Key Points:

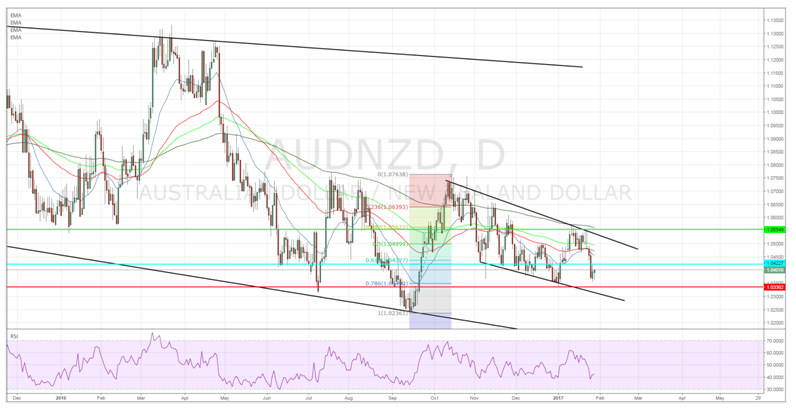

- AUD/NZD trading within a descending channel.

- Price action nearing lower channel constraint.

- RSI Oscillator enters a reversal zone.

The embattled AUD/NZD has been on a largely downward trajectory over the past few months as markets have reacted to deteriorating Australian domestic economic conditions. Subsequently, we have witnessed the pair trading within a relatively tight descending channel that has largely constrained the pair’s price action. However, despite the AUD/NZD’s bearish disposition, the pair is getting ready to rally, albeit in the short term.

Assessing the pair from the technical perspective provides some enticing evidence of a potential setup for a rally. The past few days has seen price action moving steadily towards the lower channel constraint which has been a key reversal zone in past periods. In addition, the RSI Oscillator is nearing oversold territory and there is some historical evidence of some sharp reversals from this level. Subsequently, there is building evidence that we may indeed see a relatively strong bounce for the Australian dollar in the coming days.

In contrast, the fundamental outlook for the Australian economy is relatively murky at best as the antipodean nation faces diminished growth in the coming few quarters. There is already evidence of an uptick in the unemployment rate as well as slipping inflationary pressures. Although the Australian economy may indeed avoid a technical recession, there is likely to still be plenty of negative aspects that will impact currency valuations in the coming months.

Ultimately, despite their being plenty of reasons to take a bearish view on the pair in the long run, the short term outlook is decidedly more bullish. Subsequently, the most likely scenario for the next few days is one where price action discovers support around the bottom of the channel before moving rapidly higher to challenge the 61.8% retracement level around the 1.0422 mark.

The upside target would likely fall around the 1.0554 level, especially considering that there is currently little chance of a break out of the short term channel. Subsequently, keep a close watch on the pair in the early part of next week as it could be setting up to fly, albeit in the short run.