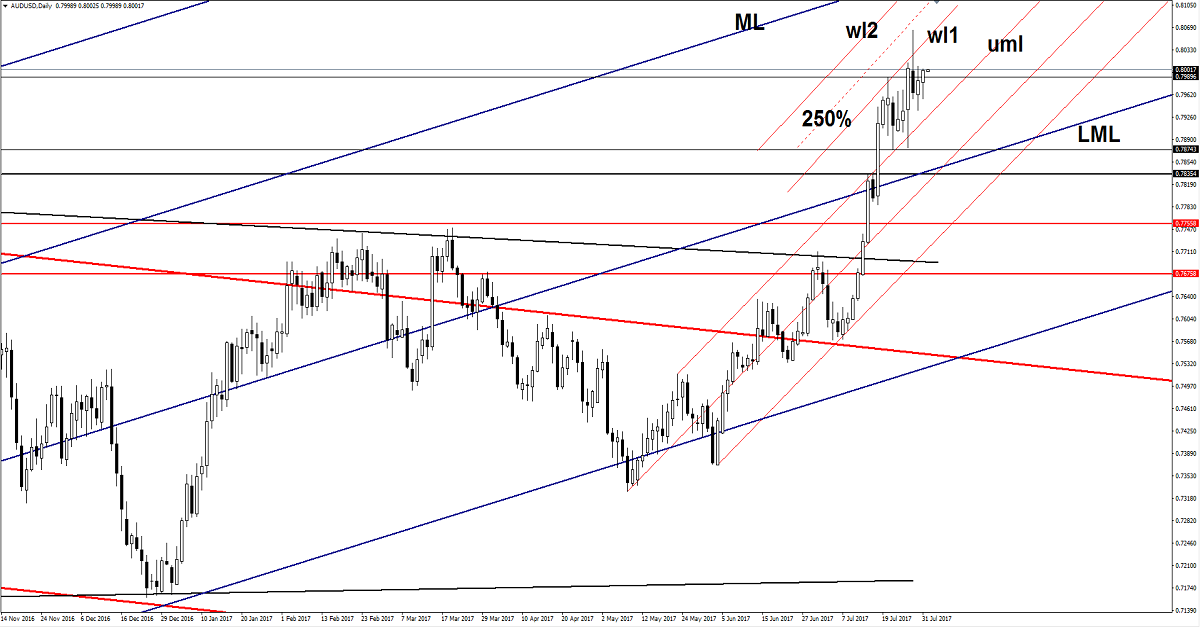

AUD/USD rallying ahead RBA

Price increased on Monday and resumed the Friday’s bullish candle, it is expected to climb much higher because is trading in the buyer’s territory. AUD/USD moves higher as the US Dollar Index dropped sharply again after the United States data was sent to the public. The US figures have come in mixed, but weren’t able to inspire the greenback.

USDX is trading much below the 93.00 psychological level and is expected to reach the 92.49 long term static obstacle, where he could find support again.

Price could be driven by the fundamental factors today because the economic calendar is filled with high impact data, the Reserve Bank of Australia will publish the Cash Rate, which is expected to remain steady at 1.50%. The Cash Rate remains unchanged since August 2016, maybe the RBA Rate Statement will bring a high volatility, so you should be careful. The AIG Manufacturing Index will be released as well later.

The perspective is bullish on the daily chart, the greenback could increase a little only if the United States data will come in better in the afternoon. Another disappointment will ruin the USD, which will resume the bearish momentum.

Price has managed to come back above the 0.7989 static resistance, a minor consolidation will bring a good buying opportunity with a first upside target at 0.8065 previous high. AUD/USD should increase further as long as the upper median line (uml) remains intact.

