Key Highlights

· The Aussie dollar traded sharply lower against the Japanese yen, and broke the 86.00 support.

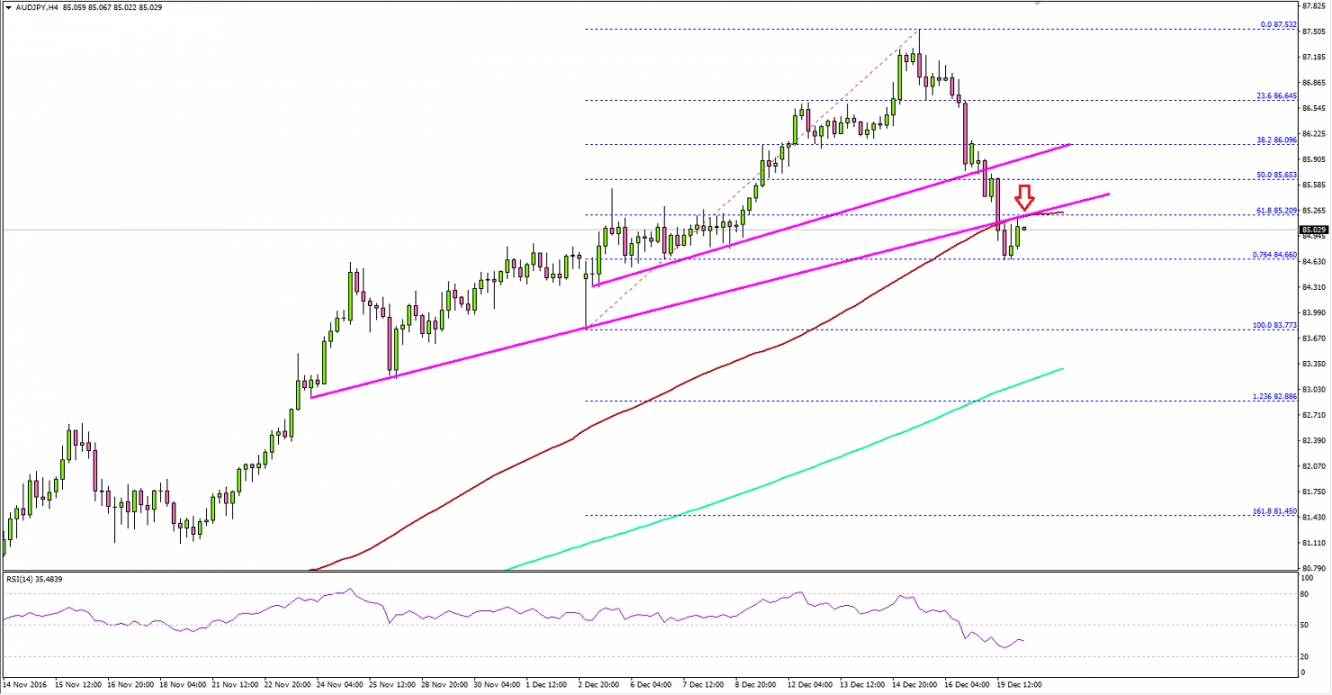

· There was a crucial bullish trend line on the 4-hours chart of AUD/JPY, which was broken at 85.80 to ignite a downside move.

· In Australia today, the minutes of the Reserve Bank of Australia meetings were published, which failed to help the Aussie dollar.

· Later today in Japan, the BoJ Interest Rate Decision will be announced by the Bank of Japan, which could impact the Japanese yen in the short term.

AUD/JPY Technical Analysis

The Aussie dollar, after trading as high as 87.53 against the Japanese yen found sellers, and traded sharply lower. The AUD/JPY traded down, and broke a crucial support area at 86.00 to pave the way for more losses.

During the downside move, the pair broke a couple of important support areas like a critical bullish trend line on the 4-hour chart. Moreover, there was even a close below the 50% Fib retracement level of the last wave from the 83.77 low to 87.53 high.

Looking at the current H4 chart, it looks like the Aussie dollar has established a downtrend versus the Japanese yen and may trade towards 84.50. The H4 RSI is also well below the 50 level, which is a bearish sign for AUD/JPY and calling for more declines. The last important point is that the pair is also below the 100 simple moving average on the same chart, which is currently acting as a resistance. So, it looks like the AUD/JPY pair has settled below a major support area.