- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

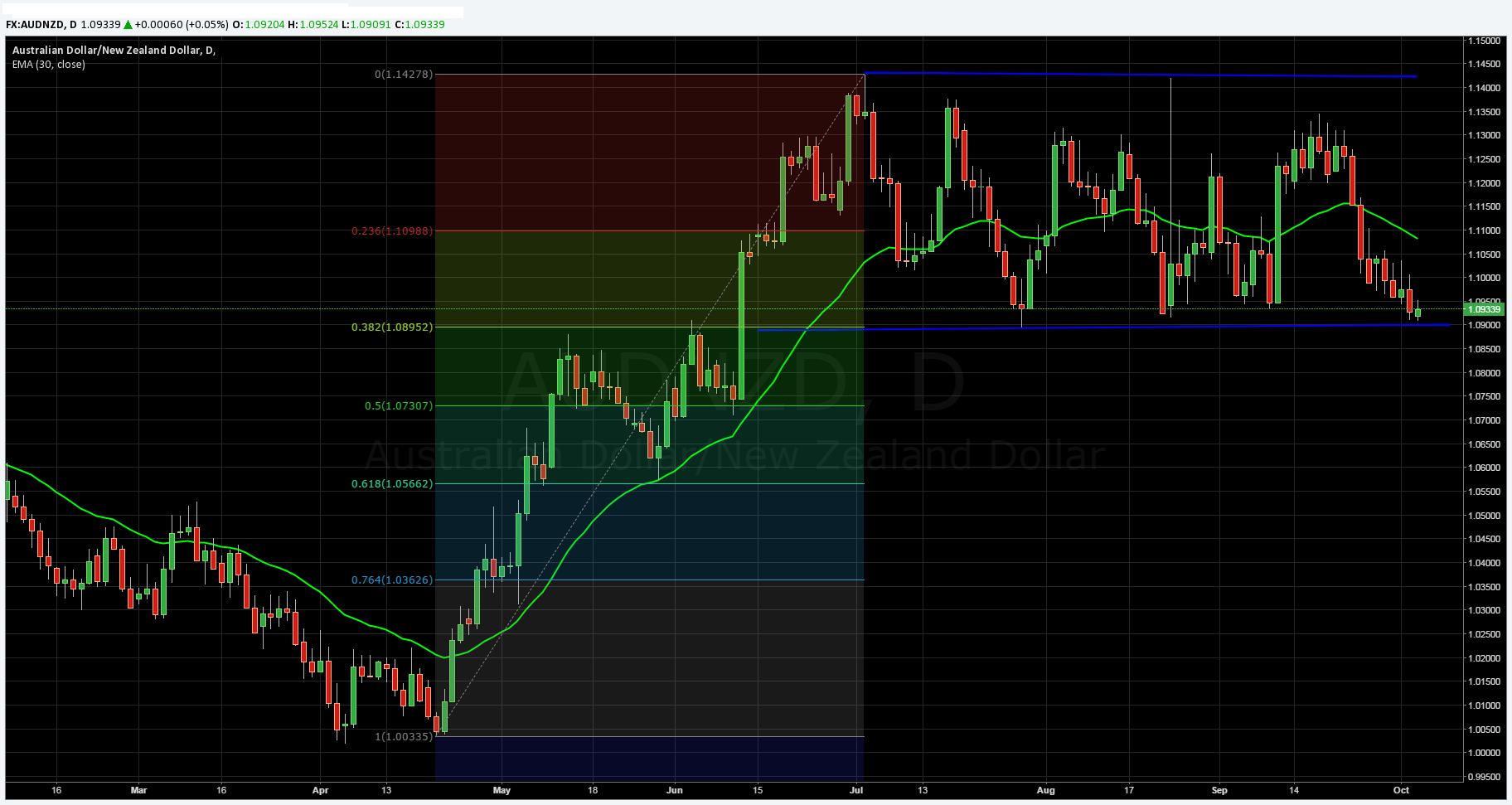

AUD/NZD: Heading For The Top Of The Range?

The AUD/NZD has remained somewhat constrained, within a tight range, for some time now but despite the lack of a definite trend direction, trading opportunities abound and the pair is subsequently readying for another thrust to the long side.

Since June, the venerable pair has traded between 1.0920 and 1.1368, with the smart money playing the bounces from the channel lines. Friday saw the AUDNZD approaching the bottom of the channel but a buoyant Australian retail sales result of 0.4% put a stop to any further depreciation and the pair now looks set to rally.

From a technical analysis viewpoint, the pair continues to be supported by a relatively strong channel that is constraining its price action. The 38.2% Fibonacci retracement level also coincides with the supporting channel line adding to the weight for a short term long bias, especially given the pairs current valuation within the range.

In addition, an analysis of the RSI oscillator shows the key indicator flattening and ticking upwards in a signal of things to come. In comparison, stochastics show the pair having entered into over-sold territory and slowly trending higher. Given the pairs location, relative to the bottom of the channel, the risk reward ratio for any long biased trade is advantageous.

However, a major fundamental event looms on the near term horizon, as the RBA considers whether to cut interest rates further given the lack of action from the US Fed. It seems clear that the Australian central bank is likely to take a conservative approach to any monetary policy decisions and subsequently hold rates steady until the US FOMC makes their minds up.

Ultimately, to cement a move higher, the pair will need to surmount the 23.6% Fibonacci retracement level at 1.1098, as well as resistance at 1.1210. The intermediate bullish target for the pair falls around the 1.1320 mark but any further break above that level would require a significant risk event, such as the RBNZ cutting rates.

So enjoy the short term bullish romp in the park but know that as the top of the channel nears that the bears will gather, once again,to ruin the party.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

Forex Strategy is Bullish: We are currently @ 1.2660 in a channel. Nice bounce here and if GBP/USD continues, we are looking for a continuation to the ATR target @ 1.2725 area,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.