Both RBA and BOC hold their monetary policy meetings this week, which has put AUD/CAD into focus as it teases the Jan 2017 lows. CAD crosses exploded on Friday after Canadian GDP and employment data far exceeded expectations. Whilst the expectations for a hike this Wednesday remain low, BOC members continue to speak highly of the economy and firmer data brings forward expectations for any tightening action from BOC.

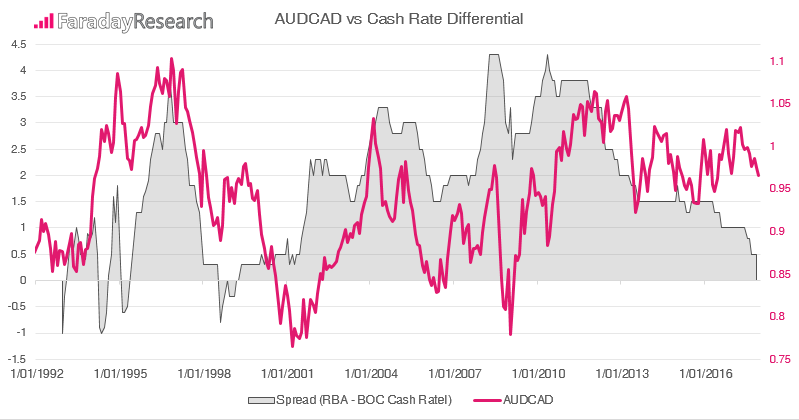

Although RBA’s cash rate remains at a 50bps premium to BOC’s, the potential for this to narrow at some point in the future has weighed on AUD/CAD in recent months. One could also argue that AUD/CAD remains high by historical standards when compared with the interest rate differential. So, this leaves potential for AUD/CAD to move lower if Canada’s economy continues to outperform Australia’s on a relative basis. We’re keeping a close eye on AUD/CAD around current levels to see if it can break key support.

Since the May highs, AUD/CAD continued to print a series of lower swing lows to show bears are in control. We have seen three intraday attempts in November to break Jan’s low but, on a closing basis, has so far failed to break it. But with bearish momentum on our side, we suspect an eventual downside break to be the more likely course of action.

We have taken note of the two bearish range expansion candles which accelerated the downtrend towards January’s lows. The first bearish range expansion was then followed by several days of price compression before extending its move lower. It is this alternating pattern of low to high volatility which we seek, whilst trading in the direction of dominant momentum. Yet due to Friday’s range expansion being a particularly volatile session, we would not be interested in jumping onto the move until further evidence of price compression materialises. Furthermore, as the RBA and BOC’s meetings are flagged as a high volatility calendar event, we’d only consider trading AUD/CAD when both are out of the way before reassessing the technical picture before trading.

In an ideal scenario, we would prefer to see at least a couple of days of price compression before considering a short trade. It would then require a momentum break on a lower timeframe to act as a trigger, assuming it breaks in line with the bearish trend.

And whilst traders have placed their bets on a more hawkish meeting on Thursday for Canada, CAD crosses run the risk of profit taking (and retracements) if the meeting doesn’t live up to expectations. We also have the risk that RBA’s meeting could be more hawkish than expected tomorrow, which leaves AUD/CAD vulnerable to a move higher.