Investing.com’s stocks of the week

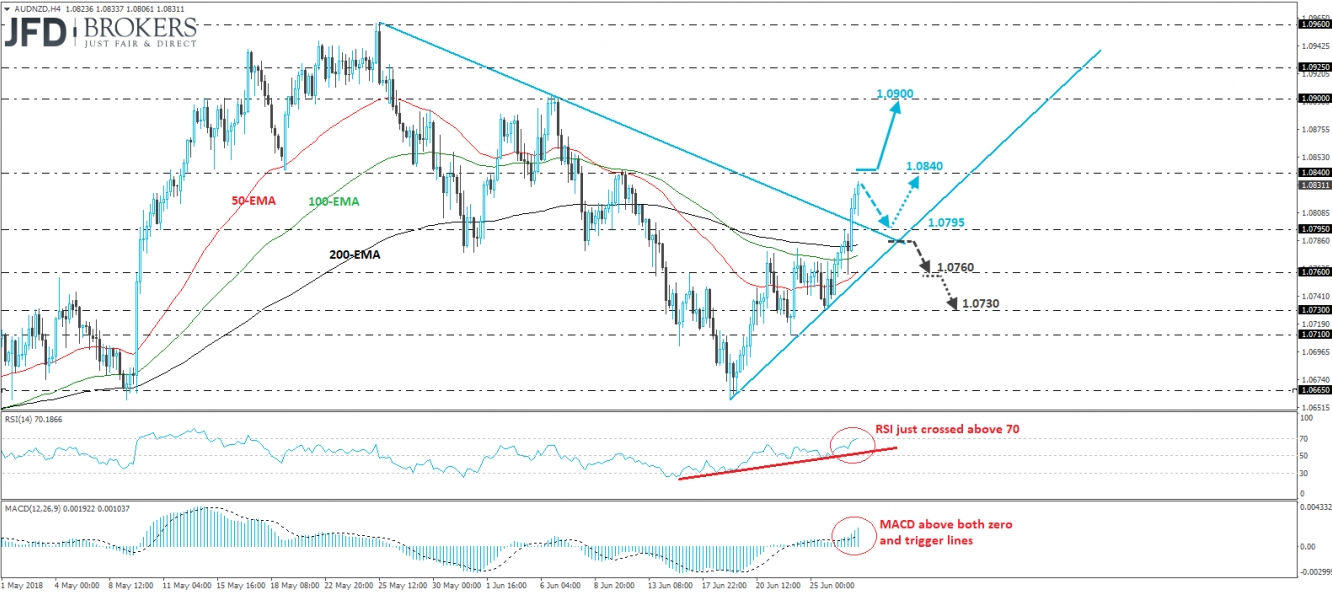

AUD/NZD surged overnight, breaking above the 1.0795 barrier and the downside resistance line drawn from the peak of the 25th of May. This, combined with the fact that the price structure is of higher peaks and higher troughs above the new tentative uptrend line taken from the low of the 19th of June, paints a positive near-term outlook in our view.

If the bulls maintain their momentum, we would expect them to challenge the 1.0840 resistance soon, the break of which could carry more bullish implications and perhaps set the stage for the 1.0900 territory.

The case for further upside is also supported by our short-term momentum studies. The RSI edged north and just poked its nose above its 70 line, while the MACD lies above both its zero and trigger lines, pointing up.

On the downside, if the bears manage to take the rains from current levels, we may see them driving the battle lower, perhaps for a test near the 1.0795 zone, or the aforementioned tentative uptrend line. That said, even if this is the case, we would still consider the short-term picture to be somewhat positive as the bulls may decide to jump in again from near that trendline.

We would like to see a clear and decisive break below that short-term upside line before we abandon the bullish case. Such a dip could also bring the rate back below the downside line drawn from the peak of the 25th of May and could initially aim for the 1.0760 support. Another move below that obstacle could pave the way for our next support barrier of 1.0730, defined by the low of the 25th of June.