Investing.com’s stocks of the week

A stream of weak data, brewing trade wars and a growth warning from RBNZ has resulted in NZD being the weakest major over the past three months, allowing AUD to regain some ground and send AUD/NZD back to May’s high.

We warned upside pressures were building on AUD/NZD back in May as it approached a key bearish trendline. Following its break higher, whilst the broken trendline failed to act as immediate support as hoped, ultimately it did mark a momentum shift from the lows.

We can see on the daily chart that the 3.1% rally from the 1.0658 low firmly rejected a bed of support comprising of a 61.8% Fibonacci level, bullish hammer and May’s low. Moreover, prices have accelerated away from a newly established bullish trendline to underscore a pickup of momentum.

If the current leg higher is to match the distance from the 1.0488 low to 1.0962 high (474 pips), AUD/NZD could find itself just below the 1.1140 swing high in due course. That said, it could be time for a consolidation or retracement before the anticipated leg resumes.

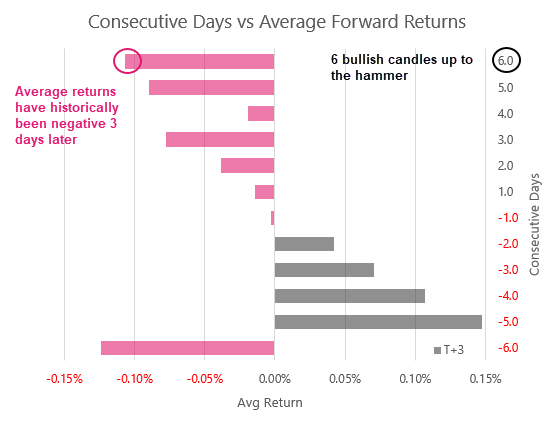

Yesterday’s bearish pinbar failed to break above (and ultimately close below) the May high at 1.0962 to warn of weakness at these highs. There’s also the fact that the bearish hammer marked its sixth consecutive bullish close (on an open to close basis), which has only occurred 18 times (0.4%) since 2002. Furthermore, the average return following six bullish candles has been negative for 1, 2 and 3 days ahead. Placed alongside the bearish pinbar below key resistance, a retracement isn’t out of the question.

Still, this is a near-term warning and we have greater confidence in dominant bullish momentum resuming. So, for now we await a more suitable entry for a long position once price has had a chance to consolidate or revert to the mean.