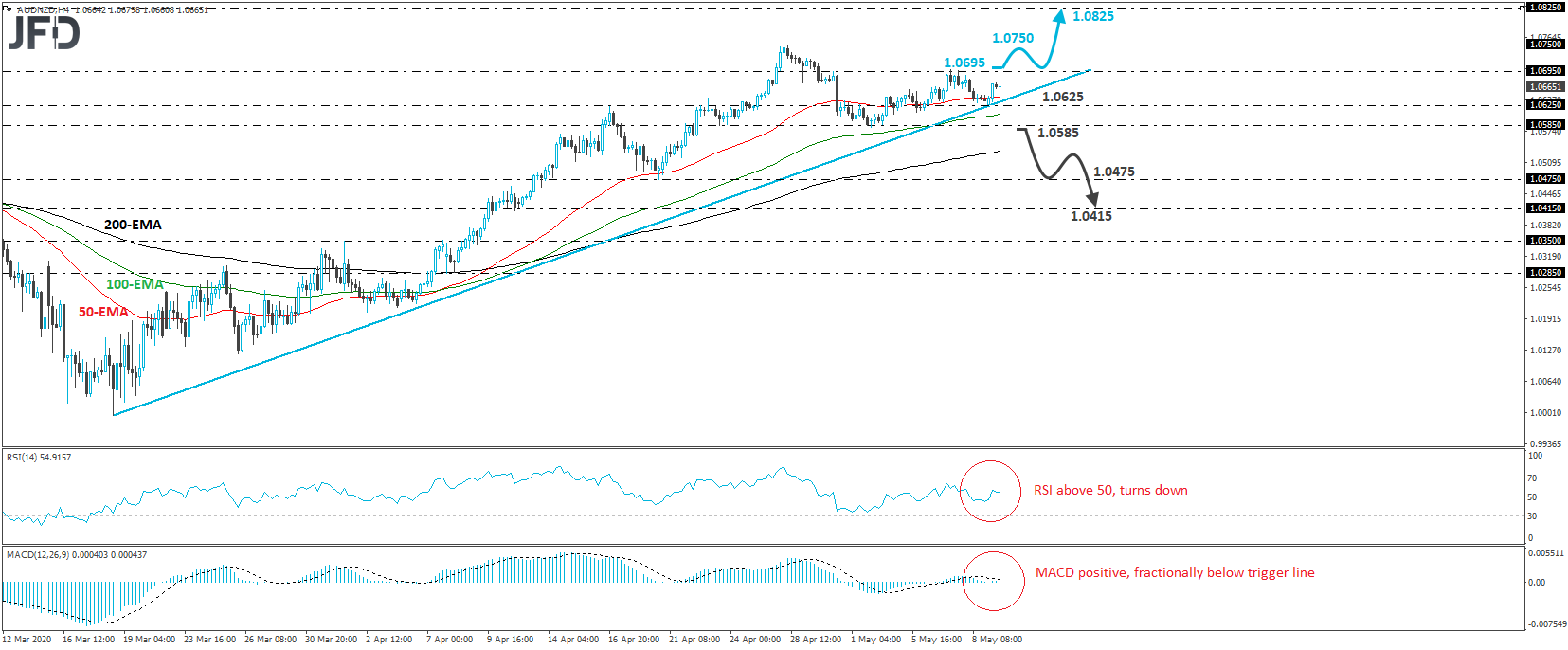

AUD/NZD traded higher on Monday after it hit support at the crossroads of the 1.0625 level and the upside support line drawn from the low of March 18th. As long as the rate continues to trade above that line, we would consider the near-term outlook to be positive.

However, before we get confident on more advances, we would like to see a clear break above 1.0695, a resistance level marked near the high of last Thursday. If the bulls are strong enough to overcome that zone, we could see them aiming for the high of April 28th, at around 1.0750. Another break, above 1.0750, would confirm a forthcoming higher high and could set the stage for extensions towards the 1.0825 barrier, defined by the highs of October 30th and November 12th.

Taking a look at our short-term oscillators, we see that the RSI, although above 50, has ticked down, while the MACD lies slightly above zero, but fractionally below its trigger line. Both indicators detect weak upside momentum, which suggests that another minor setback may occur before the next leg north, perhaps for the rate to challenge again the aforementioned upside line.

In order to turn our gaze to the downside, we would like to see a strong break below 1.0585. Such a move would confirm a forthcoming lower low, while the rate would already be below the upside line. The bears may get encouraged to drive the battle towards the low of April 20th, at 1.0475, the break of which may allow declines towards the low of April 13th, near 1.0415.