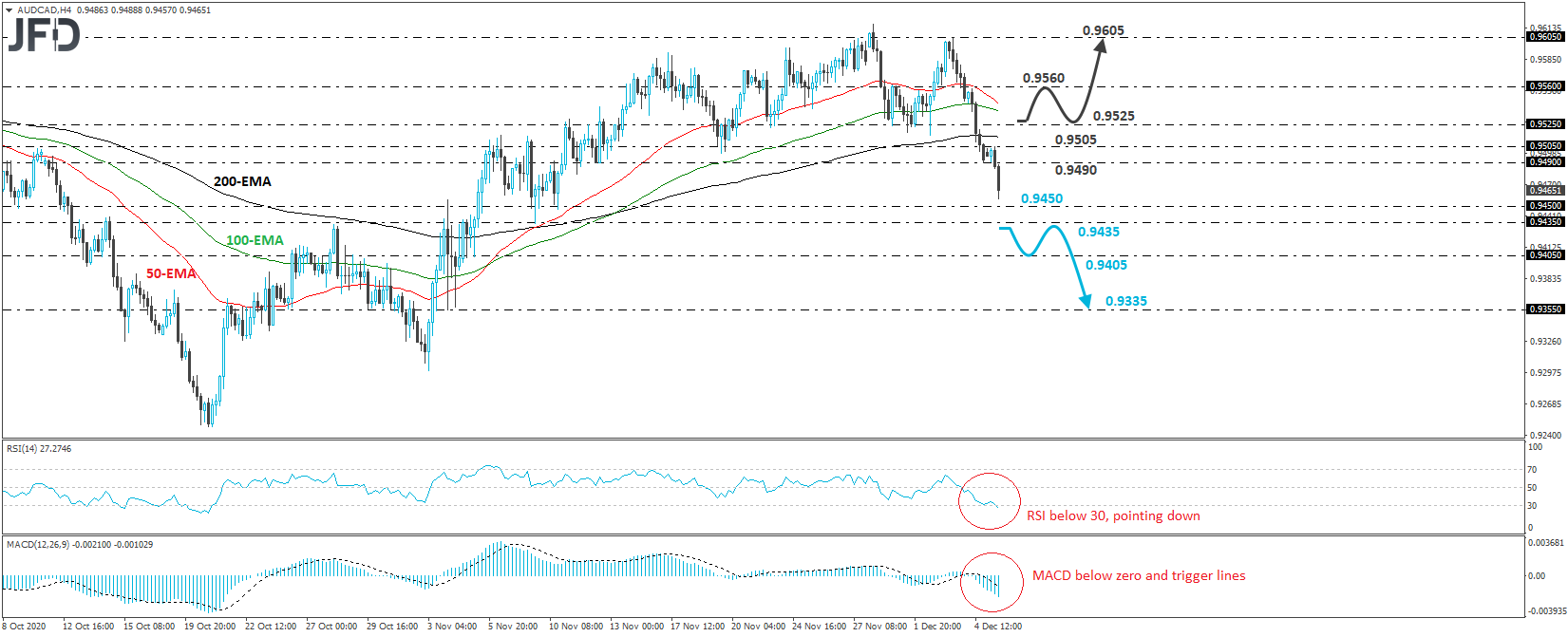

AUD/CAD fell sharply on Friday, breaking below the key support barrier of 0.9525 and completing a short-term trend reversal. The tumble continued today as well, with the rate falling well below Friday’s low of 0.9490. Bearing in mind that the dip below 0.9525 may have changed the short-term trend from an uptrend to a downtrend, we will hold a bearish stance, at least for now.

If the bears are strong enough to stay in the driver’s seat, we would expect them to target the 0.9450 zone soon, which is the low of November 10th, or the 0.9435 hurdle, marked by the low of the day before. A clear dip below that hurdle could carry larger bearish implications, perhaps paving the way towards the low of November 5th, which if also broken, could allow the fall to continue towards the 0.9355 area, marked as a support by the low of November 4th.

Shifting attention to our short-term oscillators, we see that the RSI drifted lower, touched its toe below its 30 line, and continues to point down, while the MACD lies below both its zero and trigger lines, pointing south as well. Both indicators detect strong downside speed and enhance the view that this exchange rate may continue drifting lower for a while more.

In order to abandon the bearish case, we would like to see a strong rebound back above 0.9525. This could wake up some bulls, who in their turn may shoot for Thursday’s inside swing low, at 0.9560, the break of which may see scope for advances towards the peak of that day, at around 0.9605.