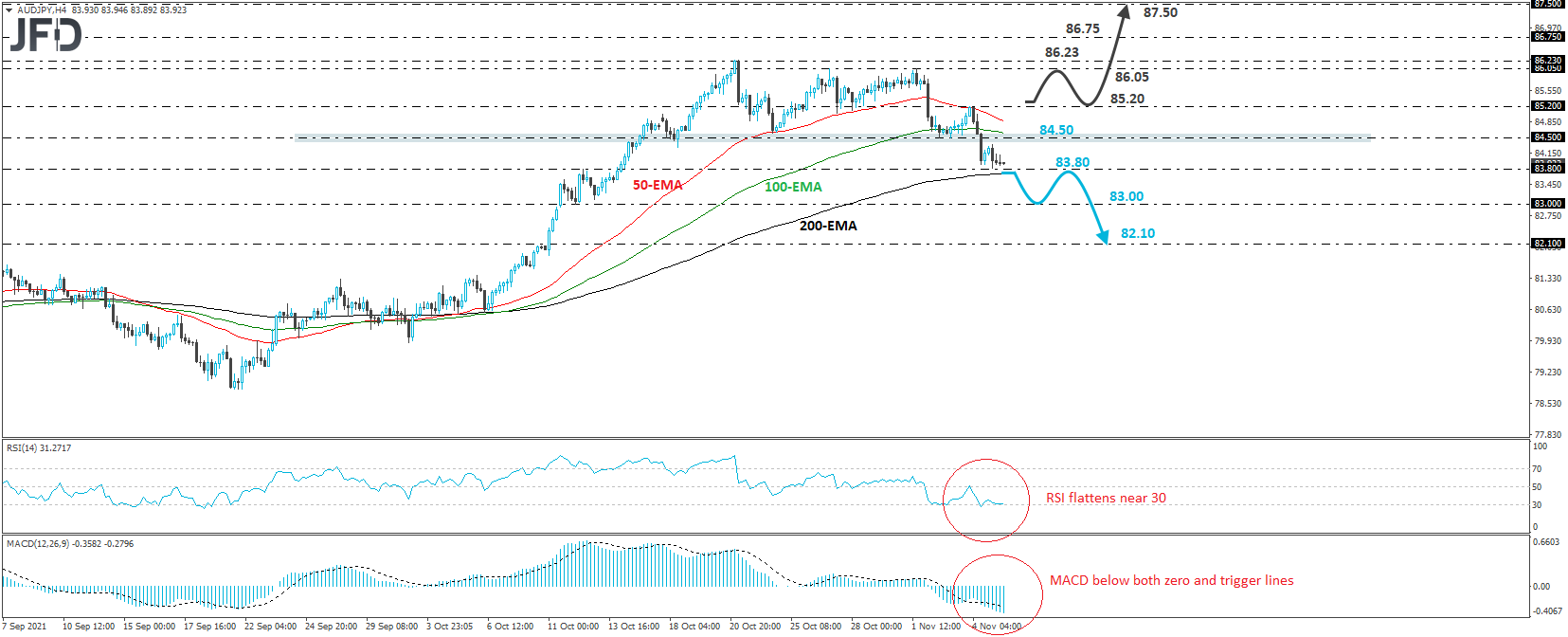

AUD/JPY traded lower on Thursday, breaking below the critical support (now turned into resistance) barrier of 84.50. The rate has been printing lower highs since Oct. 21, but it has never fallen below the 84.50 zone since then. Yesterday’s slide confirmed a lower low and, in our view, signaled a short-term trend reversal.

At the time of writing, the rate is hovering slightly above the 83.80 barrier, marked by the inside swing high of Oct. 12, the break of which may encourage the bears to take action down to the 83.00 zone, which provided support on Oct. 12. A break lower could see scope for declines towards the 82.10 area, near the inside swing high of Oct. 8.

Shifting attention to our short-term oscillators, we see that the RSI has flattened near its 30 line, but the MACD remains below both its zero and trigger lines, pointing down. Both indicators detect downside momentum and support the notion for further declines. Still, the flattening of the RSI makes us careful over a possible slight rebound before the next leg south.

We will abandon the bearish case only if we see a return above the 85.20 zone, marked by yesterday’s high. The rate will already be above the reversal point of 84.50 and may climb towards the 86.05/23 territory, marked by the highs of Oct. 21, 27, and Nov. 1.

A break higher would confirm a forthcoming higher high on the daily chart and may see scope for extensions towards the 86.75 barrier, or even the 87.50 hurdle, marked by the highs of Feb. 6 and 5, 2018, respectively.