The Aussie dollar has felt the wrath of bearish traders over the last month, as it moved towards forming a new six year low. Currently, the embattled pair is hanging on for dear life right around the 0.73 handle, but further falls are almost assumed considering the overall bearish sentiment.

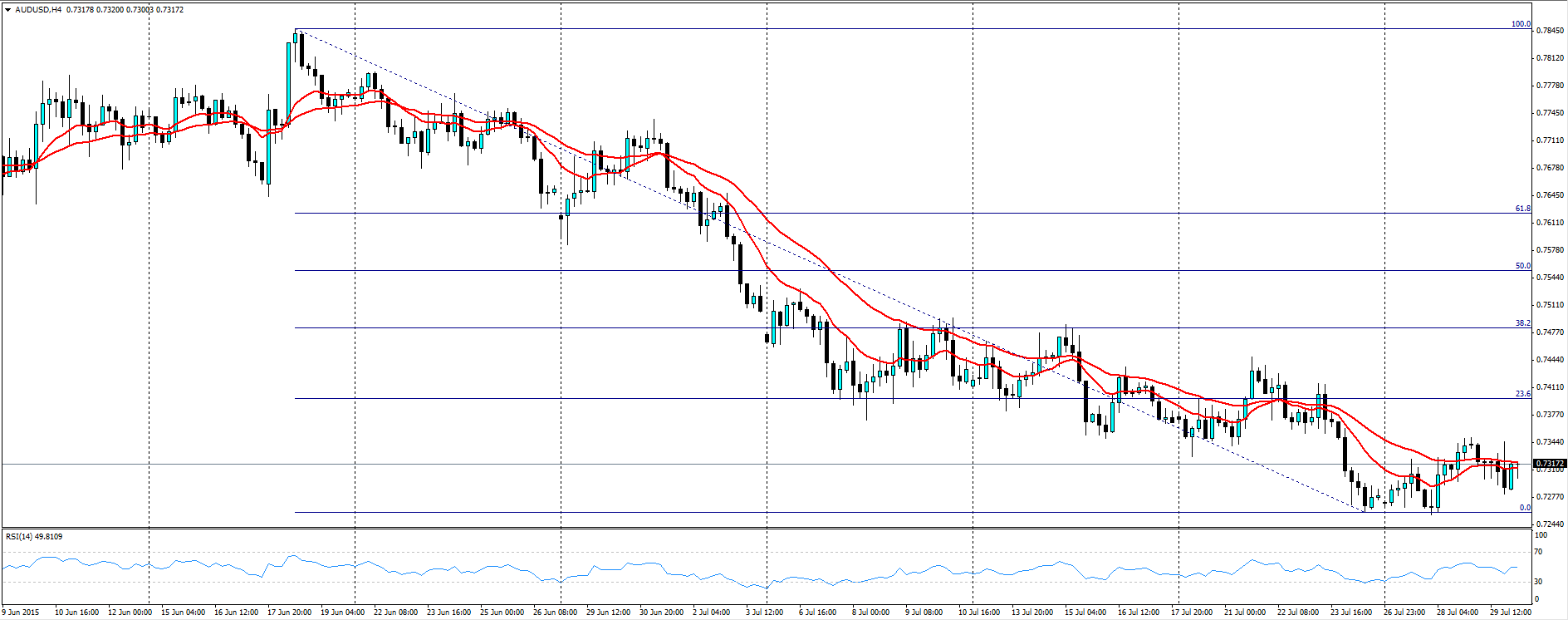

June really formed the key month for the pair as the currency surged higher to form new highs above the 0.77 level. However, the push ran out of steam and the AUD found strong resistance around the key 0.7850 level. Subsequently, the retracement was severe and the currency has continued to be dominated by bears all the way down to its current level at the 0.73 handle.

It is going to be difficult for the Aussie to hang on to the 0.73 handle considering the potential slowdown in Chinese demand for commodities. The currency is also likely facing further monetary easing from the RBA, despite continual jawboning from Governor Stevens to the contrary. The fact is, despite what the RBA may desire, the market will ultimately determine the overall valuation of the currency.

Frankly, the technicals are looking significantly bearish for the Aussie dollar. The moving averages are declining, whilst RSI still remains within neutral territory which indicates there is still plenty of room on the downside. Also, any long side push is likely to meet significant resistance at 0.7393 which represents the 23.6% Fibonacci level.

The Australian dollar is subsequently setting itself up to continue its bearish run and woe behold the trader who attempts to get in its way. The analogy of never trying to catch a falling knife certainly comes to mind and is more than appropriate in this situation.

So in the immortal words of Australia’s most successful citizen, Crocodile Dundee, that’s not a knife…this is a knife!