The AUD/USD pair has settled into a range over the last couple of weeks and remains supported above 0.76400. Further losses can arise if this level is broken, with traders currently closely watching the 0.76600 level for early signs of a break down. The 0.76000 area contains two trend lines and should provide some strong support. A loss of that area would target 0.75000.

Resistance comes at the 0.76950 level, followed by the recent high at 0.77260. The 200 DMA is found at 0.77600, with the 50 DMA, having just crossed under the 100 DMA, at 0.77650. The falling trend line is close to the 100 DMA at 0.77850. A break above this area puts buyers back in control and targets 0.78900, followed by 0.79550 and 0.80000. A break higher would lead to a retest of the highs from January at 0.81352.

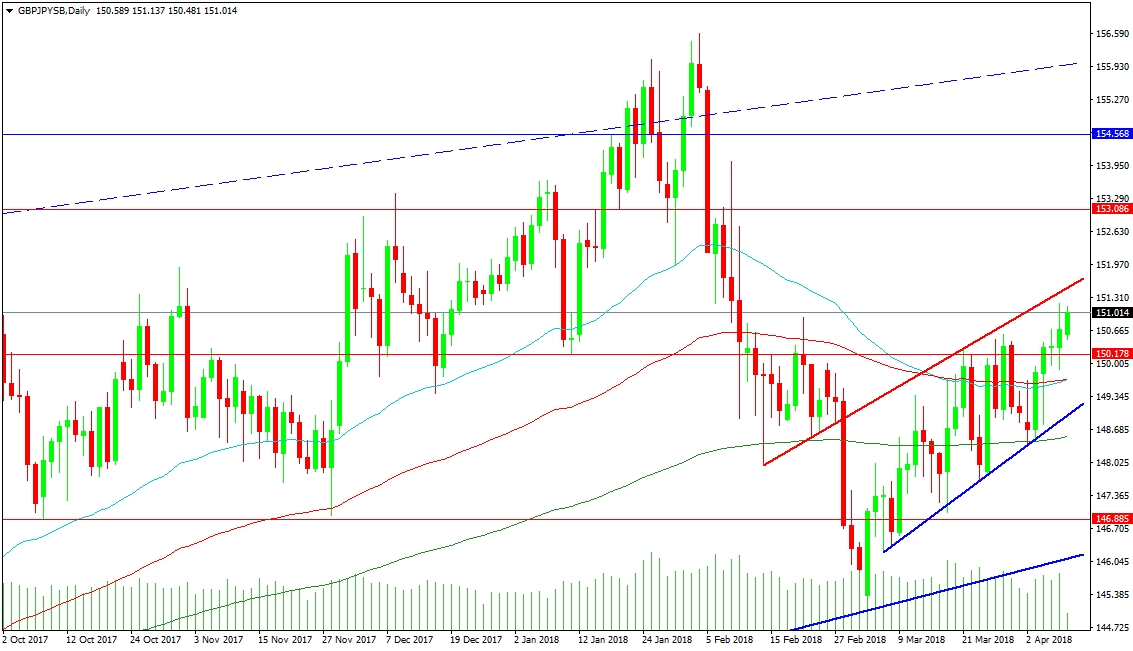

This pair has rallied from the supporting trend line at 144.980 in early March, back up through the 150.000 level and is currently trading around 151.000. This rally may turn into a bearish pattern but that would require a break below the supporting trend line at 149.020. In order to reach that trend line, the moving averages at 149.700 need to be broken. These moving averages are the 50 DMA and the 100 DMA, which are starting to turn higher at present. The 200 DMA is supportive at 148.537. The 146.885 level is also supportive should price break down. Targets on the downside come in at 142.000.

Resistance on the chart is represented by the rising red at 151.420. Price action may choose to follow this line higher but a bigger move would target the 153.086 area, with 154.568 a clear overhead target. The recent highs at 156.600 are protected in the short term by the broken trend line at 155.907.