- China’s latest set of inflationary data for September increases the risk of a deflationary spiral being entrenched.

- China policymakers continued to use rhetoric to push out new fiscal stimulus policies but lacked details in terms of the amount and scope of implementation.

- An erosion of confidence in China’s policymaking process may trigger a negative feedback loop into the AUD/USD.

This is a follow-up analysis of our prior report “AUD/USD: The recent rally of the Aussie dollar may face a ceiling below 0.6900” published on 2 September 2024. Click here for a recap.

Since our last publication, the AUD/USD has managed to shape a push-up from its 11 September low of 0.6622 (close to the 200-day moving average support at 0.6600) and hit the 0.6900 key medium-term pivotal resistance before it reversed down from an intraday high of 0.6943 printed on 30 September.

In the recent two weeks, the AUD/USD slipped by -3.3% which saw a low of 0.6701 on last Thursday, 10 October. Its renewed weakness has been indirectly linked to the fortunes of the Chinese economy via the demand propensity for industrial-related commodities such as iron ore which is Australia’s key export to China.

Still No Clear And Specific Amount of Fresh Fiscal Stimulus From China

On 26 September, China’s top leadership decision-making body, the Politburo issued a “strongly worded” message in its press statement with the promise of more stimulus measures to stop the beleaguered real estate market from declining further.

It has led market participants to highly anticipate a fresh round of fiscal stimulus measures amounting to two to three trillion yuan to be announced after the Golden Week national day holidays.

However, both the press briefings of National Development and Reform on Tuesday, 8 October, and the Ministry of Finance on Saturday, 12 October were lukewarm in terms of meeting expectations as they lacked details and scope without any specific fresh fiscal stimulus amount being announced and focused instead of using rhetoric messaging as forward guidance.

The Deflationary Risk Spiral Persists

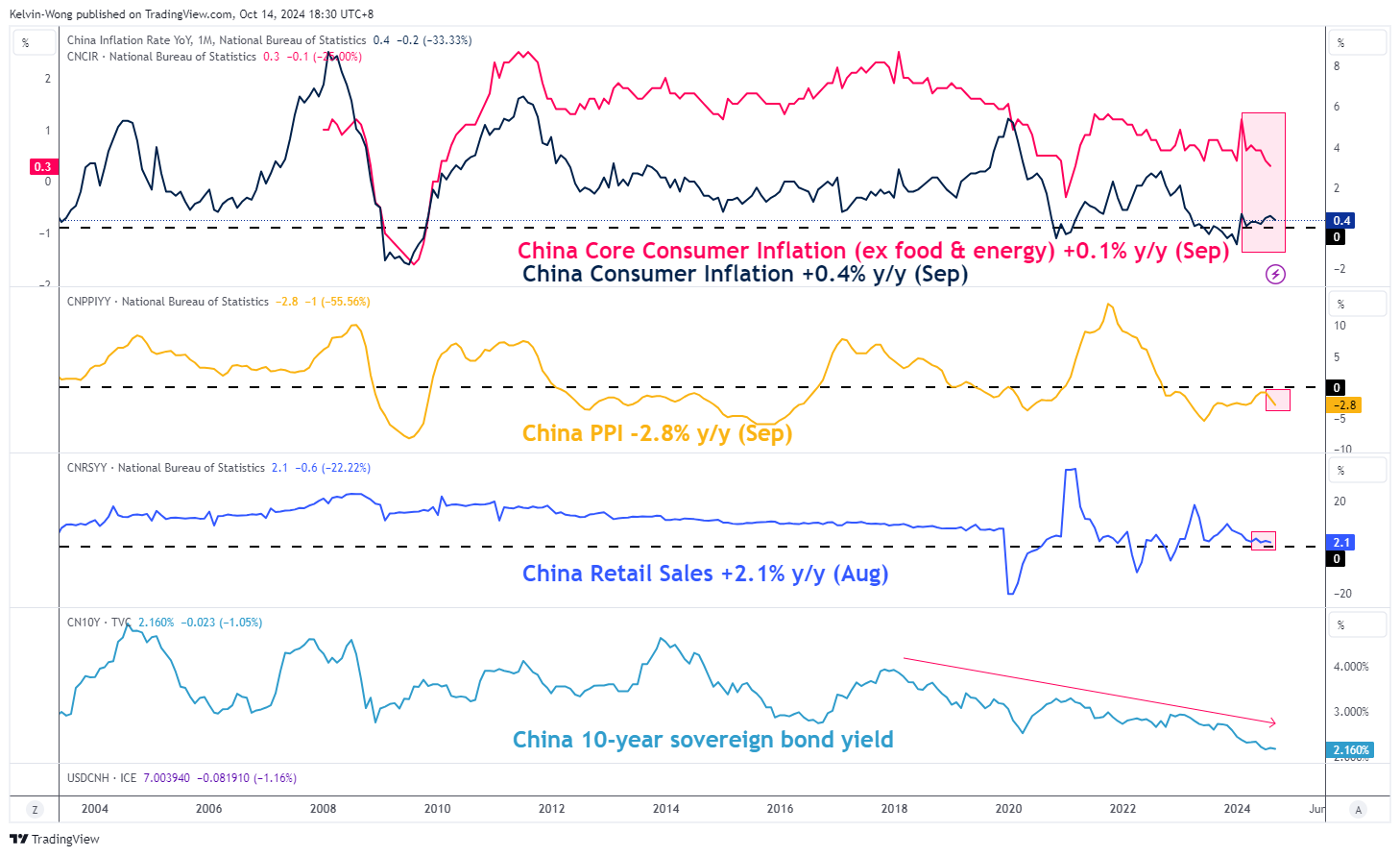

Fig 1: China consumer inflation & PPI trends as of Sep 2024 (Source: TradingView)

The headline consumer inflation rate for China has slipped down further to a three-month low of 0.4% y/y in September, below the consensus and August’s print of 0.6%.

The core consumer inflation (excluding food and energy) has decelerated by a higher magnitude to 0.1% y/y in September from 0.3% in August, its lowest level since February 2021 (see Fig 1).

PPI (factory gate prices) decelerated to -2.8% y/y in September from -1.8% in August, the sharpest contraction since March.

All in all, the window is closing to negate this set of persistent internal demand-led weaknesses inherent in the China economy through the actual implementation of fresh fiscal stimulus measures that boast consumer confidence directly rather than just “morale boasting” rhetoric messaging.

Lacking a new set of fresh fiscal stimulus, market participants are likely to lose patience and their collective behavior may morph into a bandwagon of “negative animal spirits” that may drive down the prices of tradeable instruments that have a significant correlation with the health of Chinese economy such as the Aussie dollar.

0.6700 Key Near-Term Support To Watch on AUD/USD

Fig 2: AUD/USD medium-term trend as of 14 Oct 2024 (Source: TradingView)

In the past week, the price actions of AUD/USD have been hovering precariously around the 0.6700 key near-term support (see Fig 2).

The daily RSI momentum indicator has staged a bearish breakdown below the 50 level and a parallel ascending trendline from its 2 August oversold reading. These observations suggest that medium-term bearish momentum has resurfaced which increases the odds of a breakdown below 0.6700.

Failure to hold at 0.6700 exposes the next support at 0.6600 (close to the 200-day moving average), and a daily close below 0.6600 may see a deeper correction towards the medium-term range support at 0.6360.

On the other hand, a clearance above 0.6900 key medium-term pivotal resistance negates the bearish bias for a test on the next medium-term resistance at 0.7135 (swing highs of 11 August 2022 and 3 February 2023).