Investing.com’s stocks of the week

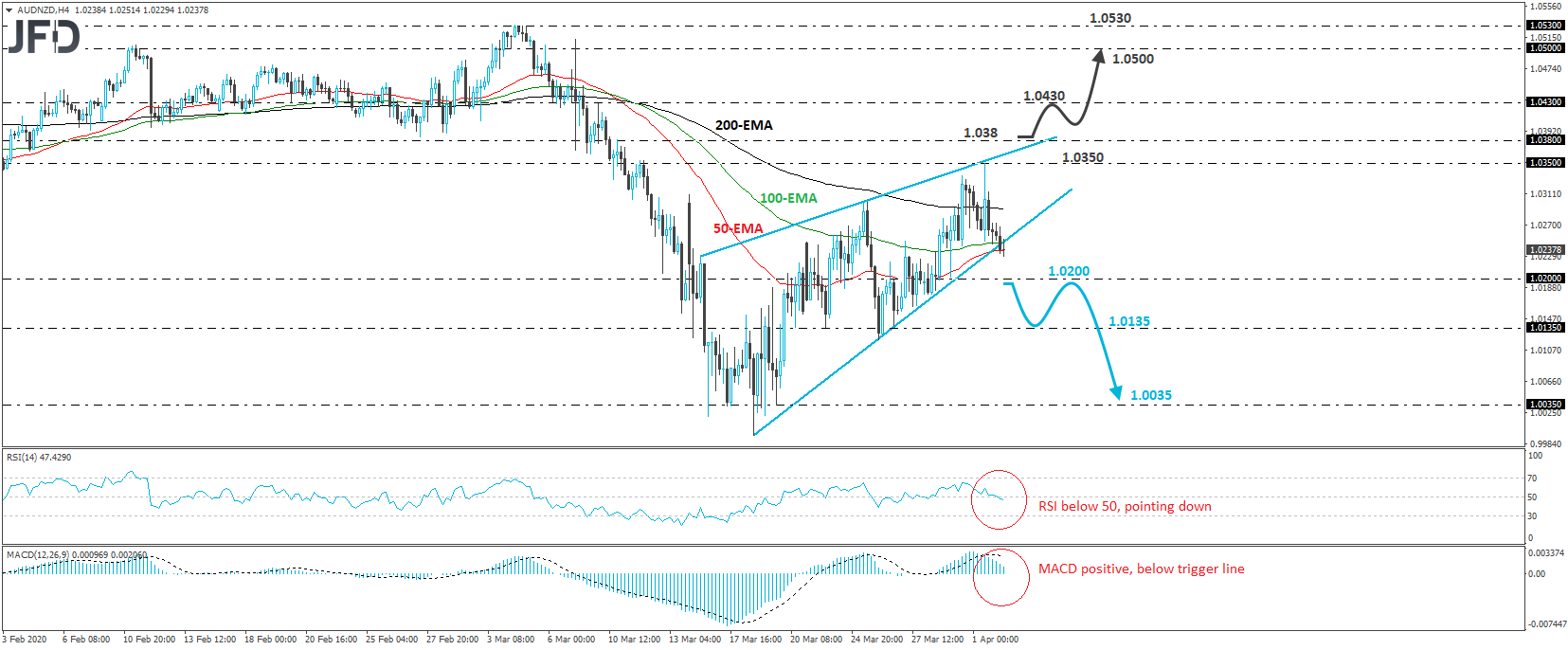

AUD/NZD traded lower today, breaking below the lower end of a rising wedge formation that was in play since March 16th. In our view, this shifts the short-term outlook somewhat to the downside, but before we get confident on larger declines, we would prefer to wait for a decisive dip below the 1.0200 zone, which is fractionally below Tuesday’s low.

A clear dip below that area may wake up more bears, who could push the battle towards the 1.0135 territory, which is slightly above the low of March 26th, and marks the low of March 23rd. If the sellers are not willing to stop near that zone either, then we may see them diving all the way down to the 1.0035 obstacle, marked by an intraday swing low formed on March 19th.

Shifting attention to our short-term momentum studies, we see that the RSI runs below 50 and points to the downside, while the MACD, although positive, lies below its trigger line and points down. It could obtain a negative sign soon. Both indicators suggest that the rate may start gathering more downside speed soon and corroborate our view for some further near-term declines.

In order to start looking north again, we would like to see a strong recovery back above the 1.0380 barrier. Such a move may also signal the break above the upper bound of the wedge and could initially target the peak of March 10th, at around 1.0430. Another break, above 1.0430, could set the stage for the psychological territory of 1.0500, or the 1.0530 area, marked as a resistance by the highs of March 4th and 5th.