FX Week In Review

USD

We have continued the slowdown in the Dollar with the DXY closing -0.7% down at 93.54, this is despite some encouraging economic data. But we seem to be more focused on the Trump effect at the moment.

EUR

The euro, after being largely unchanged shrugged off the worries of Italy and Spain and had a good week. Some ECB members talked about possible future tightening with caught the markets off guard and pushed the EUR up with the EUR/USD by 1% to 1.1766.

GBP

Mixed again for the pound, with a mixture of good economic numbers but Brexit worries and David Davis standoff with the Prime Minister causing some market jitters. Despite this the pound was up 0.5% on both the GBP/USD and GBP/JPY.

Yen

We mostly traded sideways this week with no real data or major developments.

The Week Ahead

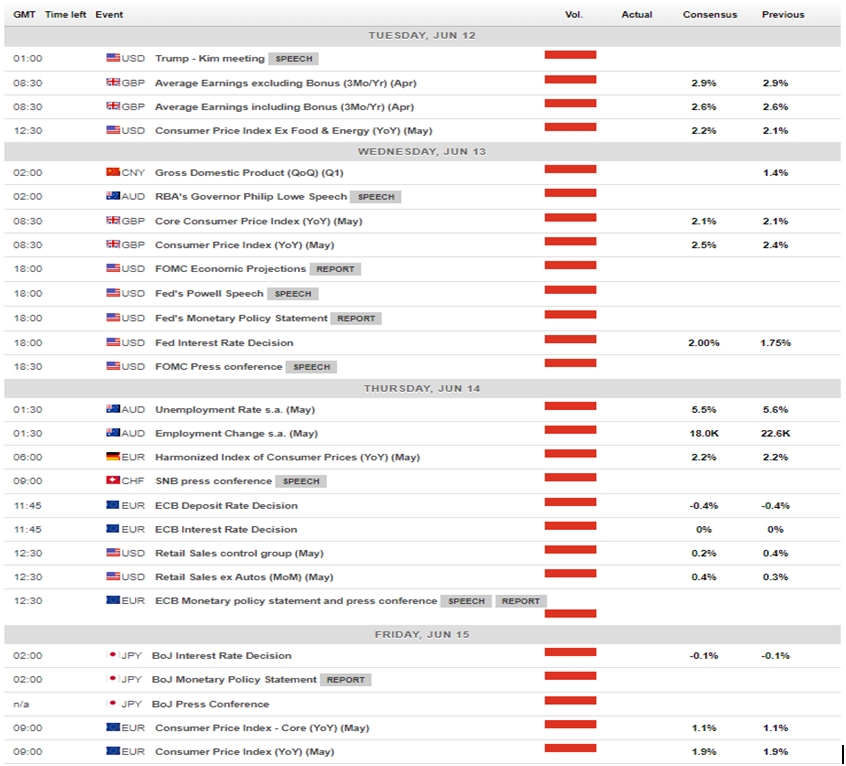

Data wise we have CPI from the US, UK and some eurozone Countries. We also have the FED interest rate decision with a widely expected rate hike by 25bps. We must keep an eye on the ECB and BoJ rate decisions, but we expect no movement here.

But the news is dominated by the Korean Summit with Donald Trump and Kim Jong-Un, very hard to predict if this will affect the markets or in what way. But we just need to be aware. Also, the Europe situation and Brexit are all still on the geo-political agenda.

Major Data Releases

(Data provided by FX Street)

Currency Pairs To Watch

We will be interested in the USD, EUR and JPY this week. We will be looking at the ’trade of the week’ and the EUR/USD, AUD/JPY, and USD/JPY.

Trade Of The Week

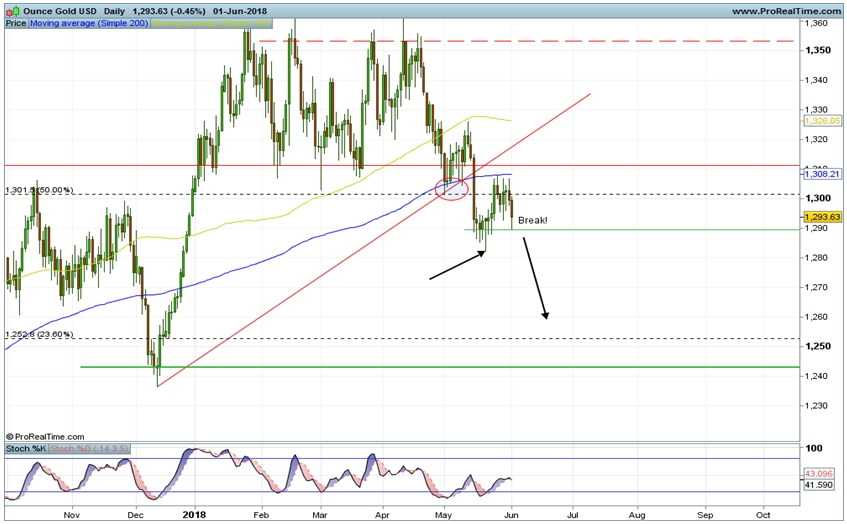

So, last week we will look at Gold and we will look for 1289.55 to break for a move to 1282.00 area and maybe 1254 area. This did not happen so was not triggered.

So today we will be looking at the AUD/NZD, we will look for a break of 1.079, to retest the 100 day MA at around 1.075 and then 1.069 area.

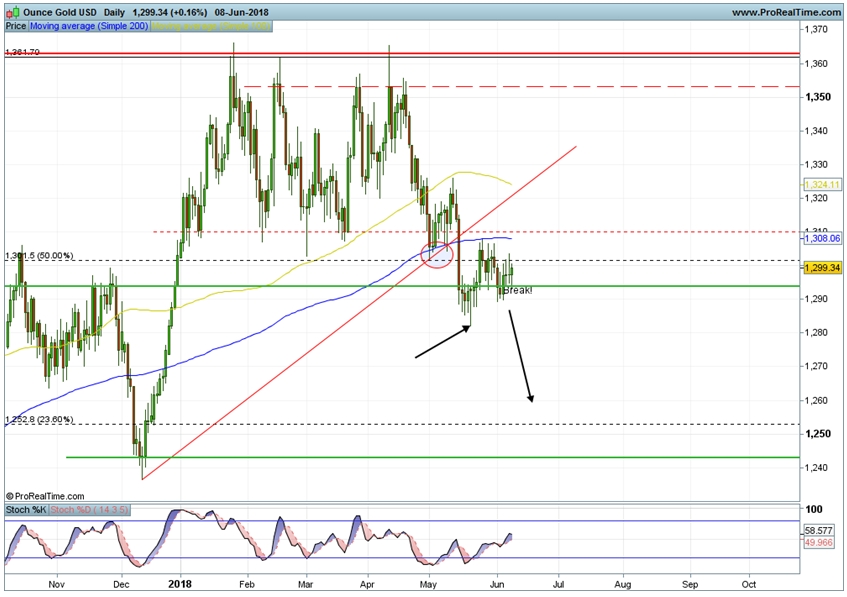

We note in the last week the 50% fib and 200-day MA has held price, and if we do not get caught between the two we may see a push lower.