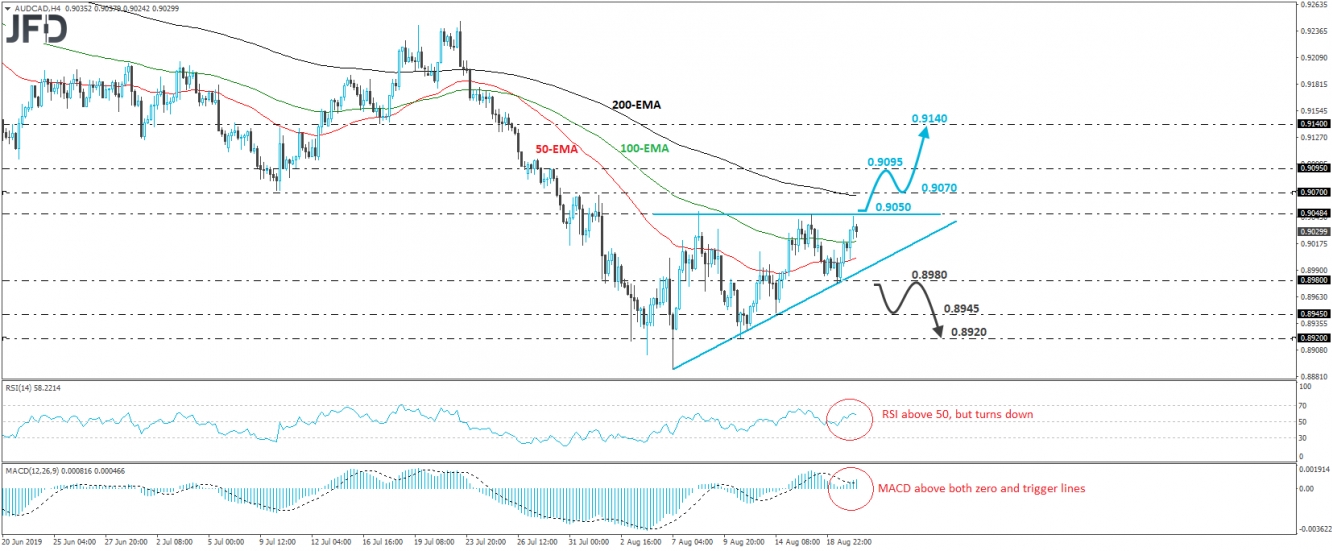

AUD/CAD edged north yesterday after it hit support near the 0.8980 area, but the recovery was paused today during the Asian morning, below the key resistance territory of around 0.9050, which has been acting as a temporary ceiling since August 8th. Combining this with the fact that the rate has been printing higher lows since August 7th, we can say that an ascending triangle is in play. According to the theory, such triangles are considered bullish patterns, but we prefer to wait for the exit before we start examining where the pair may be headed next.

If indeed the bulls regain control soon and manage to overcome the 0.9050 zone, then we may see them initially aiming for the 0.9070 area, which is slightly above the peaks of July 31st and August 1st, and slightly below the low of July 10th. If they don’t stop there, then we could see the rate trading above the 200-EMA for the first time since July 23rd, with the next potential resistance area seen at 0.9095, marked by the high of July 30th. Another break, above 0.9095, may carry more bullish implications, perhaps setting the stage for the 0.9140 territory, near the inside swing low of July 17th.

Turning attention to our short-term oscillators, we see that the RSI lies above its 50 barrier, while the MACD stands above both its zero and trigger lines. That said, although both studies point to positive momentum, the RSI has turned down, which enhances our choice to wait for a break above 0.9050 before we turn our eyes to the upside.

On the downside, we believe that a dip below 0.8980 may be needed to signal that the bears have gained the upper hand. Such a move would confirm a forthcoming lower low on the 4-hour chart and would also confirm the downside exit out of the aforementioned triangle. The rate could then slide towards the low of August 14th, near 0.8945, the break of which could extend the decline towards the 0.8920 barrier, marked by the low of August 12th.