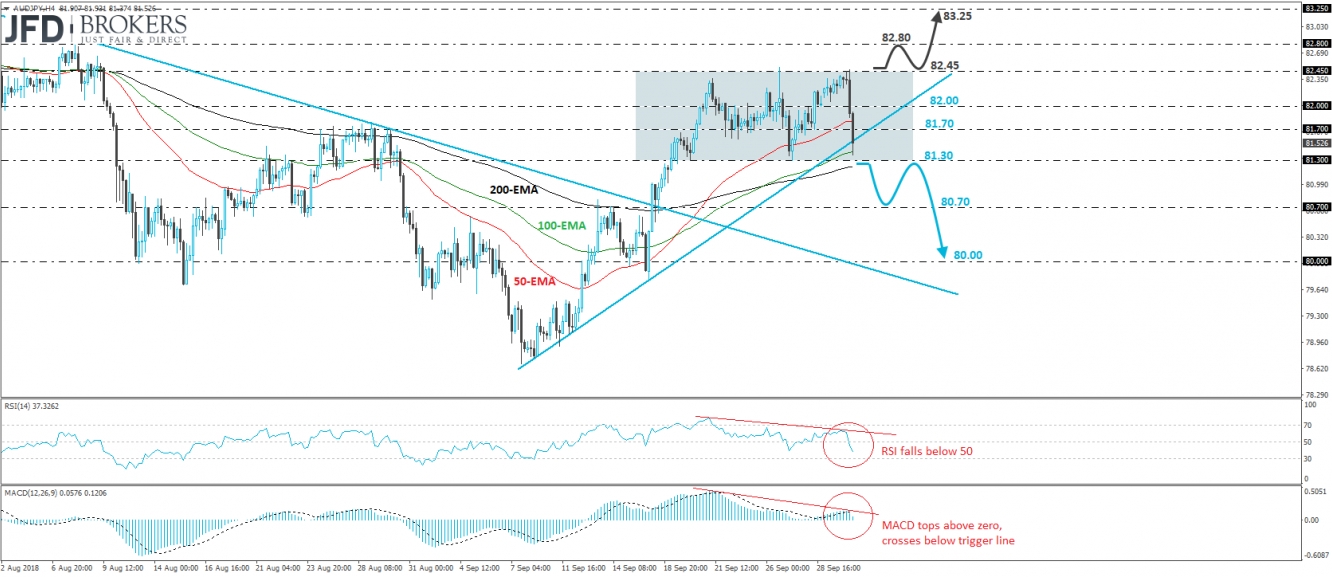

AUD/JPY fell sharply on Tuesday, after hitting resistance near the 82.45 territory. The rate broke through two support (now turned into resistance) barriers in a row, and also managed to dip below the upside support line drawn from the low of the 10th of September. That said, the pair continues to trade within the sideways range that’s been in place since the 19th of the month, between 81.30 and 82.45, and thus, we would adopt a wait-and-see stance for now.

We would like to see a clear dip below 81.30, the lower end of the aforementioned range, before we start examining whether the short-term outlook has turned negative. Such a break would confirm a forthcoming lower low on the 4-hour chart and may initially aim for our next support area of 80.70. Another dip below 80.70 could carry more bearish extensions and perhaps open the path for the psychological zone of 80.00.

Looking at our short-term oscillators, we see that the RSI turned down and fell below its 50 mark, while the MACD has topped slightly above zero and crossed below its trigger line. It could turn negative soon. What’s more, there is negative divergence between both these technical studies and the price action. All these signs support the notion for further declines, but as we already noted, we prefer to wait for a decisive dip below 81.30 before we get more confident on that front.

On the upside, we believe that a move above 82.45, the range’s upper end, is needed for the short-term outlook to turn positive again. Such a move would signal a higher high and could pave the way for the 82.80 zone, defined by the peak of the 8th of August. If that level fails to prevent the bulls from driving the battle higher, then we may experience extensions towards the high of the 31st of July, at around 83.25.