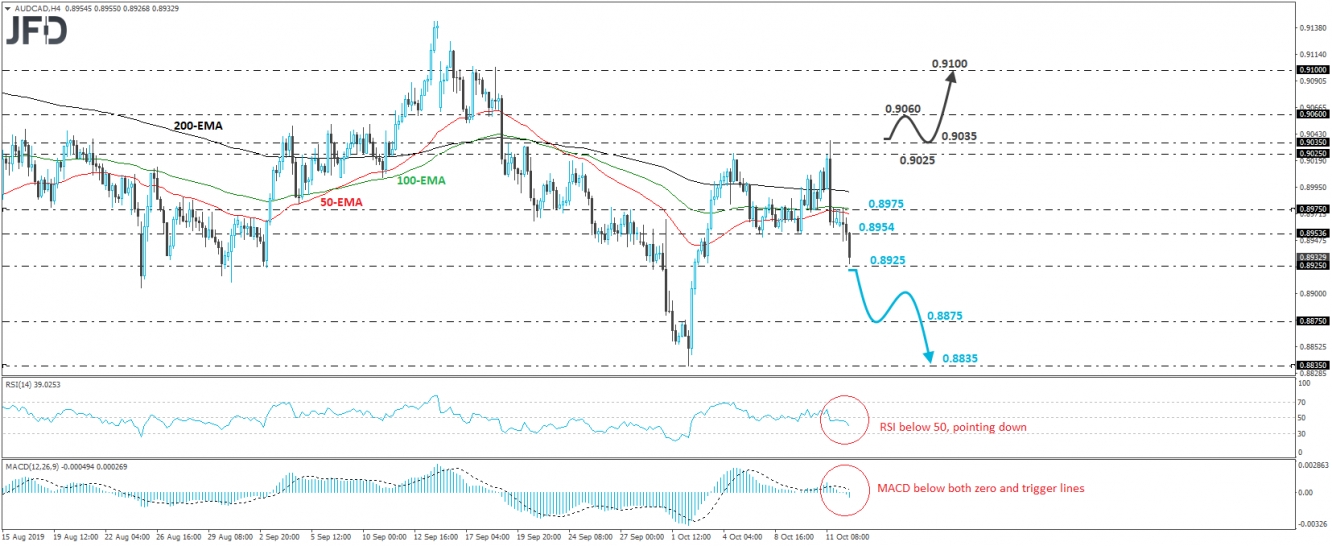

AUD/CAD has been in a declining mode since Friday, while today, it managed to fall below the key support barrier of 0.8954, thereby completing a short-term “double top” formation on the 4-hour chart. In our view, this combined with the fact that the rate is trading below all three of our moving averages, suggests that there is scope for the rate to continue drifting south for a while more.

If the bears are willing to stay behind the driver’s seat and push below the 0.8925 hurdle, we may then see them aiming for the 0.8875 zone, which is marked as a support by an intraday swing high formed on October 2nd. They may decide to take a small break after testing that zone, thereby allowing the rate to rebound somewhat, but as long as it would stay bellow 0.8925, we would see decent chances for the sellers to re-enter the field. The upcoming negative leg may drive the pair below 0.8875 and perhaps extend the decline towards the low of October 2nd, at around 0.8835.

Looking at our short-term oscillators, we see that the RSI lies below 50 and points down, while the MACD stands below both its zero and trigger lines, pointing down as well. Both these indicators detect negative momentum and support the notion for this exchange rate to keep sailing south.

On the upside, a move back above 0.8954 may discard the double top and turn the outlook back to neutral. The move that could make us turn to positive is a strong break above 0.9035. Such a move would confirm a forthcoming higher high on the 4-hour chart and could initially aim for the 0.9060 zone, near the inside swing low of September 19th. If that level is not able to halt the advance either, its break may allow the bulls to put the 0.9100 territory on their radars.