with a stop above for protection. A potential target would be the 200-day moving average around .6628. If the price were to hold .6700 you could flip the trade, initiating longs with a tight stop below for protection. The 50-day moving average or .6760 loom as a possible target.