GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1100, target 1.1400, stop-loss moved to 1.1240, risk factor **

EUR/CAD: long at 1.3880, target 1.4100, stop-loss 1.3780, risk factor **

AUD/JPY: long at 95.00, target 97.50, stop-loss 94.00, risk factor ***

Pending Orders:

USD/JPY: sell at 123.90, if filled – target 120.65, stop-loss 125.10, risk factor *

AUD/USD: buy at 0.7670, if filled - target 0.7880, stop-loss 0.7570, risk factor **

NZD/USD: buy at 0.7110, if filled – target 0.7320, stop-loss 0.7020, risk factor **

EUR/GBP: buy at 0.7275, if filled - target 0.7450, stop-loss 0.7225, risk factor **

EUR/CHF: buy at 1.0460, if filled - target 1.0680, stop-loss 1.0410, risk factor **

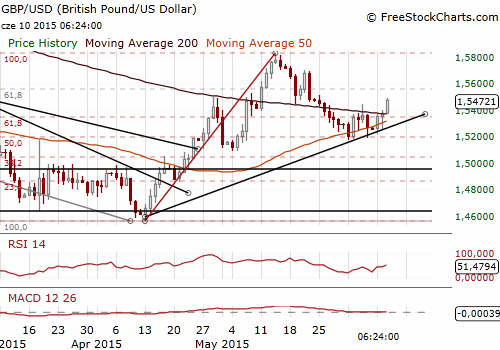

GBP/USD: Profit Taken, Waiting For US Retail Sales Data Tomorrow

(profit taken at 1.5420, stay sideways)

- British industrial output rose by 0.4% mom, above the median forecast for a 0.1% increase, after rising by 0.6% in March. oil and gas extraction rose 8.7% mom, the fastest increase since February 2014 as North Sea installations came back on line.

- Recent British figures have suggested the pace of economic recovery should pick up in the current quarter after slowing sharply at the start of the year. Data released yesterday showed Britain's trade deficit narrowed more than expected in April, adding to hopes for a pickup in the pace of growth in the second quarter.

- We took profit on our GBP/USD long at 1.5420 today. We stay sideways now waiting for US retail sales data tomorrow that could change the market picture.

Significant technical analysis' levels:

Resistance: 1.5488 (session high Jun 10), 1.5506 (high May 25), 1.5689 (high May 22)

Support: 1.5371 (hourly low Jun 10), 1.5328 (10-dma), 1.5191 (low Jun 5)

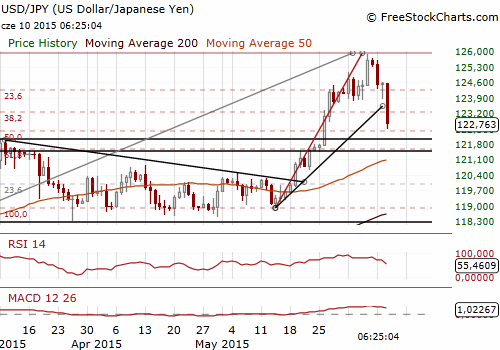

USD/JPY: Kuroda Remarks Made A Noise

(sell at 123.90)

- Bank of Japan Governor Haruhiko Kuroda said the JPY is unlikely to fall further on a real effective exchange rate basis because it is already very weak. The USD/JPY fell to 122.46 after Kuroda's comments, having struck 125.86 on Friday - its weakest since June 2002. Our EUR/JPY and CHF/JPY longs reached stop-loss levels.

- Kuroda also said the USD was not bound to rise against the JPY if the Federal Reserve raises interest rates as traders may have already priced into the market the possibility of a rate hike. Kuroda said it is desirable for the JPY to trade in a range that broadly reflects economic fundamentals, but declined to say whether or not the JPY is currently in line with fundamentals. The BOJ chief said he still expected inflation to rise to the central bank's 2% target around the first half of fiscal 2016, adding that quantitative easing would continue until inflation stabilized around that level.

- Data released early on Wednesday showed Japan's core machinery orders unexpectedly rose 3.8% mom and 3.0% yoy in April, versus the median estimate for a 1.3% yoy decline. The data are regarded as an indicator of capital spending in the coming six to nine months.

- We wrote at the end of May that Japanese data were likely to improve and some positive surprises could encourage investors to buy JPY. But the USD/JPY rose to a new 13-year high since that time as the market shrugged off the upside surprise in the Japanese data and focused on firm US non-farm payrolls. However, our scenario is probably realizing now triggered by Kuroda’s comments. We had stronger-than-expected GDP growth for the first quarter released on Monday and stronger-than-expected machinery orders data today. In our opinion the stream of ‘stronger-than-expected’ figures may be continued.

- In our opinion the JPY is likely to appreciate further, so our trading strategy is to sell the USD/JPY on upticks. We have placed sell order at 123.90. If the order is filled the target will be 120.65.

Significant technical analysis' levels:

Resistance: 123.16 (hourly high Jun 10), 124.62 (high Jun 10), 124.73 (high Jun 9)

Support: 122.46 (session low Jun 10), 122.04 (high Mar 10), 122.03 (38.2% of 115.85-125.86)

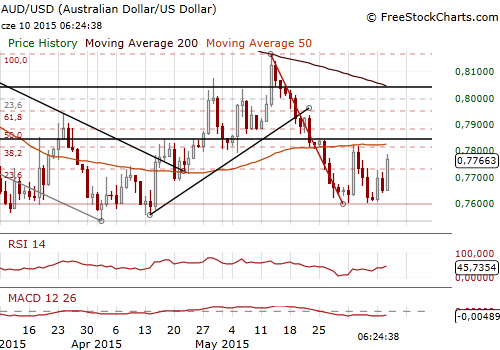

AUD/USD: Watch RBNZ Decision And Employment Report

(buy at 0.7670)

- Reserve Bank of Australia Governor Glenn Stevens said the bank was open to the possibility of more interest rate cuts if needed.

- Stevens also warned monetary policy alone could not deliver everything that was needed and expecting too much from it could lead to much bigger problems. In particular, heavily indebted households had less scope to use borrowing to fund more spending. Stevens emphasised that more infrastructure spending could be a driver of growth and confidence.

- Stevens added the pace of house price increase in Sydney was crazy and acutely concerning, though he noted markets in other major cities were not nearly as hot.

- A measure of Australian consumer sentiment slid a seasonally adjusted 6.9% mom in June. The drop wiped out May's 6.4% mom increase which had followed a cut in interest rates to record lows and a government budget that included a surprise tax break for small businesses. Concerns about the economy were at the forefront of consumer minds. The survey's measure of economic conditions for the next 12 months dropped 7.7%, while that for the next 5 years plunged 17.1%.

- There are two important events ahead of AUD traders: the decision of the Reserve Bank of New Zealand (21:00 GMT) and Australian employment report (tomorrow, 1:30 GMT). In our opinion the RBNZ is likely to cut rates by 25 bps, which may be reflected in the AUD/USD fall. This could be a good opportunity to buy the AUD/USD ahead of jobs data, which are likely to bring some good news for Australian economy. We raised our buy order to 0.7670.

Significant technical analysis' levels:

Resistance: 0.7787 (high Jun 4), 0.7818 (high Jun 3), 0.7839 (high May 26)

Support: 0.7636 (session low Jun 10), 0.7604 (low Jun 8), 0.7598 (low Jun 5)

Source: Growth Aces Forex Trading Strategies