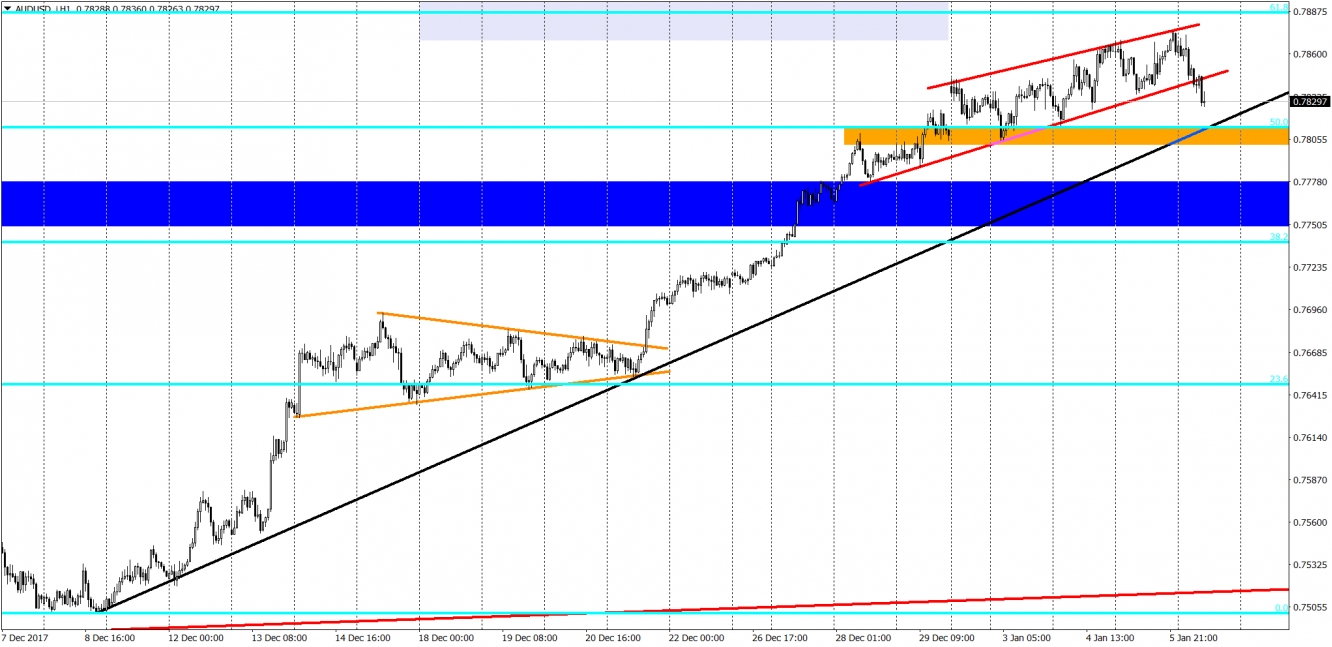

Since the beginning of the December, AUD/USD is trading in a beautiful up trend, which can serve as an example of how the full bullish dominance should look like. On the FX market nothing lasts forever though and it looks like we have a time for a bearish correction now. Although we may experience a drop soon but the up trend as whole, still looks juicy and sustainable.

Recent bullish movement is very technical. The price is making higher highs and lows supported by the black up trendline. In addition to that, we can see a great respect for the Fibonacci retracements (especially 23,6% and 50%). What is more, we had two nice bullish formations. First one was the symmetric triangle pattern (orange) and second was was the channel up formation (red).

If it looks so good, why we see a chance for a reversal. This idea comes from the fact that the lower line of the channel up formation mentioned above, just got broken. That may spark the movement towards the up trendline (15 pips – very probable in the short term) or even slightly deeper – towards the blue area, which is an important support created by the long-term price swings. Any of those two levels look like a good place for a bounce. How to trade it? As soon as you will see a bullish pattern on one of those levels, that will be a great occasion to go long.