Key Points:

- AUD/JPY demonstrating confluence.

- RSI Oscillator within oversold territory.

- Watch for a move higher to complete the D leg around the 84.83 mark.

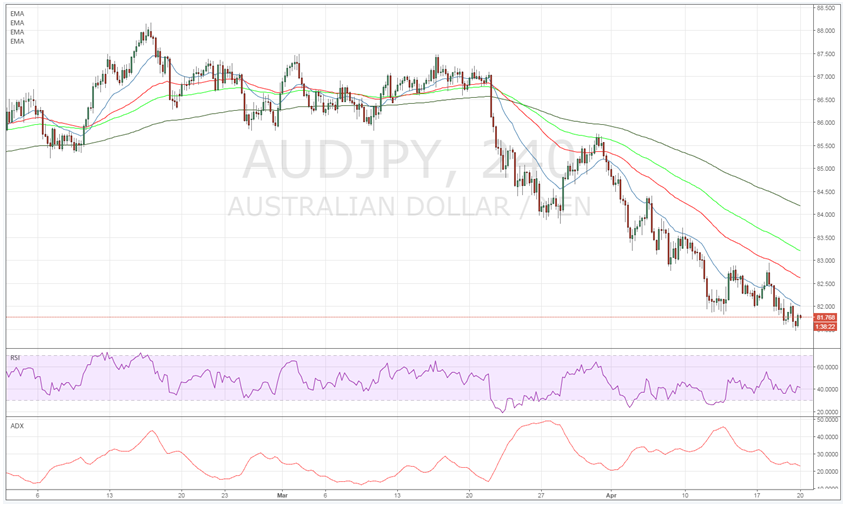

The AUD/JPY currency pair has convincingly trended lower over the past few months as the air has steadily leaked from the balloon that is the Australian economy. Subsequently, the market has seen price action falling from its high above the 87.00 handle, to the present close at 81.79. This is a significant depreciation but there are some signs that the pair might finally have hit rock bottom.

In particular, there is plenty of confluence being exhibited around the 81.50 mark which suggests that we are nearing a relatively big move. At this level, price action is likely to form a bullish crab pattern, as well as the C point of two bearish 5-0 patterns. In addition, the RSI Oscillator is starting to rise out of oversold levels in another indication that a turnaround is on the cards.

Further adding to the bullish contention is the appearance of ABCD pattern on the 4-hour timeframe that is now nearing completion. In fact, the C leg should complete right around the key 81.50 level which would suggest that the full pattern completion would finish at 84.83. Subsequently, there is plenty of scope for a retracement sharply higher.

Fundamentally, the Australian economy has suffered a fairly protracted decline which largely mirrors the fall in world commodity prices and the end of the super cycle. In fact, just this past month has seen the price of iron ore slump by around 30% as China pulls back their future steel purchases. However, the Aussie Dollar has largely rejected the negative pressures due to the already steep decline. Subsequently from a mean reversion point of view, the pair might have already plumbed its current depths.

Ultimately, the AUD/JPY is likely to find plenty of support at its present level around the 81.50 mark given that both the ADX and RSI Oscillators are signalling oversold levels. In addition, strong confluence and the completion of a C leg hints at the validity of the bullish contention. Subsequently, the most likely scenario is one where price action consolidates around the 81.50-70 mark before commencing a relatively strong rally back towards 84.83 thereby completing the ABCD pattern.