- New Zealand’s unemployment rate has accelerated to 5.1% in Q4 2024, a whisker below its Covid peak of 5.2% while Australia’s unemployment rate remained stable at 4%.

- A further steepening of yield spreads between Australian and New Zealand sovereign bonds may trigger further upside in the AUD/NZD cross rate.

- Watch the 1.0980 key medium-term support on AUD/NZD.

This week, the Antipodean countries’ central banks will decide their respective monetary policy; Australia’s RBA on Tuesday, 18 February, and New Zealand’s RBNZ on the following day on 19 February.

The Aussie (AUD/USD) and Kiwi (NZD/USD) have strengthened against the US dollar since 3 February when US President Trump “fired” his trade tariffs salvo against Canada, Mexico, and China.

The AUD/USD and NZD/USD rallied by 4.6% and 4% in the past two weeks from their respective 3 February lows to 17 February at this time of writing.

Market participants have started to price in 25 basis points (bps) cut by RBA, its first cut in four years after being “late” to the global interest rate cut cycle (excluding Bank of Japan) to reduce its policy cash rate to 4.1%.

A slowdown in the Australian inflation trend came in faster than the RBA anticipated where the trimmed mean gauge of consumer rose 3.2% y/y in Q4 2024 versus a higher consensus expectation of 3.3%.

Meanwhile, New Zealand’s RBNZ is expected to deliver another “jumbo size rate cut” of 50 bps after three consecutive rate cuts conducted in 2024 to reduce its official cash rate to 3.75% due to a deceleration in inflation trend and a rapid slowdown in growth conditions. Business confidence has declined for three consecutive months coupled with a 22-month streak of contraction in manufacturing PMI data.

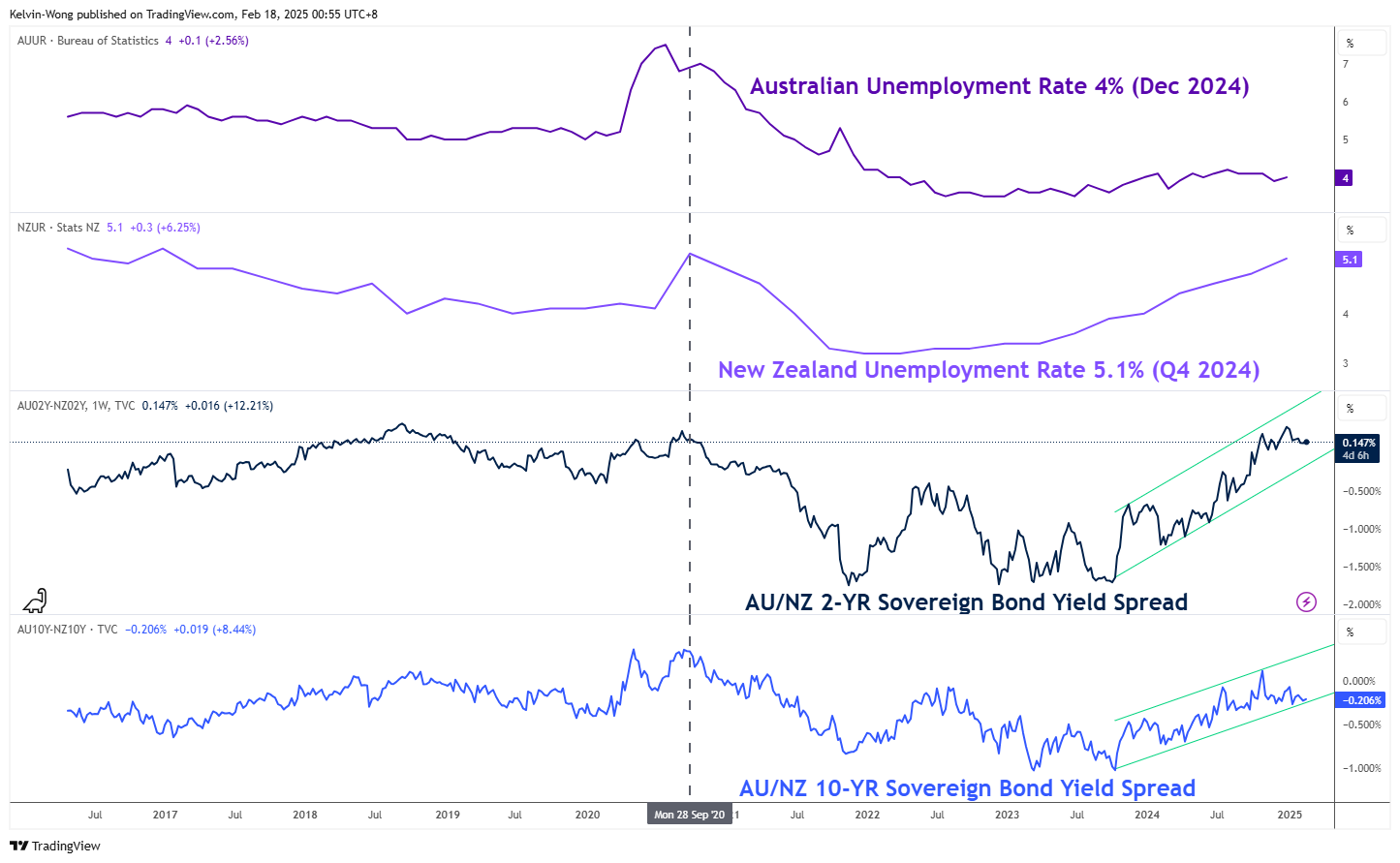

A Weaker New Zealand Labour Market Is Supporting a Further Steepening of AU/NZ Sovereign Bonds’ Yield Spread

Fig 1: AU & NZ unemployment rate with 2-Year & 10-Year yield spreads of AU/NZ government bonds as of 18 Feb 2025 (Source: TradingView)

New Zealand’s unemployment rate has accelerated to 5.1% in the three months through December 2024 which is almost its Covid peak of 5.2% recorded in Q3 of 2020 (see Fig 1).

Meanwhile, the unemployment rate for Australia remained stable at 4% for its latest reading of December 2024, within the range of 4.1% to 3.7% recorded in 2024.

The bleaker labour market condition in New Zealand increases the odds that RBNZ is likely to adopt a relatively more dovish monetary policy in 2025 over RBA.

Therefore, the 2-Year and 10-Year yield spreads between Australia and New Zealand sovereign bonds are likely to steepen further and, in turn, may ignite upside pressure on the AUD/NZD cross rate.

Potential Bullish Change of Trend for AUD/NZD

Fig 2: AUD/NZD major and medium-term trends as of 18 Feb 2025 (Source: TradingView)

Since 17 July 2024, the price actions of AUD/NZD have not been above to break above a “stubborn” range resistance of 1.1165/1190 as it continued to consolidate above a rising 200-day moving average.

Several positive technical elements have emerged that support a potential impending bullish breakout above 1.1165/1190 for the AUD/NZD.

Firstly, its price actions have started to trade above its 50-day moving average since 4 February.

Secondly, the daily MACD trend indicator has just staged a bullish breakout from its descending trendline resistance, and its centreline on 10 February suggests a potential start of a medium-term bullish momentum condition that may lead to higher price actions on the AUD/NZD (see Fig 2).

Watch the 1.0980 key medium-term pivotal support and clearance above 1.1190 may see the next medium-term resistances coming in at 1.1245 and 1.1430/1460 (also the upper boundary of a major ascending channel from 22 February 2024)

However, failure to hold above 1.0980 invalidates the bullish scenario for a corrective decline to expose the next medium-term supports at 1.0850 and 1.0735.