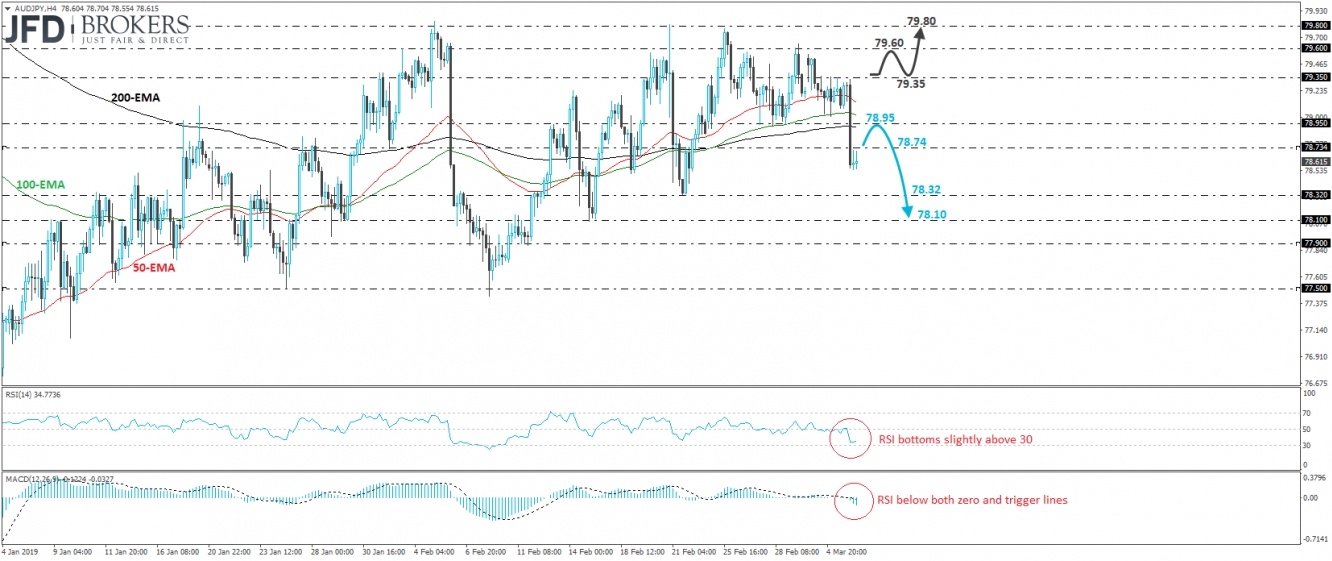

AUD/JPY tumbled overnight following Australia’s disappointing GDP data, breaking below the key support (now turned into resistance) of 78.95, that way completing a short-term failure swing top formation. Although this suggests that further short-term declines may be in the works, in the somewhat bigger picture, the pair remains trapped within the range that’s been in place since January 10th, between 77.50 and 79.80. Therefore, we will lean to the downside for now, but only within the aforementioned range.

At the time of writing, the rate consolidates slightly below the 78.74 level, and if the bears are strong enough to take charge again soon, we would expect another leg down, perhaps towards the 78.32 barrier, defined by the low of February 21st. If the bears do not hit the breaks near that zone, then we may see them putting the 78.10 area on their radars, marked by the low of February 15th. However, before the next move lower, we see the case for a minor corrective rebound, perhaps for the rate to test 78.95 zone as resistance this time.

Looking at our short-term oscillators, we see that the RSI topped near 50 and edged south, while the MACD lies below both its zero and trigger lines. These indicators suggest downside momentum, but the RSI has started to bottom slightly above its 30 line, adding to our view that a corrective bounce may occur before, and if, the bears decide to take the reins again.

In order to start examining whether the bears have abandoned the battlefield, at least for a while, we would like to see recovery above 79.35. Such a move may see scope for advances towards the 79.60 resistance zone, the break of which could pave the way for the 79.80 area, which is the upper bound of the aforementioned sideways range.