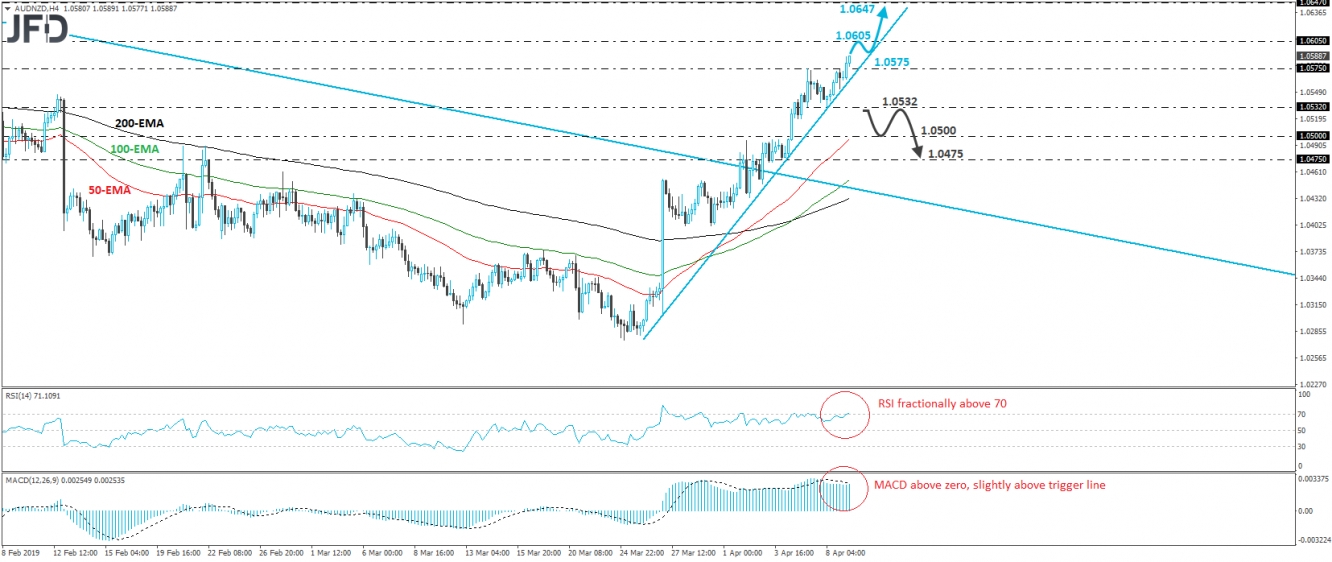

On Monday, AUD/NZD hit support near the 1.0532 level and rebounded. The rate continued drifting north on Tuesday as well, breaking above Friday’s peak of 1.0575, that way reaching levels last seen on January 22nd. Since April 1st, the pair has been trading above the prior medium-term downtrend line drawn from the peak of August 10th, which combined with the fact that the rate remains supported by the upside line drawn from the low of March 27th, paints a positive near-term picture.

The break above 1.0575 has confirmed a forthcoming higher high on the daily chart and thus, we would expect the bulls to aim for the 1.0605 zone soon, a resistance defined by the inside swing low of January 20th. If they are not willing to hit the brakes near that zone, then further extensions towards the 1.0647 zone, marked by the peak of January 22nd, could be possible.

Shifting attention to our short-term oscillators, we see that the RSI just crossed above its 70 line and continues to point up, while the MACD, already positive, has turned up and just poked its nose above its trigger line. These indicators suggest accelerating upside speed and corroborate our view for further near-term advances.

On the downside, a break below the crossroads of the 1.0575 level and the upside support line drawn from the low of March 27th, may signal that the bulls have started to abandon the battlefield. That said, we would like to see a clear dip below 1.0532 before we start examining whether the bears have gained the upper hand in the short run. Such a move would confirm a forthcoming lower low on the 4-hour chart and could open the path towards the psychological zone of 1.0500. Another break, below 1.0500, could extend the slide towards the low of April 4th, at around 1.0475.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI