The Australian dollar is leading commodity currencies higher, after shrugging off soft employment data. The Australian jobs report saw a weak headline figure and a drop in full-time employment, with a downward revision of last month’s number. 4.9k jobs were added in March, well below expectations of 20.3k. The Aussie initially dropped on the data but has since recovered. Australia is a major exporter of commodities to Asia, and in particular China, so the markets will react to any Chinese economic news or comments regarding trade. Moreover, considerable strength in commodity prices has supported the gains made by the AUD.

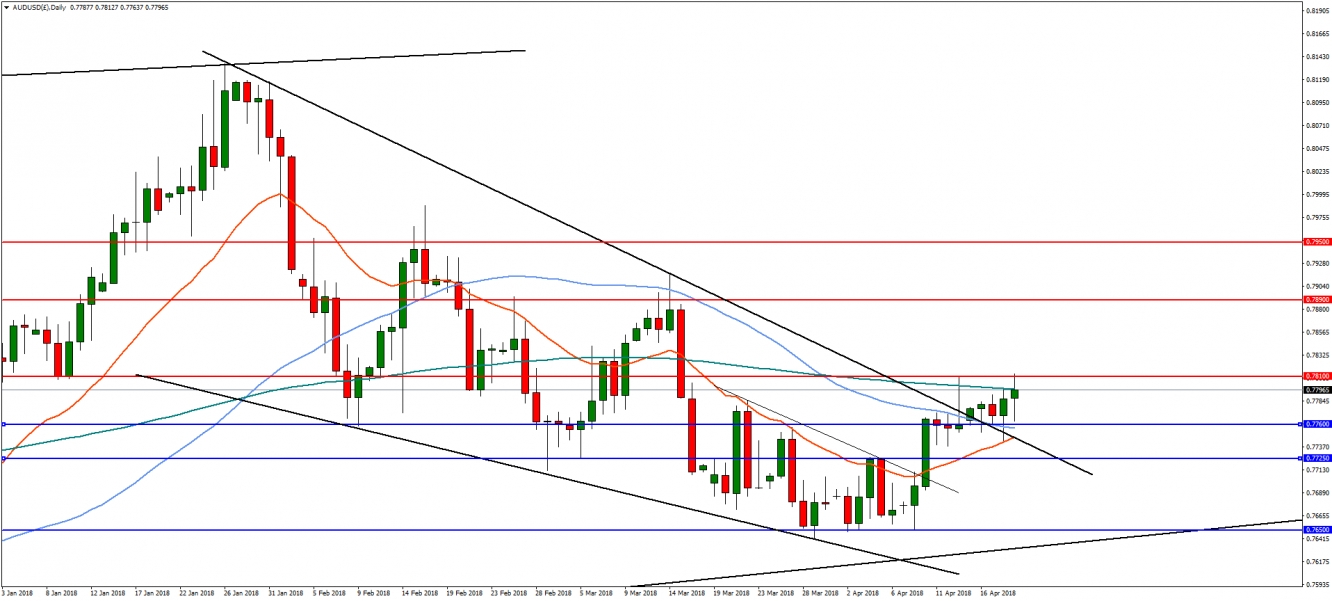

On the daily chart, AUD/USD has broken above the falling wedge reversal pattern, which opens the way to further upside. A break of immediate resistance at 0.7810 is needed to make progress towards the 50% retracement at 0.7890, followed by 0.7950. However, a reversal and break of horizontal and the 23.6% level at 0.7760 could see the pair test the upper line of the falling wedge near 0.7725.

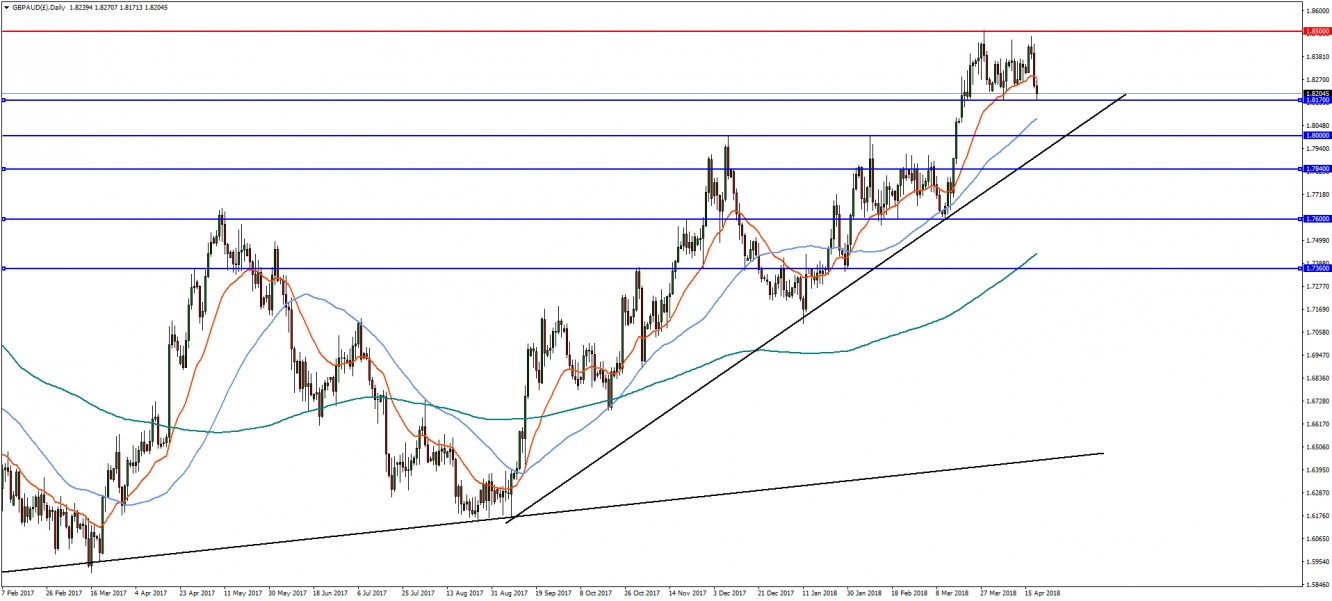

The British pound has come under pressure after the release of wages and CPI data earlier in the week. A weaker GBP, combined with some strength in AUD could cause the GBP/AUD pair to decline. On the daily chart, GBP/AUD has a possible double top at 1.85, and a break of support at 1.8190 would give a measured target of 1.784, with downside support at the trend line and horizontal level of 1.80. On the flip-side, a bullish move and break of highs at 1.85 could see a continuation to the 1.88 handle.

By Edward Anderson, FxPro Analyst