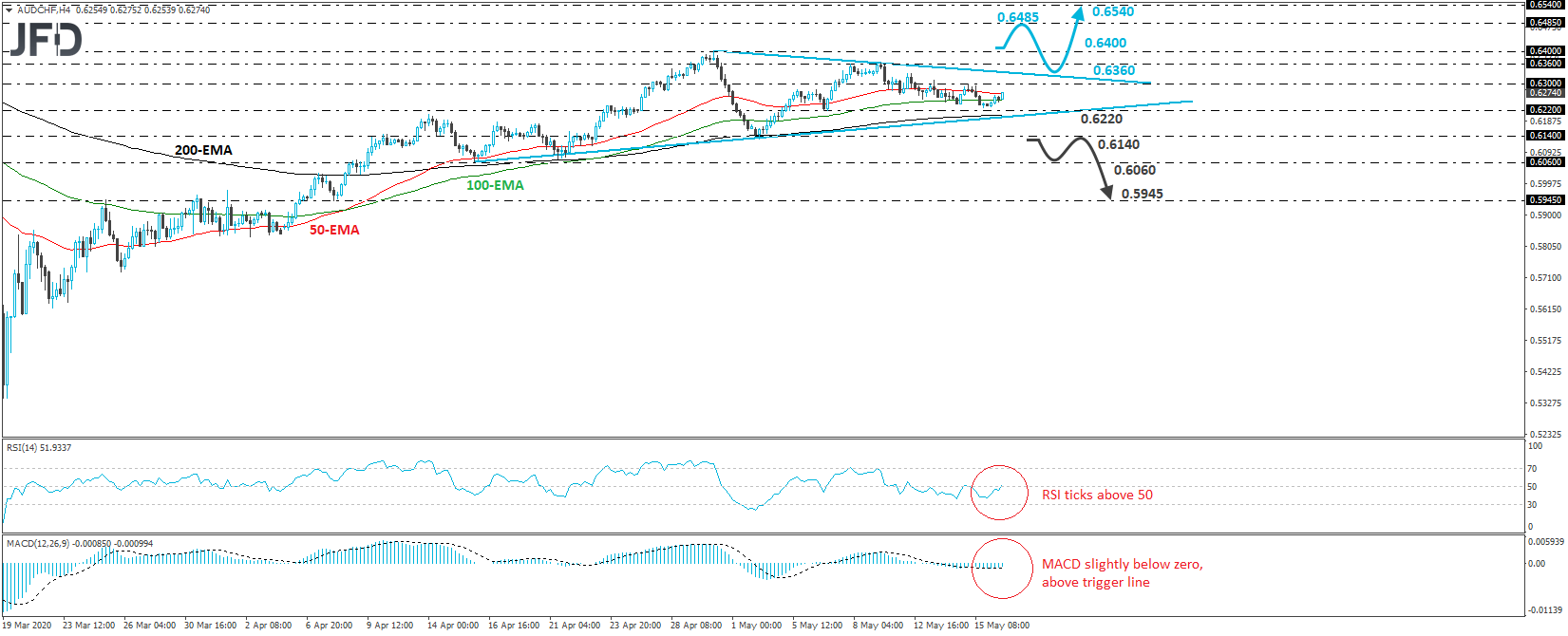

AUD/CHF traded higher today, after it hit support slightly above the 0.6220 barrier on Friday. Overall though, the pair looks to be trading in an indecisive manner, staying stuck between an upside support line drawn from the low of April 16th, and a downside resistance one taken from the peak of April 30th. As long as the rate oscillates between those two lines, we will hold a neutral stance with regards to the short-term outlook of this pair.

In order to start examining the resumption of the prevailing uptrend, we would like to see a clear break, not only above the downside line, but also above the 0.6400 barrier, which is marked as a resistance by the high of April 30th. Such a move would confirm a forthcoming higher high and may encourage the bulls to climb towards the high of February 25th, at around 0.6485. If that level is broken as well, then the next stop may be the 0.6540 zone, marked by the inside swing low of February 18th.

Shifting attention to our short-term oscillators, we see that the RSI has just poked its nose above its 50 line, but the MACD, although it recently crossed above its trigger line, it remains slightly below zero, pointing east. The fact that the indicators do not confirm each other yet, enhances our choice to remain sidelined for now.

For the outlook to turn negative, we would like to see a decisive dip below the low of May 4th, at around 0.6140. This would confirm a forthcoming lower low and may initially aim for the low of April 16th, at 0.6060. Another break, below 0.6060, could carry more bearish implications, perhaps paving the way towards the 0.5945 level, defined as a support by the low of April 8th.