Investing.com’s stocks of the week

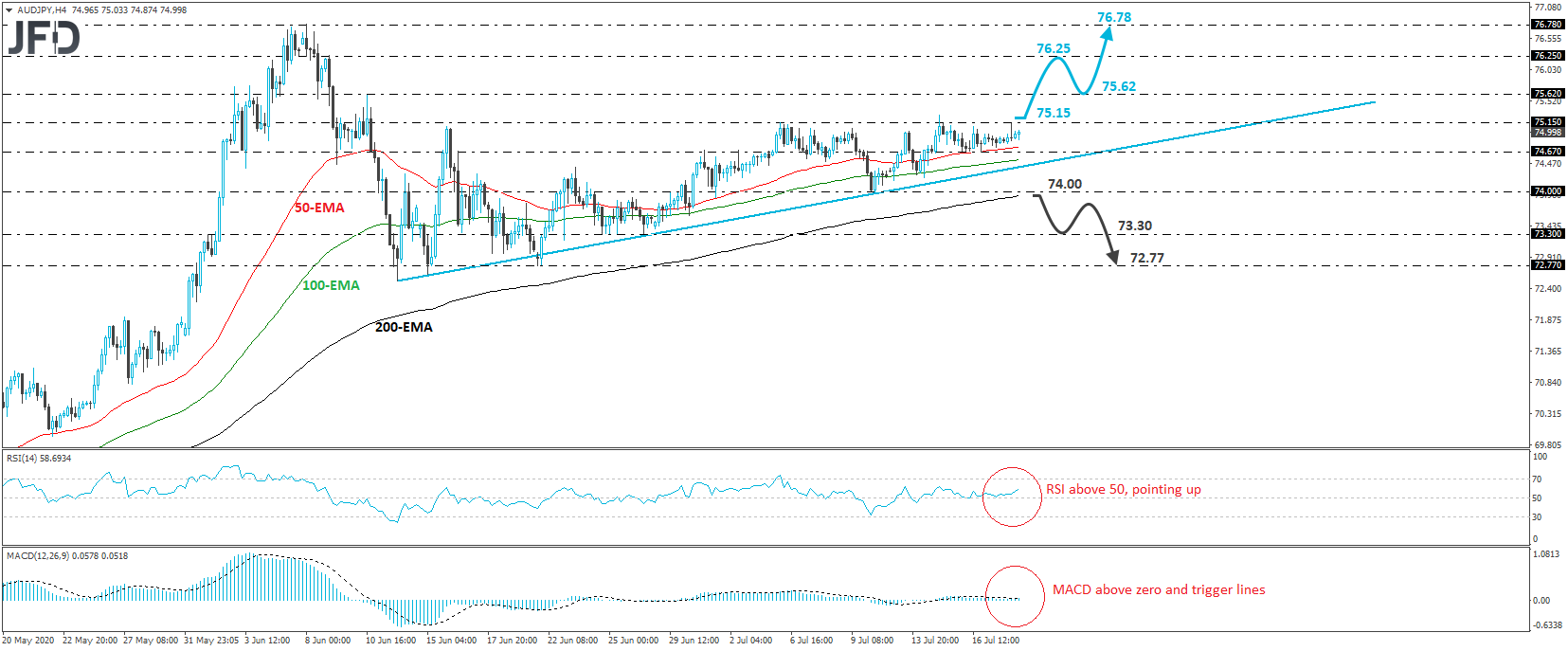

AUD/JPY traded slightly higher on Monday, but once again, the advance remained limited below the 75.15 key resistance barrier. That barrier has been holding the rate down since July 6th. Although AUD/JPY is trading above an upside support line taken from the low of June 12th, we would like to see a strong break above 75.15 before getting confident on larger bullish extensions.

A decisive break above that hurdle would confirm a forthcoming higher high and may initially aim for the high of June 10th, at around 75.62. If the bulls do not stop there, the next resistance to consider is the 76.25 zone, near the high of June 9th. The rate may pull back after testing that zone, but as long as it is trading above the upside support line, we would treat such a setback as a correction before the next positive leg. Another leg north may drive the battle above 76.25 and perhaps set the stage for extensions towards the high of June 8th at 76.78.

Looking at our short-term oscillators, we see that the RSI lies slightly above 50 and points up, while the MACD stands fractionally above both its zero and trigger lines. Both indicators suggest that the pair has started picking up some upside speed, but we stick to our guns that a move above 75.15 is required to signal the resumption of the prevailing uptrend.

On the downside, a dip below 74.00 may be the signal for a short-term trend reversal. The rate would already be below the aforementioned upside line, something that may encourage the bears to push towards the 73.30 area, which provided strong support between June 23rd and 26th. If they overcome that hurdle as well, then, the next stop may be at 72.77, a support defined by the low of June 22nd.