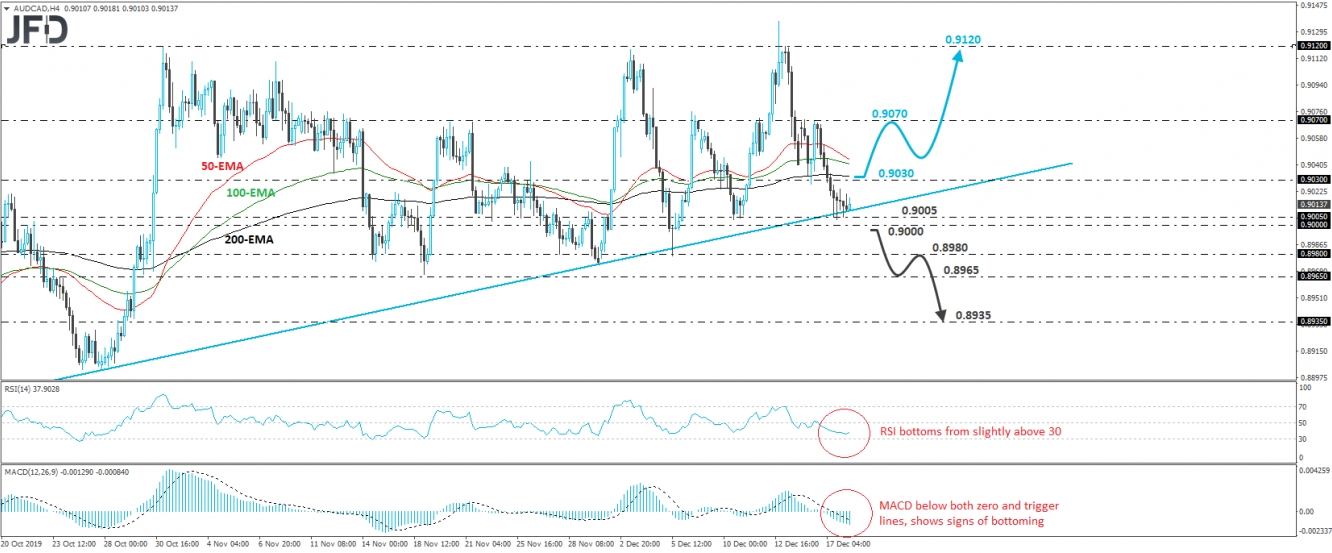

AUD/CAD had been in a tumbling mode this week, after it hit resistance near 0.9070 on Monday. That said, the fall was stopped slightly above the psychological zone of 0.9000, near the 0.9005 level and the upside support line drawn from the low of Oct. 16. Bearing in mind that the rate is now flirting with that upside line, we will adopt a flat stance for now.

If the bulls are strong enough to take charge from near that line and push above the 0.9030 zone, we would start examining higher areas. The break may set the stage for Monday’s peak of 0.9070, which if also broken may carry larger upside extensions, perhaps towards the high of Dec. 13 at around 0.9120.

Taking a look at our short-term oscillators, we see that the RSI stands slightly above 30, but has turned up, while the MACD lies below both its zero and trigger lines, but shows signs it could start bottoming as well. These indicators support somewhat the notion that there are some chances for a rebound from near the pre-mentioned upside support line.

In order to turn bearish, we would like to see a decisive dip below 0.9000. This would also bring the pair below the upside line drawn from the low of Oct. 16, and may initially aim for the 0.8980 zone, or the 0.8965 barrier, which is fractionally below the low of Nov. 19. Another break, below 0.8965, could allow the fall to continue towards the 0.8935 obstacle, marked by the inside swing high of Oct. 28.