- New Zealand’s core inflation trend has decelerated at a faster pace than Australia.

- RBNZ may use tomorrow’s monetary policy meeting to offer dovish guidance and bring forward its projected first interest rate cut in H1 2025.

- A dovish hold by RBNZ may reinforce the continuation of the AUD/NZD medium-term bullish trend with key support at 1.0890/0840.

On Wednesday, 14 August, the New Zealand central bank, RBNZ will announce its monetary policy decision and issue its quarterly Monetary Policy Statement with fresh forecasts on growth, inflation, and monetary policy outlook.

The consensus is expecting RBNZ to maintain its official cash rate (OCR) steady again at 5.5% after it extended its rate pause for the eighth consecutive time in the July meeting.

In the meeting, RBNZ peppered its July monetary policy statement with a dovish tilt that indicated the current high-interest rate environment in New Zealand had led to a decline in economic activities.

A Possible Dovish Hold by RBNZ Cannot Be Ruled Out

In the previous quarterly Monetary Policy Statement released in May, the RBNZ signaled that the first interest rate cut in New Zealand would occur after Q2 2025.

However, given the latest lackluster data on growth and inflationary trends in New Zealand, RBNZ is likely to relook at its monetary policy projection and may bring forward its first interest rate cut to the first half of 2025 as Q2 core inflation rate has declined significantly to 2.8% y/y from 3.7% y/y recorded in Q1, its slowest pace of growth in three years.

Hence, RBNZ may utilize Wednesday’s monetary policy meeting to offer guidance and lay the groundwork for an imminent interest cut cycle in New Zealand while maintaining its OCR unchanged at 5.5%.

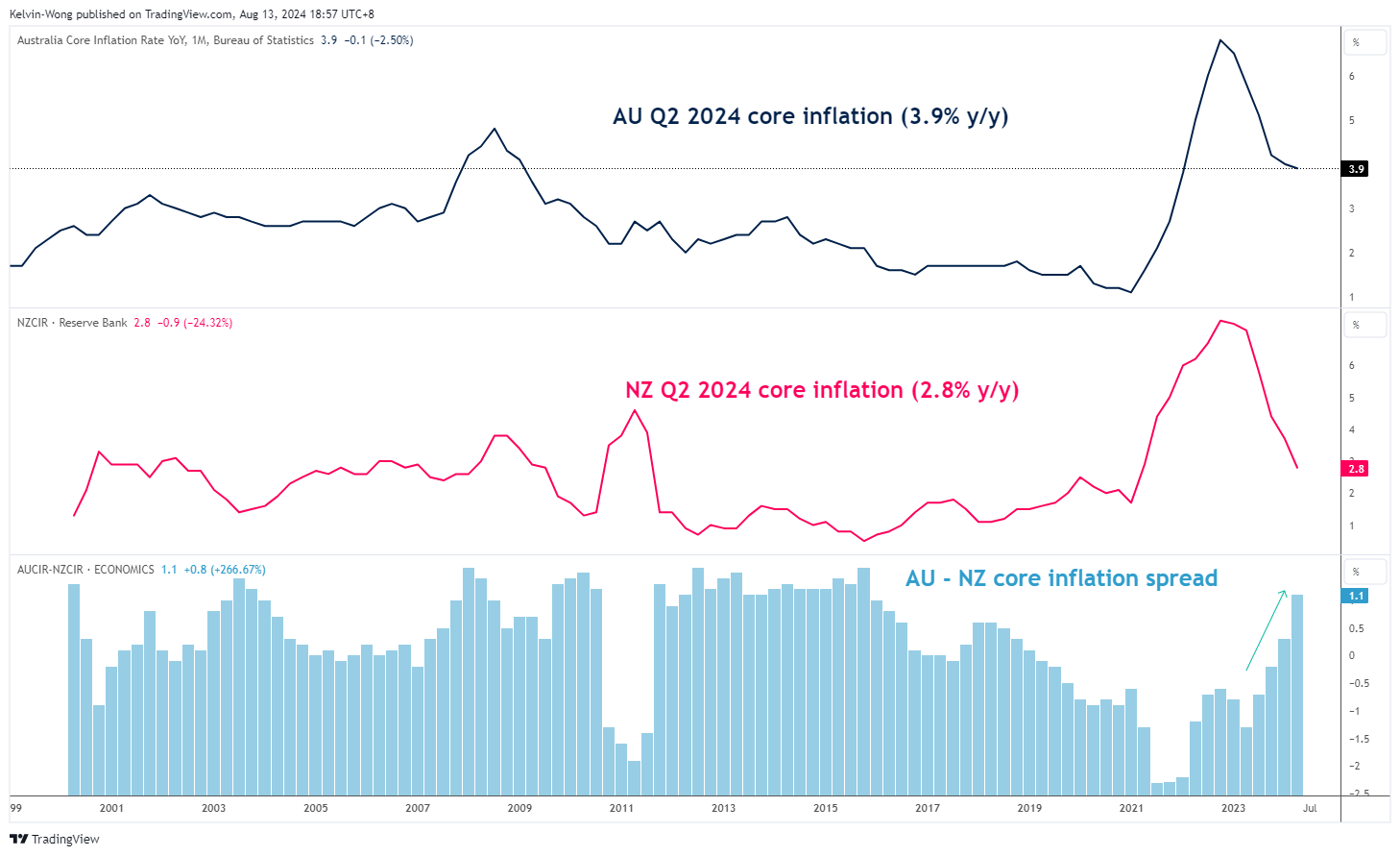

New Zealand’s Inflation Trend Is Decelerating at a Faster Rate Than Australia

Fig 1: Australia & New Zealand core inflation trends as of Q2 2024 (Source: TradingView)

The path of the inflationary trend is slightly different from the two Antipodeans. The Q2 core inflationary rate in Australia was still rather sticky as it recorded almost the same rate of growth as seen in Q1 (3.9% y/y vs. 4% y/y).

Therefore, the current picture of Australia and New Zealand’s inflationary environment is a stark contrast when we measure the difference between them; since Q2 2023, Australia’s core inflation rate has been decelerating at a slower pace than New Zealand’s core inflation rate (see Fig 1).

Therefore, this difference in inflationary trends supports a further potential RBNZ dovish monetary policy guidance which in turn may trigger an outperformance of the Aussie dollar over the Kiwi.

The Recent Slide in AUD/NZD Managed to Find Support at the Key 200-Day Moving Average

Fig 2: AUD/NZD major and medium-term trends as of 13 Aug 2024 (Source: TradingView)

The recent decline of 2.80% from its 17 July 2024 swing high area of 1.1165/1190 has managed to stall at a key medium-term pivotal support at 1.0890/0840 (also the 200-day moving average).

In addition, the price actions of the AUD/NZD cross pair have started to oscillate within a medium-term ascending channel since the 22 February 2024 low of 1.0570 (see Fig 2).

A clearance above 1.1030 intermediate resistance may see a retest on the 1.1165/1190 medium-term resistance in the first step.

However, a breakdown below 1.0840 invalidates the recovery scenario to expose the next medium-term support at 1.0735.