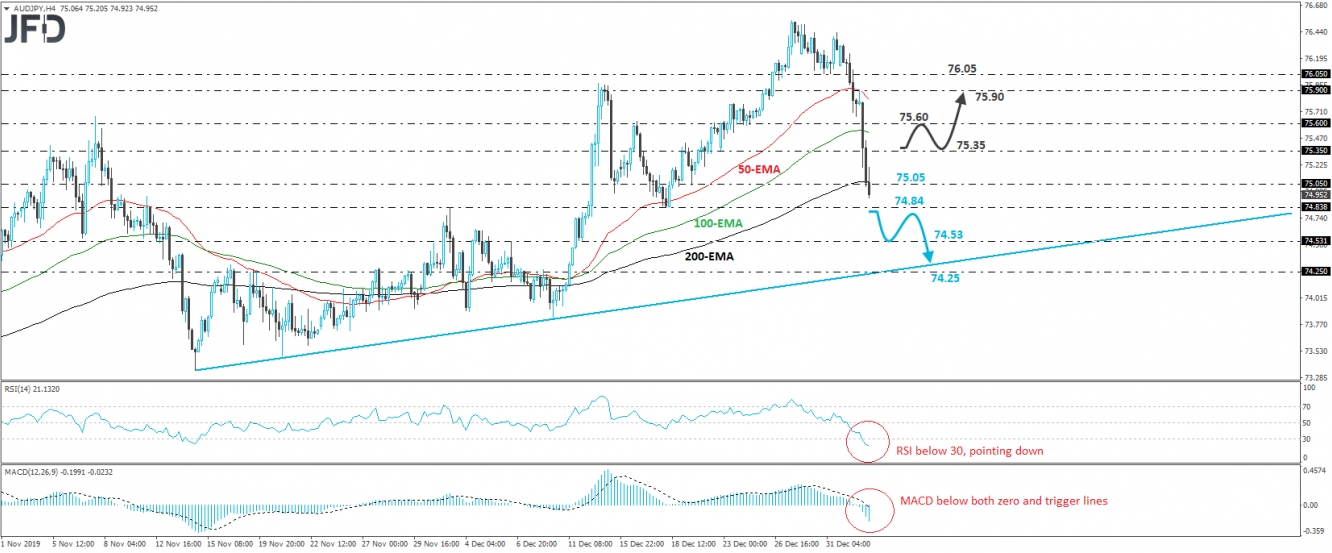

AUD/JPY collapsed today following the US airstrikes at Baghdad’s international airport. The pair broke below three support (now turned into resistance) barriers and is currently trading slightly below the 75.05 zone, which currently coincides with the 200-EMA on the 4-hour chart. Although the rate is still trading above the upside support line drawn from the low of November 14th, there is still decent room to the downside before traders could reach that line.

The door to more declines may be opened if the bears manage to overcome the 74.84 zone, which is marked as a support by the low of December 18th. They could then aim for the low of December 12th, at around 74.53, the break of which may allow a test near the aforementioned upside support line, or the 74.25 level, marked near the inside swing high of December 10th.

Taking a look at our short-term oscillators, we see that the RSI stands within its below-30 zone and points down, while the MACD lies below both its zero and trigger lines, pointing south as well. Both indicators detect strong downside speed and corroborate our view for further near-term declines.

In order to start examining whether the bears have dropped their swords, we would like to see a decent recovery back above 75.35. This may be a sign that the tumble is over and may allow the bulls to set the stage for the 75.60 territory, near the low of December 24th. Another break, above 75.60, could allow extensions towards the 76.90 level, or the 76.05 zone, which provided support on the last day of 2019.