Key Points:

- Falling wedge should encourage a reversal in the near term.

- Stochastics are presently heavily oversold.

- Downside breakout is looking unlikely, as is a subsequent upside breakout.

For those looking to sidestep some of the USD’s volatility in the lead up to the holidays, the AUD/CAD could be worth consideration. Indeed, the pair’s relatively consistent falling wedge structure offers up some fairly solid range-bound movement, in the near-term at least.

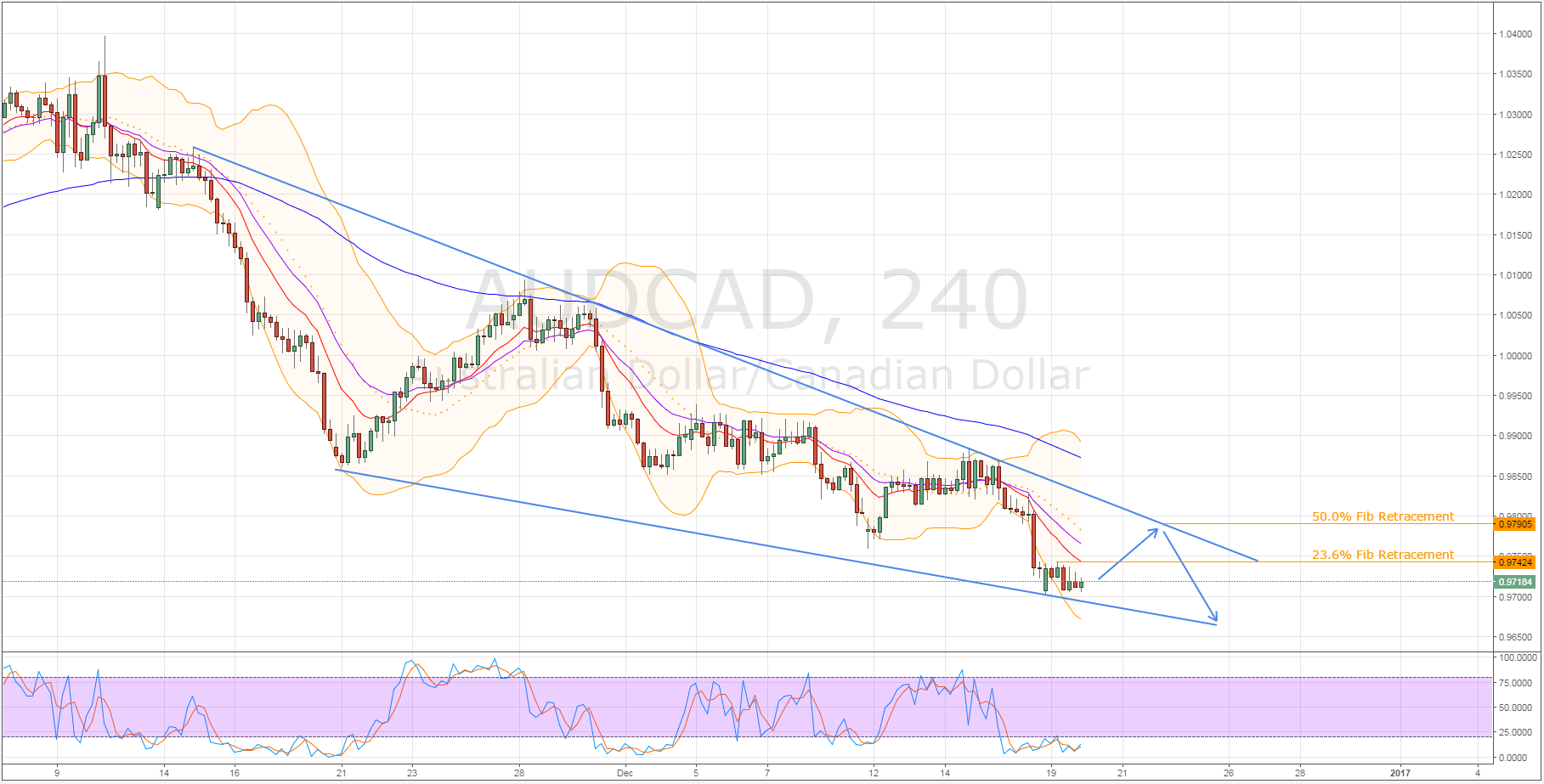

As depicted below, the pair has been forming a fairly tight falling wedge structure as of late, which should encourage a sizable reversal in the coming sessions. However, some might rightly question if this should be the case, given the rather languid ranging phase that has formed recently.

In response to this, I would argue that the AUD/CAD’s reluctance to rebound from the downside constraint of this wedge has largely been stemming from the slew of somewhat weaker Australian fundamental results. Fortunately, as things are looking a little lighter on the news front moving forward, technical forces should begin to be felt somewhat more keenly this week and these forces are in favour of a reversal.

As a result of this likely reversal, we expect to see the pair move back to the upside constraint in the near-term. Specifically, we should see the AUD/CAD reach the 0.9790 mark, which would be around the intersection on the upside boundary and the 50.0% Fibonacci retracement. This move would largely be in line with some of the other signals present on the H4 chart, such as the highly oversold stochastic oscillator.

However, as a result of a bearish Parabolic SAR and EMA bias, one could also be forgiven for expecting a downside breakout within the next session or so. Looking at the Bollinger Bands® goes some way in countering the argument for a breakout, as the H4 bands are currently highly divergent. Typically, this would indicate that the chances of a downside breakout are, in fact, rather slim in the absence of some strong fundamental upsets. And as has already been stated, news is scant this week, which should limit the chances of any surprises occurring and, therefore, limit the probability of a downside breakout as well.

Ultimately, the near-term rally should prove to be just that, short lived and prone to being erased within a week or so. After reaching the 0.9790 mark, the AUD/CAD should subsequently reverse and seek out support from the downside constraint as the long-term bearish bias once again takes hold. However, do keep half an eye on the fundamental side of things as the pair challenges the upside constraint as, if it can break through the 100 period EMA, we could end up seeing the falling wedge resolve and a new medium to long-term trend take hold.