Investing.com’s stocks of the week

AUDUSD – Largest 1 Day Gain Since June

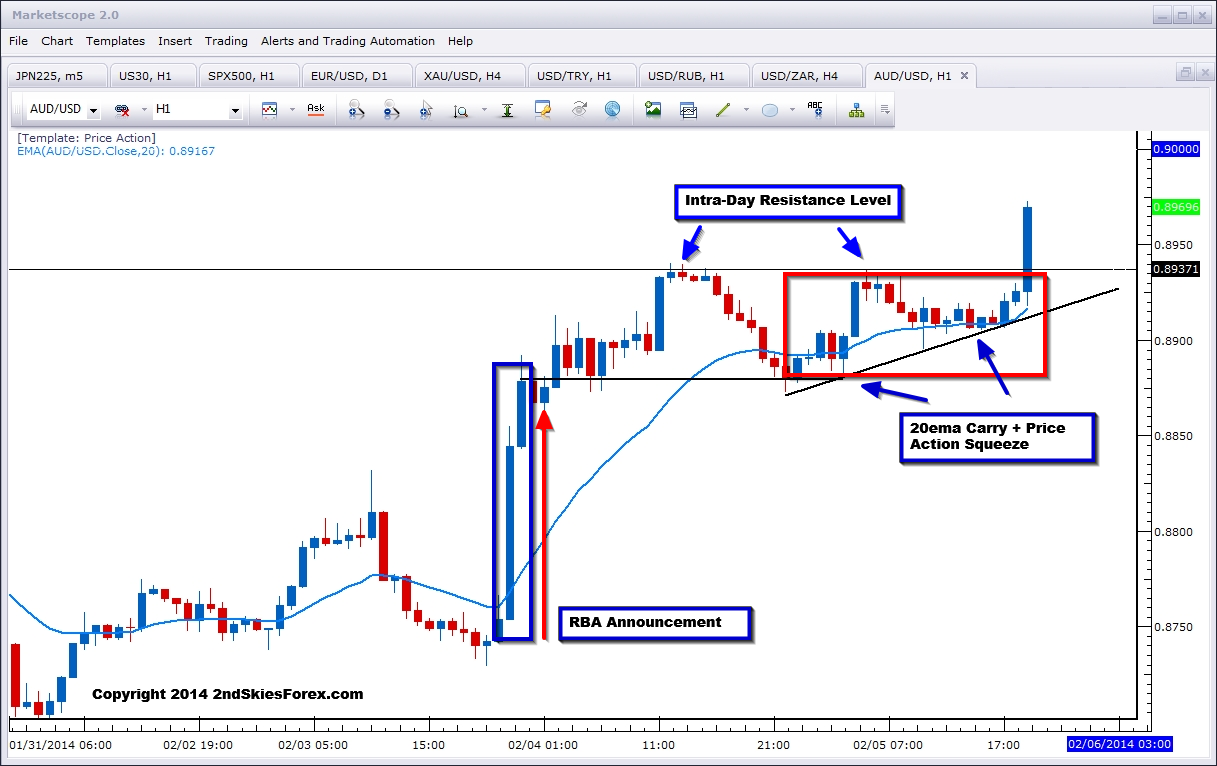

After a more hawkish stance from the RBA, the AUDUSD hard its largest 1 day gain in over 6 months, gaining 2% on the day on Feb. 4th in a massive counter-trend impulsive move. There was a record number of shorts and leveraged positions heading into the RBA meeting, as most were betting on a further decline. But the change in tune led to a huge jump and massive short covering. I’m guessing there is going to be a further capitulation of shorts since the pair today just trotted in place at the highs, forming a with trend pin bar.

Looking at the 1hr chart below, we can see the key intra-day resistance literally got broken as I was writing this article. The price action suggests the pre-breakout squeeze and 20ema carry will likely lead to further upside. I’ll watch the intra-day charts around 8940 to get long, targeting 8996 and 9039 with tight stops below. Any 4hr close below 8930 suggests likely range to persist for another day.

Original post