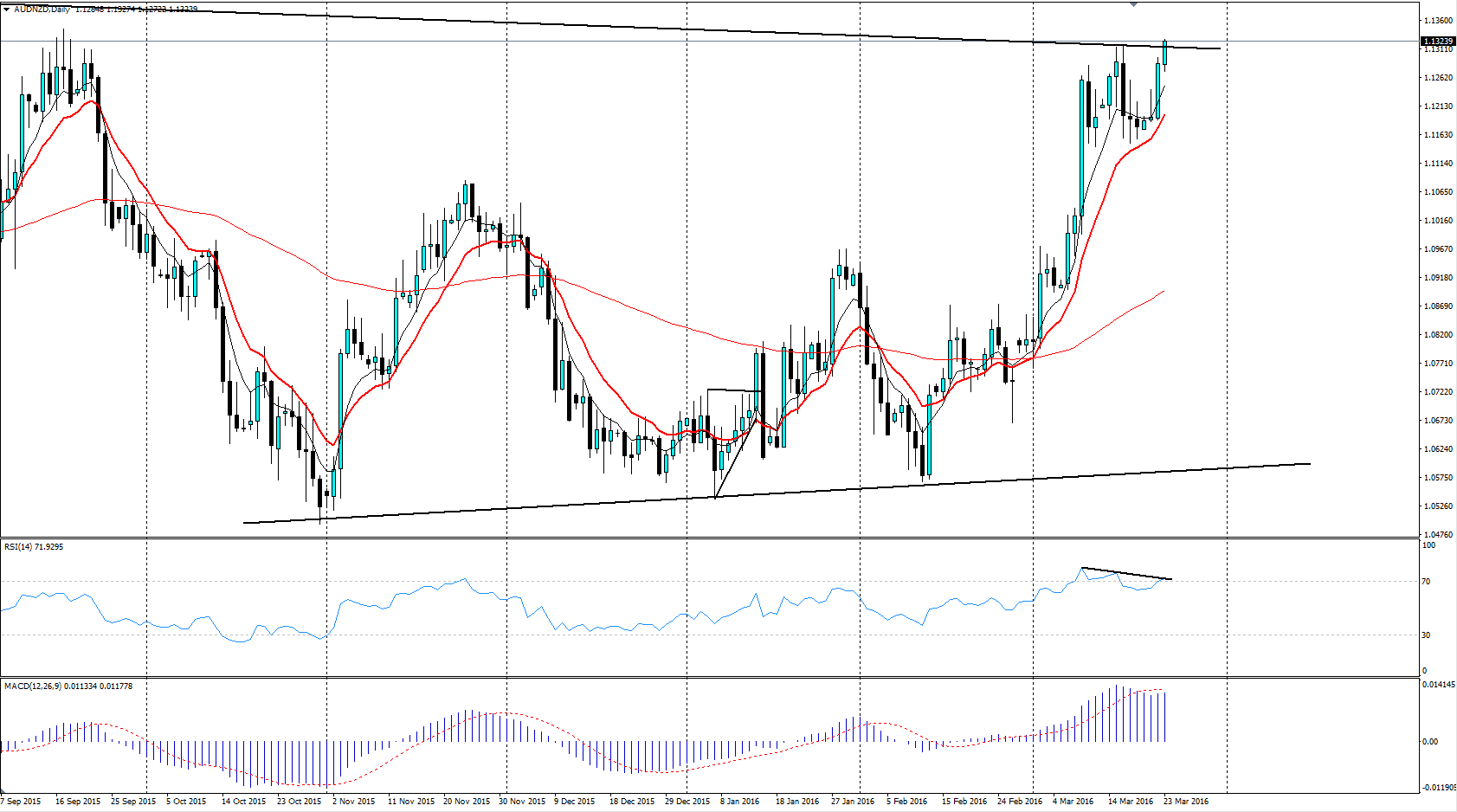

The volatile AUD/NZD pair has largely fallen within a consolidation pattern over the past few months as the currency reacts to the swings that world sentiment has provided. However, despite a rise to the top of the requisite channel, the pair is now facing some selling as a bearish bat wing pattern has just been completed. Subsequently, the question remains as to whether the pair is heading strongly south in the coming days.

Taking a look at the daily chart for the AUD/NZD shows a currency pair that has been under a consolidation phase over the past few months before attempting a failed breach of the top of the channel. However, despite the recent rally, an analysis of the RSI oscillator shows an indicator that has just re-entered over-bought levels and now threatens to turn lower.

In fact, the hourly chart seems to confirm the short side bias with the appearance of a bearish bat pattern. The recent completion of this pattern, coupled with price action’s location at the top of the channel, is a strong indicator that the upside moves have run out of steam. Additionally, there is also some divergence apparent on the RSI oscillator which is slowly drifting lower.

Subsequently, there is likely to be plenty of selling opportunities for the pair in the days ahead as price turns bearish and subsequently challenges the 1.1147 support level. Ultimately, any break of that level is likely to see the pair moving rapidly to challenge the bottom the range around the 1.08 handle.

However, despite the burgeoning signals of a short side move, be wary of the NZ Export and Trade Balance figures due out shortly. Any subsequent surprises around that data release could see some definite volatility in the pair and spoil the short push as the markets react to the risk of further interest rate divergence.

Ultimately, from a technical analysis point of view, the currency is largely heading one direction and that is clearly towards the short side. When you consider the appearance of the bearish bat wing, along with an RSI oscillator that has entered oversold, it is clear that the pair is predisposed to the downside. In addition, the risk and reward ratio for a short position is also advantageous given price’s relation to the channel trend line. Subsequently, get on board for a strong short side push back towards a liquidity zone around the 1.08 handle but watch for any bulls hiding in the wings.