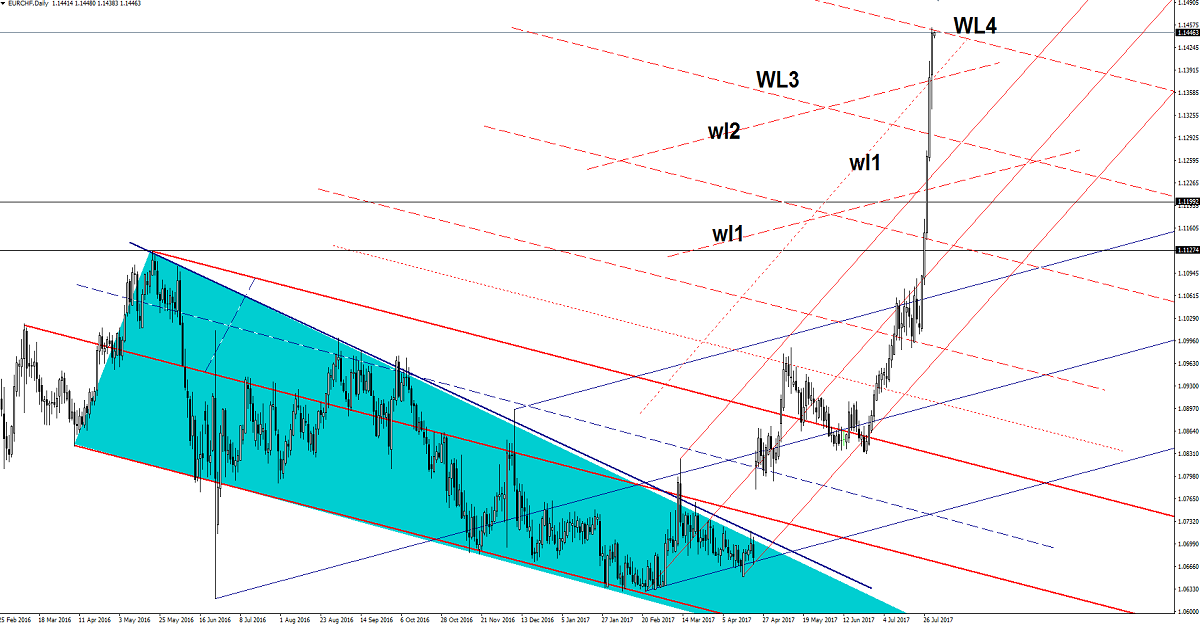

EUR/CHF bullish until sellers appear

EUR/CHF extends the amazing rally, has managed to climb above the 1.1450 level on Monday, much above the 1.1405 last week’s high. Price dropped in the fresh start of the week, but the buyers are still in the game and have forced the rate to breakout above the confluence area formed between the wl2 and the wl1.

You can see that has reached another upside target (WL4), a valid breakout above the fourth warning line (WL4) will confirm a further increase.

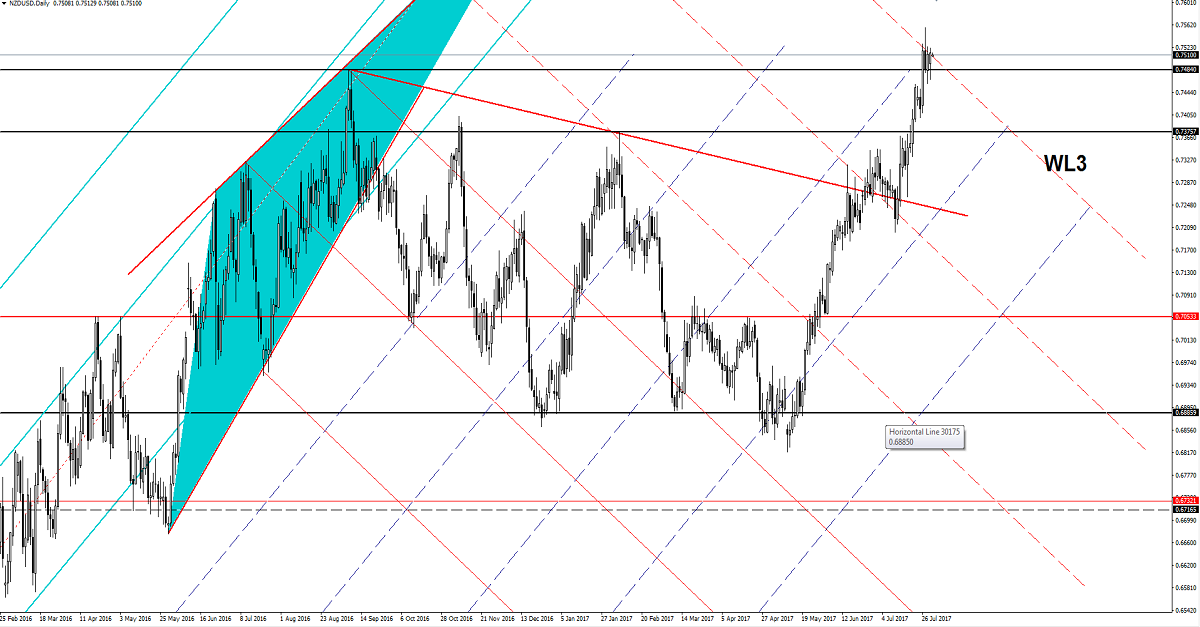

NZD/USD breakout in play

NZD/USD is trading in the green and tries to perforate the fourth warning line (WL4) of the major descending pitchfork. We may have a buying opportunity if will close above the WL4 and if will come to retest the 0.7484 support (resistance turned into support).

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.