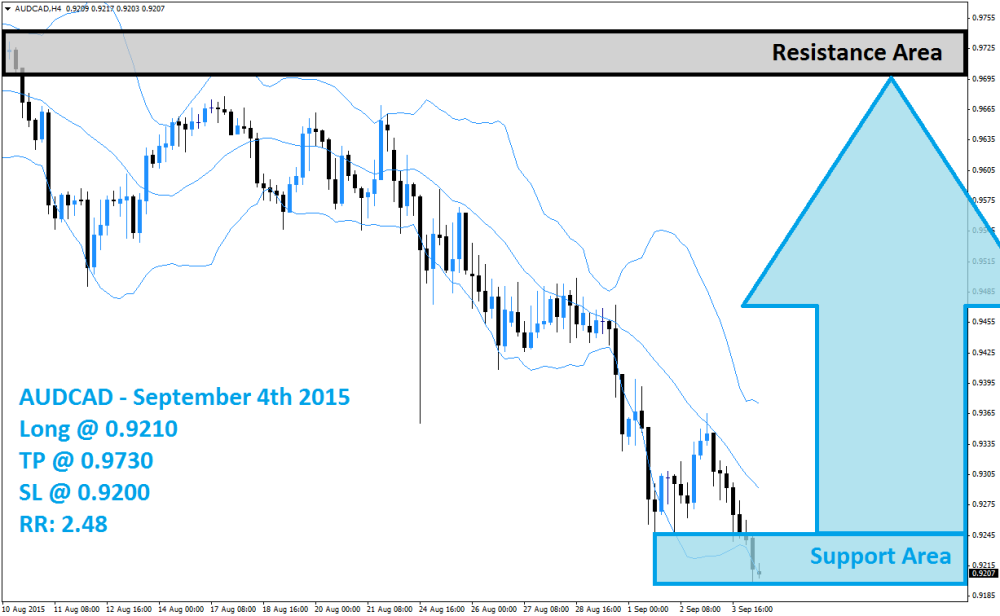

The AUD/CAD is trading inside of its support area, marked in light blue in the above H4 chart after a strong sell-off took place, which led to the breakdown below its resistance area which is visible in light grey. The Bollinger Band® indicator has collapsed together with price action and the middle band acted as a solid resistance level during the course of the sell-off which prevented any breakout attempt. The Bollinger Band indicator now shows signs of stabilization.

The lower band of the Bollinger Band indicator is now trading sideways inside of its support area and the upper band has broken its downtrend as well while the middle band continues to move lower and is now approaching its support area. The AUD/CAD is trading between its lower band and its middle band. A breakout above the middle band could result in a wave of profit taking forex traders which will lead to a short-covering rally. Forex traders are advised to seek long positions in this currency pair at 0.9210 and below this level which will position their trading accounts for the expected short-covering rally.

Conservative forex traders should wait for a breakout above the middle band of it Bollinger Band indicator before entering their long positions. A take profit target of 0.9730 has been set for a potential trading profit of 520 pips on the H4 Chart. More buy orders are expected after the AUD/CAD completes its breakout above the middle Bollinger Band. Forex traders should protect this trade with a stop loss level at 0.9000 for a potential trading loss of 210 pips which will result in a Risk-Reward (RR) ratio of 2.48

- AUD/CAD Long at 0.9210

- TP at 0.9730 SL at 0.9000

- RR: 2.48