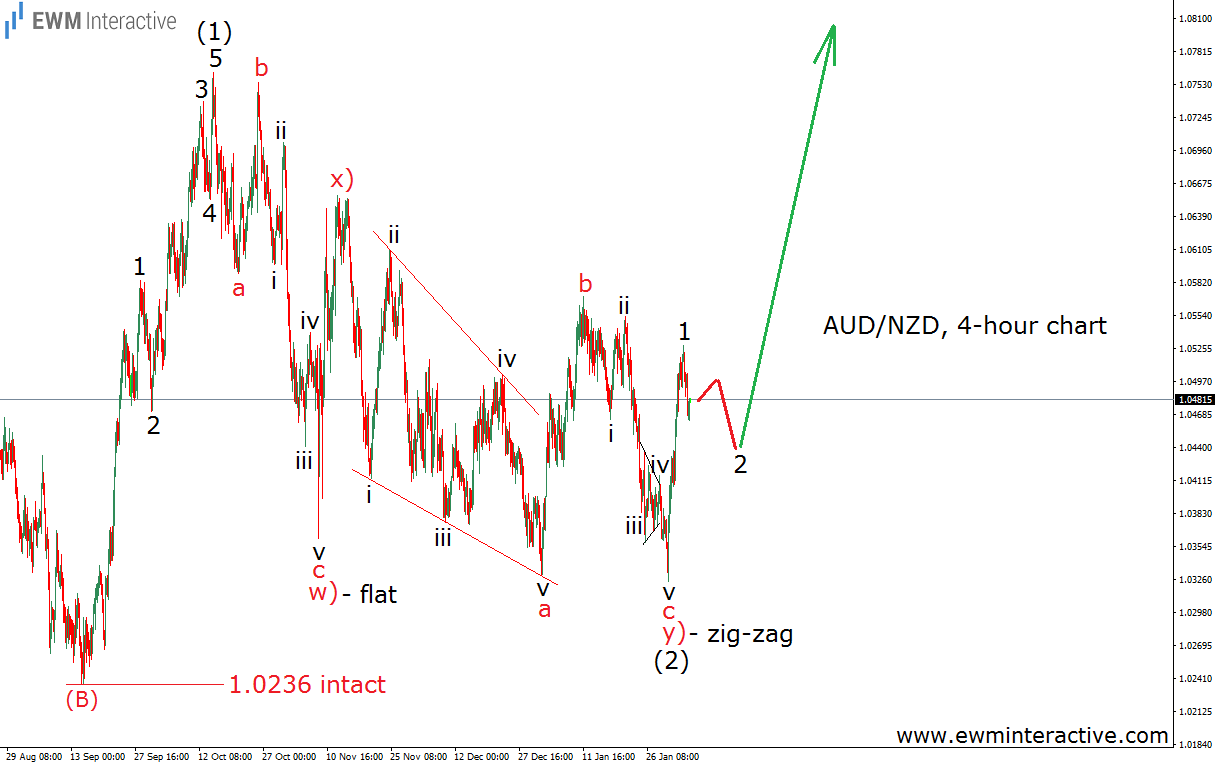

On December 30th, 2016, we published AUD/NZD Bears Weaker Than They Appear. At the time of writing of that article, while the pair was trading near 1.0380, we thought the bulls should soon return and lift AUD/NZD much higher. The reason for that optimism was the Elliott Wave analysis of the chart below.

As visible, AUD/NZD was trading in a corrective combination between a flat correction in wave w) and a simple zig-zag in wave y). However, combinations are not easy to decipher, so we simply concluded that as long as AUD/NZD trades above 1.0236, we remain confident in the bulls’ ability to turn things around. Staying above 1.0236 was critical, because in order for this bullish count to remain valid, the rate was not supposed to decline below the starting point of the five-wave impulse, marked as wave (1).

If you have been following how AUD/NZD has been doing during the last month, you know things did not go quite as planned. On the other hand, the invalidation level at 1.0236 was never threatened and so was the bullish outlook. Today, the Australian dollar is trading at 1.0480 against the New Zealand counterpart, so let’s see what took the bulls so long.

Wave (2) really is a corrective combination. The difference is that wave y) evolved into a much larger a-b-c zig-zag, where wave “a” is a leading diagonal, followed by a sharp wave “b” and a regular impulsive wave “c” down to 1.0324, where the bears seem to have finally given up.

The market has multiple ways to deceive us and prove us wrong. As AUD/NZD demonstrated, even if the initial idea is right, the exact price path remains unknown. That is why we have to rely on the key levels the Wave Principle arms us with. No matter what the market does, as long as they hold, the odds remain in our favor.

Wave (2) looks complete. The bottom at 1.0324 should be safe from now on. If this is the correct count, AUD/NZD has a lot of rallying to do, especially considering the big picture outlook.