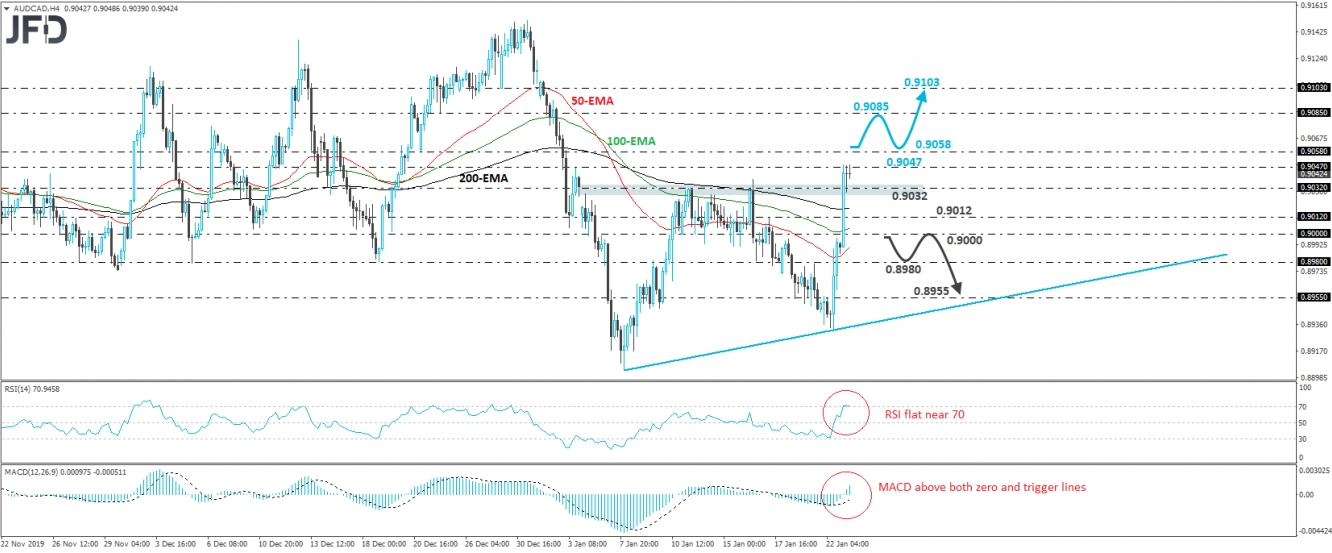

AUD/CAD rallied yesterday after the BoC turned dovish, opening the door to a rate cut. The surge continued during the Asian morning today as well, after Australia announced better than expected employment numbers. From a technical standpoint, the rally brought the rate above the key resistance (now turned into support) zone of 0.9032, that way completing a wide failure swing bottom pattern. That said, AUD/CAD hit resistance at 0.9047, marked by the high of January 3rd, and thus, we will adopt a cautiously-bullish approach for now.

For getting confident on larger advances, we would like to wait for a break above 0.9058, defined by the inside swing low of December 22nd. Such a move may encourage the bulls to drive the battle towards the 0.9085 area, marked by an intraday swing low formed on December 23rd. If they are not willing to stop there either, then a break higher could allow extensions towards the low of December 30th, at around 0.9103.

Taking a look at our short-term oscillators, we see that the RSI stands near its 70 line, while the MACD lies above both its zero and trigger lines, pointing up. Both indicators detect positive momentum, but given that the RSI has flattened near 70, we would stay careful over a possible corrective setback before the bulls decide to shoot again, perhaps for the rate to test the 0.9032 zone as a support, or even the 0.9012 area.

In order to discard the failure swing, we prefer to wait for a dip below the round figure of 0.9000. This may wake up more bears, who could push towards the 0.8980 hurdle, defined as a support by the inside swing high of Tuesday. Another break, below 0.8980, could extend the tumble towards the 0.8955 level, an intraday swing high formed yesterday, or towards the tentative upside support line drawn from the low of January 8th.