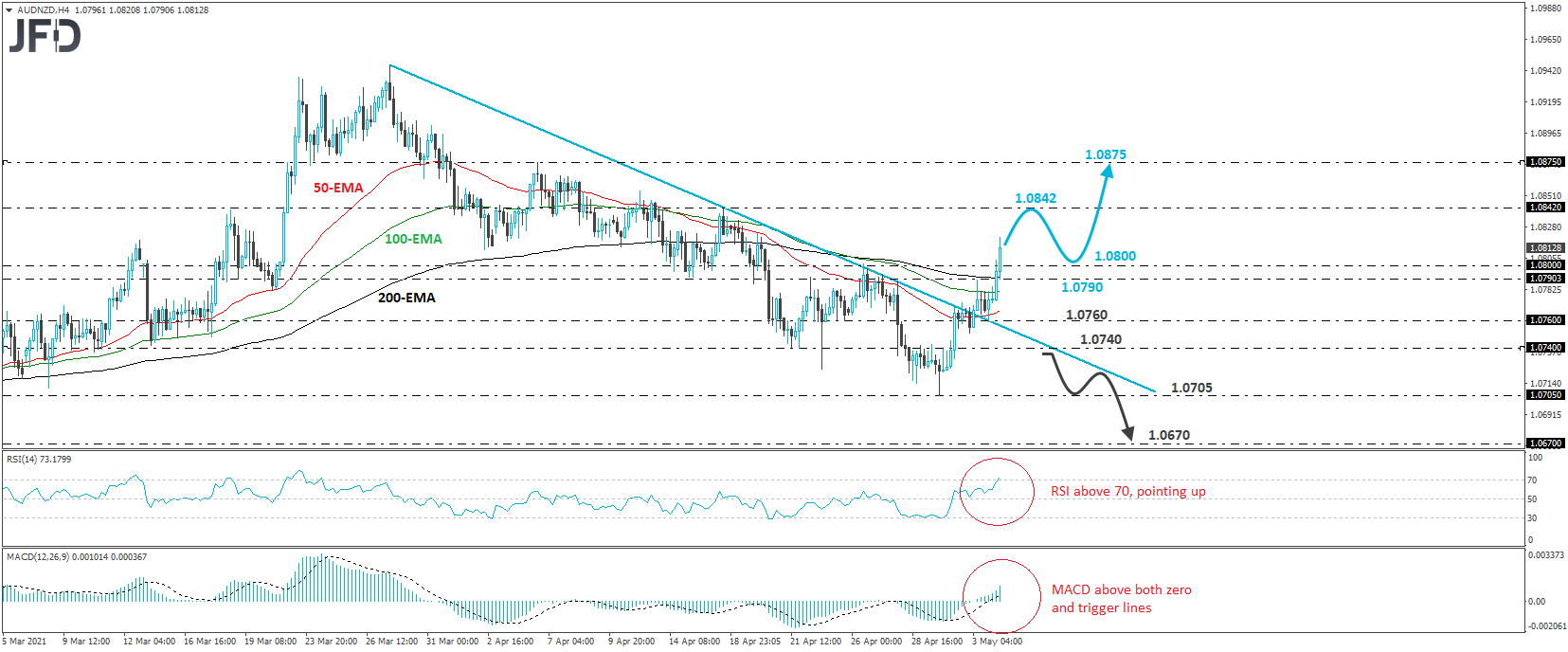

AUD/NZD rallied on Tuesday breaking above the 1.0800 zone, which was marked as a resistance by the high of Apr. 26.

The move confirmed a forthcoming higher high on the 4-hour chart, and given that the rate is already above the prior downside resistance line drawn from the peak of Mar. 29, this may have signaled a short-term trend bullish reversal.

If the bulls are willing to stay in the driver’s seat, we may see the rate rising towards the 1.0842 area, defined as a resistance by the high of Apr. 16. They may decide to take a break after testing that zone, thereby allowing the rate to correct lower, but they could regain control from near 1.0800 and perhaps push the action above 1.0842 this time around. Something like that may pave the way towards the high of Apr. 6, at 1.0875.

Shifting attention to our short-term oscillators, we see that the RSI just crossed above 70, and continues to point up, while the MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect strong upside speed and support the notion for further advances in this exchange rate.

Now, in order to start examining whether the outlook has turned back bearish, we would like to see a dip below 1.0740. This may also take the pair back below the pre-mentioned downside line and may initially pave the way towards the low of Apr. 29, at 1.0705. A break below that level would confirm a forthcoming lower low and may set the stage for the 1.0670 area, marked as a support by an inside swing low formed on Mar. 1.